[ad_1]

As China’s inventory market faces a downturn, a brand new funding pattern is rising amongst its merchants. Bitcoin and different cryptocurrencies are gaining reputation as various funding havens, providing stability throughout financial uncertainty.

This shift comes regardless of the nation’s stringent ban on cryptocurrency buying and selling and mining, showcasing the resilience and adaptableness of Chinese language traders.

Evading China’s Crypto Ban

Dylan Run, a finance sector govt based mostly in Shanghai, epitomizes this pattern. Early in 2023, because the Chinese language financial system confirmed indicators of misery, Run started diversifying his cryptocurrency investments. This transfer was regardless of the ban on crypto buying and selling and mining in China since 2021.

Run navigated the restrictions utilizing financial institution playing cards from small rural industrial banks and interesting in grey-market transactions. His technique concerned capping every buy at $6,978 to keep away from detection. He now holds roughly $141,024 in cryptocurrencies, accounting for half of his funding portfolio.

In comparison with China’s faltering inventory market, Run’s crypto investments have soared by 45%, prompting him to say, “Bitcoin is a protected haven, like gold.”

This shift in direction of cryptocurrencies shouldn’t be remoted to Run. Many Chinese language traders search inventive avenues to spend money on digital belongings. Cryptocurrencies are perceived as extra secure than the risky inventory and property markets at residence.

Certainly, traders like Charlie Wong, a buy-side fairness analyst, have turned to platforms just like the Hashkey Trade in Hong Kong to buy Bitcoin.

“It’s onerous to seek out opportunties in conventional fields. Chinese language shares and different belongings carry out poorly… The financial system is present process a vital transition,” Wong stated.

Such strikes point out the broader sentiment amongst Chinese investors seeking alternatives to the struggling home markets.

Whereas the mainland bans cryptocurrency, buying and selling platforms like OKX and Binance proceed to cater to Chinese language shoppers by way of over-the-counter channels and different means. Furthermore, abroad financial institution accounts and Hong Kong’s comparatively friendlier stance in direction of digital belongings may assist to bypass restrictions.

Bitcoin Is the Protected Haven

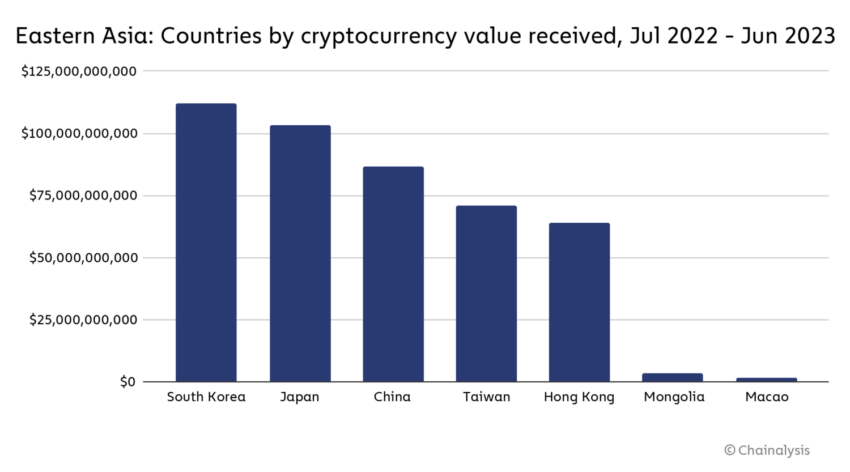

Although working in a gray space, the underground crypto market in China is prospering. Crypto knowledge platform Chainalysis noted a big enhance in China’s peer-to-peer crypto commerce quantity, with the nation climbing to the thirteenth spot globally in 2023 from 144th in 2022.

Regardless of the official ban, the Chinese language crypto market witnessed a staggering $86.4 billion transaction quantity between July 2022 and June 2023.

“China and Hong Kong additionally present distinctive breakdowns in most-used crypto platform sorts, although these numbers must be taken with a grain of salt given the anecdotal proof that a lot crypto exercise in each international locations takes place by way of OTCs or by way of casual, gray market peer-to-peer companies,” the report learn.

The surge in Bitcoin and different cryptocurrencies comes when conventional Chinese language investments are underperforming. The crackdown on the property sector and the continuing financial transition have left conventional funding avenues like shares and actual property much less interesting.

Certainly, a dominant state-owned enterprise sector, opaque governance, regulatory uncertainties, and a weak credit standing system pose vital financial challenges.

“The Chinese language financial system is making regular progress and can proceed to offer sturdy impetus for the world financial system. China is a crucial engine of worldwide improvement,” Li Qiang, Premier of the State Council of the Folks’s Republic of China, said.

Nonetheless, the present circumstances have precipitated the inventory market crash and raised considerations about the way forward for China’s financial atmosphere. In the meantime, Bitcoin’s 50% leap since mid-October additional underscores its attractiveness as an funding choice. Cryptocurrencies are rising as a viable various, providing a semblance of stability and development potential amidst the turbulence of the Chinese language financial system.

Learn extra: Bitcoin Price Prediction 2024/2025/2030

The rise in cryptocurrency investments by Chinese language merchants is a telling signal of the occasions, reflecting a strategic shift in response to a altering financial and regulatory atmosphere.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link