[ad_1]

The primary quarter of 2024 has unfolded as a pivotal chapter within the narrative of Web3 security, marked by each notable achievements in risk mitigation and profound challenges.

This report synthesizes key findings from AI Web3 safety agency Cyvers’ complete evaluation of safety incidents in Q1 2024, highlighting rising threats and underscoring the significance of resilience throughout the ecosystem.

Govt Abstract

Amid the continual development of DeFi, DePIN (Decentralized Bodily Infrastructure Networks), RWAs (Actual World Property), and different blockchain-based purposes, we’ve noticed a corresponding escalation in refined safety threats. Assault vectors have diversified, with code vulnerabilities resulting in substantial monetary repercussions and entry management breaches proving exceptionally pricey.

These traits sign an pressing want for enhanced safety measures and larger vigilance throughout the Web3 group.

Cyvers, in partnership with BeInCrypto, has demonstrated its dedication to this trigger by pioneering real-time risk detection and AI-driven safety options. The objective is to offer speedy and exact identification of threats, providing proactive mitigation and safeguarding belongings throughout the blockchain.

These threats deploy a spread of assault vectors—from sensible contract vulnerabilities to phishing scams—aiming to take advantage of the open and interconnected nature of Web3 applied sciences. In response to those challenges, the Web3 group has rallied, emphasizing the significance of safety as a foundational ingredient of the ecosystem’s infrastructure.

Key Safety Developments and Statistics

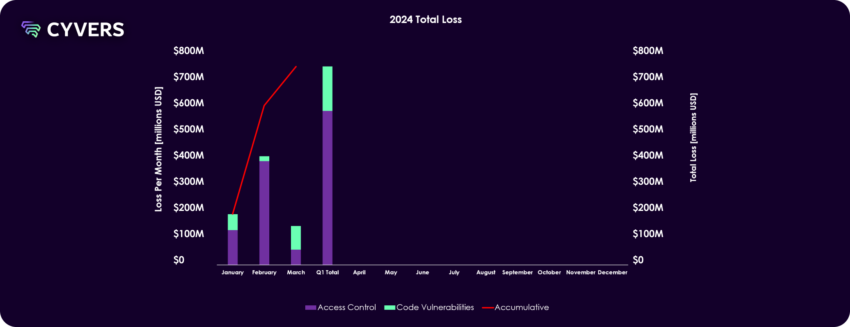

The Whole Stolen Worth (TSV) within the first quarter of 2024 is roughly $739.7 million. January witnessed the very best variety of assaults (27), adopted by March (21), and February (18). Regardless of having the least variety of assaults, February had a excessive monetary affect, with round $405.3 million misplaced to assaults.

The typical loss per assault calculated to be roughly $6.7 million, indicating the excessive stakes concerned in Web3 safety.

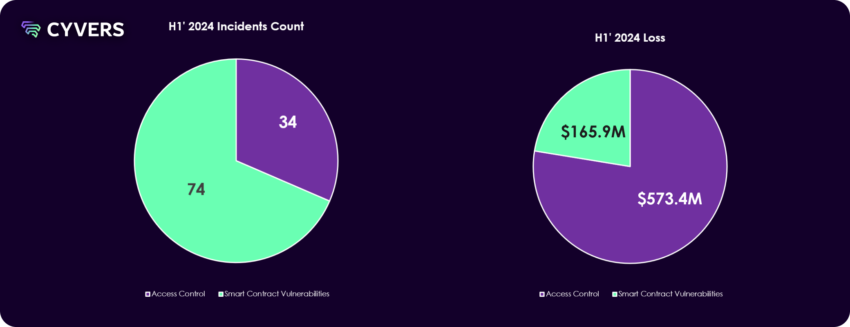

The most typical assault vector was Code Vulnerabilities, with 37 situations, leading to a lack of about $165.9 million. Although much less prevalent, Entry Management assaults have been much more pricey, leading to a lack of about $573.8 million.

There have been 10 situations the place hacks have been solely detected by Cyvers, which underlines the significance of proactive safety measures, refined algorithms, and steady optimization.

Three of those situations have been among the many High 10 Hacks of Q1 2024.

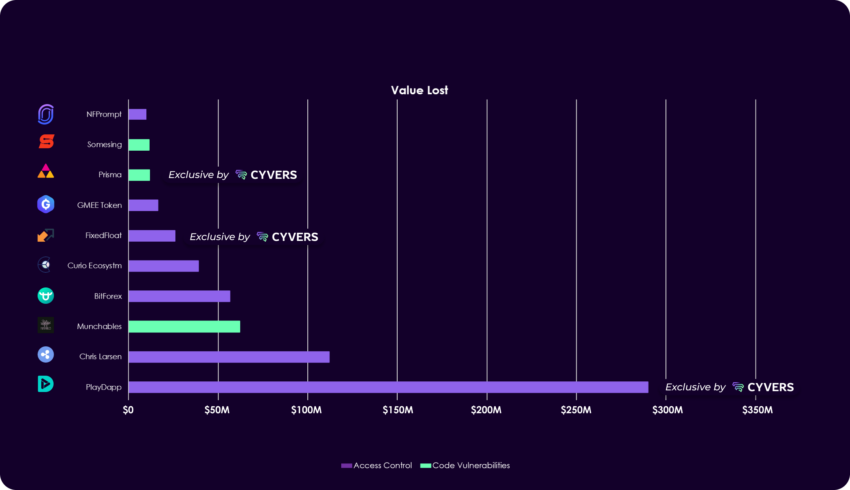

PlayDapp’s Safety Breach Evaluation

In February 2024, distinguished gaming and NFT platform PlayDapp faced a severe security challenge when it suffered two consecutive exploits resulting in an unprecedented minting of PLA tokens. Initially, on February 9, an unauthorized entity minted 200 million PLA tokens, valued at roughly $36.5 million.

A couple of days later, on February 12, the identical entity reportedly minted an extra 1.79 billion PLA tokens, equating to a staggering $253.9 million. These exploits collectively resulted in a complete lack of about $290 million.

The first reason for the breach was recognized as a wise contract vulnerability, which allowed the attacker to mint tokens with out the mandatory authority. The repercussions have been quick and extreme, because the market value for PLA tokens plummeted as a result of sudden inflow of unauthorized tokens. PlayDapp’s staff tried to barter with the attacker, providing a $1 million bounty for the return of the stolen funds, however to no avail.

The safety measures taken post-incident included the pausing of the PLA sensible contract and the initiation of a contract migration primarily based on pre-exploit snapshots of holder balances. PlayDapp’s immediate response to pause the contract and have interaction with regulation enforcement and blockchain forensic companies demonstrated a dedication to safety and transparency. The efforts to liaise with exchanges and monitor the stolen funds have been ongoing, with methods to mitigate the affect and forestall such incidents sooner or later being actively mentioned.

Learn extra: AI for Smart Contract Audits: Quick Solution or Risky Business?

The PlayDapp incident serves as a cautionary story concerning the vulnerabilities inherent in sensible contracts, significantly relating to the minting and administration of tokens. Certainly, the teachings from the PlayDapp incident are manifold: absolutely the necessity of continuous safety vigilance, the significance of proactive and reactive safety measures, and the ever-present want for group training on safety finest practices.

Regulatory Adjustments on Web3 Safety

In Q1 2024, the worldwide digital asset panorama noticed notable regulatory developments which have had a substantial affect on Web3 safety.

PwC’s World Crypto Regulatory Report emphasizes the continuing evolution in digital asset regulation, suggesting that whereas substantial progress was made in 2023, the business continues to face a big regulatory workload. Such developments are essential as they supply a structured framework for operations, improve world regulatory insurance policies, and assist set up world prudential requirements, doubtlessly influencing the EU’s Markets in Crypto-Property regulation and different worldwide insurance policies.

Furthermore, after the high-profile collapse of FTX, regulatory our bodies have been prompted to take a extra stringent strategy to digital asset guidelines to higher defend the investing public. The US Securities and Trade Fee (SEC), as an illustration, had deliberate to launch new guidelines governing digital asset exchanges and choices. These guidelines have been anticipated to offer complete laws for digital asset choices, alongside pointers for digital asset exchanges.

This response to previous occasions demonstrates a transparent intent by regulatory our bodies to enhance oversight and forestall related occurrences sooner or later.

These laws goal not solely to safeguard traders but in addition to make sure the orderly functioning of digital asset markets. For Cyvers, these developments may function a possibility to contribute to regulatory discussions, leveraging its experience to information the formulation of insurance policies that steadiness the necessity for safety with the potential for innovation within the Web3 area.

As laws evolve, Cyvers and BeInCrypto’s capability to offer compliance-aligned safety companies turns into ever extra essential. Q1 2024 has due to this fact been a pivotal time for Web3 safety, marked by regulatory our bodies world wide taking classes from previous occasions to fortify the business’s defenses and set up a safe basis for the burgeoning digital financial system.

Suggestions for Enhancing Web3 Safety

Within the pursuit of a fortified Web3 panorama, Cyvers defined to BeInCrypto strategic methods to boost safety postures for numerous stakeholders throughout the ecosystem:

For Initiatives:

- Sensible Contract Auditing: Be certain that sensible contracts bear thorough securityaudits by respected companies. Recurrently re-audit after main updates or adjustments in thecontract’s logic. Take a look at our really useful auditors right here.

- Incident Response Planning: Develop an incident response plan tailor-made to potentialWeb3-specific breaches, detailing quick actions, communication protocols, andcontingency measures.

- Safety Modules Integration: Implement real-time risk detection and securitymodules, like these offered by Cyvers, to repeatedly monitor and defend in opposition to malicious exercise.

For Builders:

- Safety-First Design: Embrace a security-first strategy when designing techniques,prioritizing safety in each part of growth.

- Steady Schooling: Keep knowledgeable concerning the newest safety analysis,vulnerabilities, and safety methods. Interact with the group to shareknowledge and finest practices.

- Decentralization of Management: Keep away from single factors of failure in your techniques. Use multi-signature wallets and distributed decision-making for essential operations.

For Buyers:

- Due Diligence: Train due diligence by reviewing the safety practices of projectsbefore investing. Test for audit studies, safety affiliations, and incident histories.

- Diversify Holdings: Shield your portfolio from focused breaches by diversifyingyour holdings throughout numerous platforms and wallets.

- Use Trusted Platforms: Interact with platforms which have a confirmed monitor report ofsecurity and that implement the newest safety measures.

For Customers:

- Safe Wallet Practices: Make the most of {hardware} wallets for vital holdings, practicesafe storage of personal keys, and make use of multi-factor authentication.

- Watch out for Phishing: Educate your self on frequent phishing ways throughout the Web3 area. Confirm URLs, double-check sensible contract interactions, and be cautious withunsolicited requests.

- Keep Up to date: Recurrently replace your software program to the newest variations, guaranteeing that safety patches are utilized.

Learn extra: Identifying & Exploring Risk on DeFi Lending Protocols

By adhering to those suggestions, stakeholders throughout the Web3 ecosystem can considerably scale back their danger profile and contribute to making a safe and resilient digital surroundings. It’s by collective vigilance and proactive measures that we are able to navigate the Web3 ecosystem with security and confidence.

Disclaimer

Following the Trust Project pointers, this characteristic article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link