[ad_1]

- Battle between Iran and Israel despatched crypto markets tumbling.

- Markets bounced again on Monday, however Bitcoin dominance unexpectedly fell.

- Contradictory calls on the arrival of altseason exist.

The crypto markets had been despatched reeling over the weekend as geopolitical tensions within the Center East reached a boiling level. In a tit-for-tat escalation, Iran launched a retaliatory drone and missile assault on Israel, responding to the April 1 bombing of the Iranian embassy in Syria, which Tehran had blamed Israel for.

The crypto markets, ever delicate to macro occasions, reacted with a swift and brutal sell-off, as the entire crypto market cap plunged over 15%, and plenty of cash had been hit with double-digit proportion losses. With markets bouncing again from the carnage on Monday, Bitcoin dominance took an surprising fall.

Bitcoin Dominance Takes a Dip

Crypto traders are inclined to flock to the perceived security of Bitcoin in occasions of market carnage. Whereas the newest turmoil noticed Bitcoin dominance spike to 57.02% on Saturday night (UTC,) marking a 158-week excessive, this uptick quickly fizzled out, dropping to as little as 55.27% by Monday, towards expectations.

This puzzling growth caught the eye of X influencer Crypto Phoenix, who concluded that Bitcoin could have hit its pre-halving peak in the course of the weekend sell-off, signaling that the beginning of the long-awaited altcoin season could possibly be shut by.

This was echoed by Altcoin ₳ardvark, who drew comparable conclusions about Bitcoin dominance, including that the situation with altcoins is “already gravy on the market, and it’s about to get an entire lot higher.”

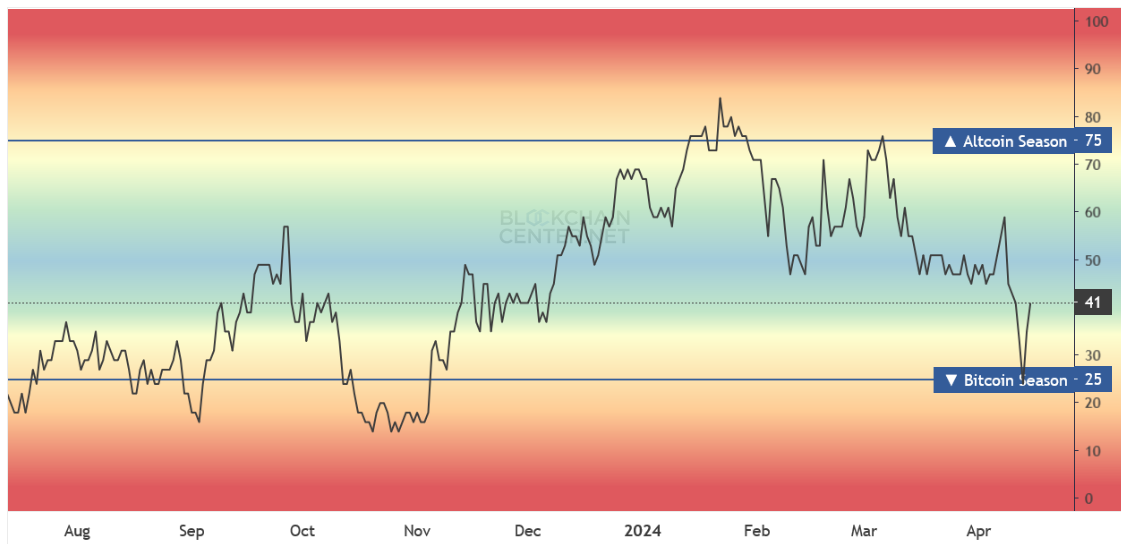

Nonetheless, the altseason calls from Crypto Phoenix, and Altcoin ₳ardvark contradicts the Altseason Index from the Blockchain Middle.

It’s Nearer to Bitcoin Season

Whereas the decline in Bitcoin dominance has stoked pleasure in regards to the potential onset of altcoin season, Blockchain Middle’s Altseason Index reveals the market is nearer to Bitcoin season than it’s to altseason.

The Altseason Index, which defines an altseason as a interval the place 75% of the highest 50 altcoins outperform Bitcoin over the past 90 days, presently sits at a studying of 41% of huge caps, outperforming the market chief. The weekend turmoil noticed the Altseason Index dip as little as 25%, however a powerful bounce means that markets don’t count on an escalation of tensions between Iran and Israel.

The highest three performing altcoins over the past 90 days had been WIF, FET, and AR. They posted features of 928%, 238%, and 189%, respectively, far outpacing Bitcoin’s 57% development over the identical interval.

On the Flipside

- The crypto bounce has but to totally recuperate the losses triggered by the weekend turmoil.

- BTC dominance has not dipped beneath 39% since Could 2018.

Why This Issues

The conflict-led market sell-off and subsequent dip in Bitcoin dominance demonstrates the extremely changeable nature of cryptocurrency investing. Though Bitcoin dominance decreased over the weekend, the opportunity of an imminent altcoin season appears distant.

Learn in regards to the final important pullback in Bitcoin dominance right here:

Altcoins Poised to Explode as Bitcoin Dominance Wanes?

NEO leads the highest 100 cryptos after weekend carnage. Learn extra right here:

NEO Leads Crypto Market Bounce Post-Weekend Crash

[ad_2]

Source link