[ad_1]

Main crypto belongings have recorded vital declines over the previous 24 hours, leading to a staggering $580 million in liquidations.

The sharp downturn grew to become evident throughout early Asian buying and selling hours, primarily resulting from actions from a pockets related to the defunct change Mt. Gox. This motion posed concern of potential promote stress to market individuals, sending costs downward by 10% on common.

Crypto Market Faces Bearish Stress

Bitcoin recorded a notable drop of 8%, briefly dipping under the $54,000 mark, successfully wiping out all beneficial properties since February earlier than barely recovering.

Equally, Ether (ETH) suffered a fair steeper drop of over 10%, whereas Cardano’s ADA and Solana’s SOL plunged by roughly 8%. Dogecoin (DOGE) took the heaviest hit, dipping nearly 18%.

The fast value declines led to over $580 million in liquidations of lengthy positions (trades betting on greater costs), one of many largest liquidation episodes in 2024.

Bullish bets on Bitcoin and Ether accounted for over $380 million in losses. The biggest single liquidation order, valued at $18.4 million in ETH, occurred on the Binance change.

In the meantime, open curiosity, which displays the whole variety of energetic futures contracts, decreased by 12%. This remark suggests {that a} vital quantity of capital exited the market.

Normally, merchants take into account liquidations a response to concern of dropping an preliminary margin. Such occasions occur when a crypto change forcefully ends a dealer’s leveraged place, contemplating the preliminary margin has been exhausted.

Liquidations additionally happen when the possibilities of a dealer fulfilling the margin necessities wanted to maintain their leveraged place are slim. In such an occasion, the change closes all trades to forestall additional losses.

Mt. Gox Actions and Market Fears

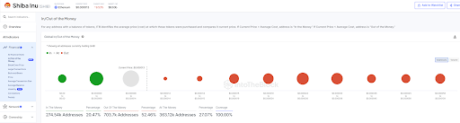

Massive quantities of Bitcoin have been moved from a crypto pockets linked to Mt. Gox, worsening the market turmoil. This exercise surfaced because the change ready to repay its collectors this month.

BREAKING

Mt Gox strikes 47,228 BTC ($2.71 billion {dollars}) from chilly storage to a brand new pockets. pic.twitter.com/3ZdSlC1IX2

— Arkham (@ArkhamIntel) July 5, 2024

Mt. Gox, which collapsed after a significant hack in 2014, is about to begin distributing recovered belongings this month after a number of delays.

Many concern that these repayments, which encompass Bitcoin and Bitcoin Money, might pose promoting stress on the markets. One way or the other, it has contributed to the present uncertainty and value volatility.

In the meantime, buying and selling agency QCP Capital expressed a cautious outlook, predicting a lackluster efficiency for Bitcoin within the coming months.

As reported by Iko Web3, the agency said in a Thursday broadcast on Telegram that Q3 2024 might be a interval of uncertainty for Bitcoin. It hinged this prediction on the availability launch from the defunct change Mt. Gox.

This sentiment displays the broader market’s concern over the potential inflow of Mt. Gox-related belongings and its influence on costs. Within the meantime, the general crypto market holds a market cap of $1.97 trillion, which signifies a 7.66% dip over the previous 24 hours.

Disclaimer: The opinions expressed on this article don’t represent monetary recommendation. We encourage readers to conduct their very own analysis and decide their very own threat tolerance earlier than making any monetary selections. Cryptocurrency is a extremely risky, high-risk asset class.

Our Editorial Course of

Our Editorial Course of

[ad_2]

Source link