[ad_1]

June has witnessed a noticeable slowdown within the development of the Tether stablecoin provide, signaling a tightening of liquidity inside cryptocurrency markets.

A latest research by Copper, a crypto custodian, highlighted that the stablecoin’s month-on-month provide growth was lower than 1.5% as of June 24, marking a major discount from the over 5% development noticed in April and Might.

Decline in Tether Buying and selling Quantity

Fadi Aboualfa, head of analysis at Copper, commented on the scenario, noting that the subdued liquidity inflow into the crypto markets is happening amid downward pressures on Bitcoin and Ethereum, with altcoins exhibiting little potential for a major rally within the close to time period.

In a stark distinction to earlier within the 12 months, Tether’s buying and selling quantity has plummeted from its all-time excessive of $767.22 billion on March 11 to only $53.55 billion by June 24.

This decline comes despite the fact that Tether boasts a market capitalization of $113 billion. The slower development fee of USDT’s provide is indicative of diminished monetary inflows into the cryptocurrency markets.

The Bitcoin market itself has not been immune to those challenges, with substantial day by day capital outflows. Copper’s evaluation signifies that greater than $540 million was withdrawn from the market within the final week alone.

During the last 30 days, the worth of Bitcoin has fallen by greater than 10%, dropping from roughly $68,000 to about $62,000.

Aboualfa additional elaborated in the marketplace dynamics, stating that regardless of the direct correlation between market flows and Bitcoin’s value, the present scenario doesn’t mirror a bullish demand however moderately a hesitance amongst traders to promote their holdings at a reduction, even amid crash fears.

Impression of ETFs on Bitcoin’s Worth

Furthermore, because the introduction of exchange-traded funds (ETFs) in January, Bitcoin’s value has risen by 37%. Regardless of this, Aboualfa maintained that Bitcoin continues to be buying and selling inside an affordable vary of its holdings, suggesting there may be nonetheless scope for downward value actions.

The broader macroeconomic panorama additionally continues to exert pressure on the crypto markets. A report from ETC Group dated June 25 indicated that conventional monetary markets have begun to downgrade their international development expectations.

This reassessment is basically as a consequence of constantly disappointing U.S. financial information. The Bloomberg US ECO Shock Index, which measures the disparity between precise macroeconomic information and forecasts, has reached its lowest level since 2019.

This metric confirms a widespread acknowledgment of a deteriorating macroeconomic local weather, which might pose additional challenges for Bitcoin’s value stability.

Tether’s Strategic Shift

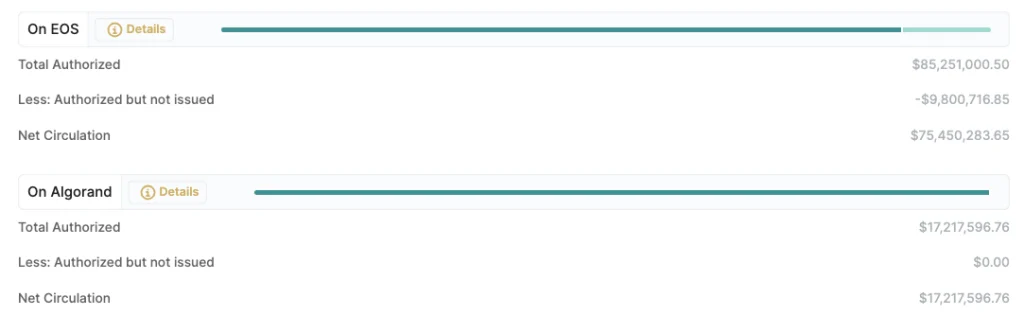

In a strategic shift, Tether has introduced that it’s going to stop the issuance of latest USDT tokens on a number of extra blockchains, together with Eos and Algorand, beginning June 24. This determination was disclosed in a weblog put up by the corporate.

Over the subsequent 12 months, Tether will proceed to redeem USDT on these blockchains as common, with potential additional modifications to be evaluated and introduced subsequently.

Tether defined that the choice to discontinue minting on Eos and Algorand aligns with its broader technique to take care of stability inside its ecosystem.

The corporate emphasised that it conducts thorough evaluations of every community’s safety structure to make sure the security, usability, and sustainability of the blockchain.

The purpose is to allocate sources optimally to reinforce safety and effectivity while fostering innovation. Tether assured its group that the transition could be meticulously executed to reduce disruption, reaffirming its dedication to delivering a seamless person expertise.

Regardless of these modifications, Eos and Algorand collectively account for lower than 0.1% of the full USDT provide. As Tether continues to section out assist on sure blockchains, it stays lively in integrating new networks, together with The Open Community (TON).

Since introducing TON-based USDT in April 2024, Tether has minted roughly $500 million price of those stablecoins, representing about 0.44% of the full circulating provide.

The very first Tether tokens have been issued on the Bitcoin blockchain via Omni again in October 2014, and Tether has since discontinued minting USDT on three blockchains in August 2023, together with Kusama, Bitcoin Money SLP (Easy Ledger Protocol), and the unique USDT blockchain, the Omni Layer Protocol.

[ad_2]

Source link