[ad_1]

KuCoin’s Hong Kong subsidiary, HKVAEX, withdrew its software for a digital asset service supplier (VASP) license.

This transfer displays the intensifying regulatory scrutiny the cryptocurrency alternate faces globally. Notably, the US Division of Justice (DoJ) lately accused KuCoin of breaching cash laundering rules.

KuCoin Retracts From Hong Kong

This retreat from the licensing course of in Hong Kong hints at a broader recalibration of KuCoin’s compliance efforts amidst mounting regulatory pressures. Business insiders speculate that the choice to desert the VASP license software might sign KuCoin’s intention to overtake its strategy to regulatory compliance.

“Three unbiased sources confirmed that KuCoin thought-about ceasing operations and promoting the alternate in 2023. KuCoin was launched into legal investigation by the US in 2023, and has additionally been topic to a number of investigations in China,” Chinese language reporter Colin Wu said.

Furthermore, the alternate’s strategic pivot seems influenced by new enforcement actions by US regulatory our bodies. These recommend a possible reassessment of KuCoin’s world operational stance. In mild of the authorized challenges, the anticipation of a potential rejection from Hong Kong regulators could have additionally performed a task.

Learn extra: 15 Best KuCoin Alternatives for US Users

Commissioner Caroline D. Pham of the Commodity Futures Buying and selling Fee (CFTC) weighed in on the legal actions against KuCoin. In an announcement, she highlighted the CFTC’s “aggressive enforcement” stance to guard US traders.

“The CFTC has filed one other aggressive enforcement motion exercising our authority to pursue alleged unregistered crypto asset derivatives buying and selling platforms and different violations of legislation. I commend the Division of Enforcement’s vigilance in defending our markets,” Commissioner Pham stated.

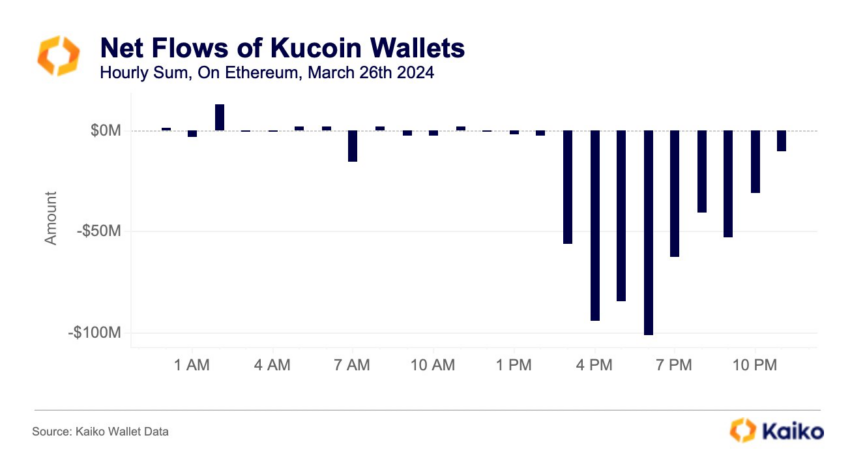

Following these enforcement actions, KuCoin’s reserves of ERC-20 tokens witnessed a dramatic 58% lower. Certainly, KuCoin reserves plummeted from $1.22 billion to $710 million.

This stark decline displays the rapid monetary affect of the regulatory challenges KuCoin faces. It additionally emphasizes the alternate’s pressing have to navigate the evolving regulatory surroundings rigorously.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link