[ad_1]

By way of its treasury, Tether, the issuer of USDT, has minted a major quantity of its stablecoin. On-chain knowledge reveals that Tether Treasury minted 1 billion USDT on Might 16, at 16:50 UTC.

Given Tether’s main market place, many assume this massive USDT issuance may influence crypto market actions.

Tether’s Current USDT Minting and Its Market Implications

Paolo Ardoino, Tether’s CEO, clarified the context of this substantial minting. He indicated that 1 billion USDT was added to the stock on Tron Community, specifying that this was a licensed transaction not but issued.

“That means that this quantity shall be used as stock for subsequent interval issuance requests and chain swaps,” he added.

Learn extra: How to Buy USDT in Three Easy Steps – A Beginner’s Guide

The final time Tether minted USDT was on April 16, when the market skilled a liquidity drain. Based on a report from the on-chain analytical platform Lookonchain, Tether Treasury has minted 31 billion USDT previously 12 months. It minted these quantities on the TRON and Ethereum blockchains.

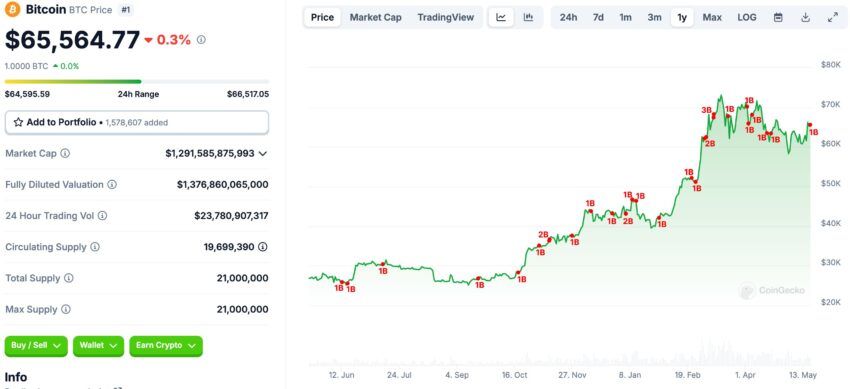

Apparently, Tether minted these USDT when Bitcoin’s (BTC) price corrected to the $64,600 vary. For the reason that finish of 2022, every enhance within the USDT provide has generally had a constructive impact on the event of the Bitcoin value.

Knowledge from CryptoQuant reveals a excessive correlation between USDT supply and Bitcoin price movement, resulting in a rise in quantity and a dynamic environment for the Bitcoin price. Subsequently, this sparks hypothesis among the many crypto group that the brand new funds is perhaps used to push Bitcoin’s value. Furthermore, Lookonchain’s report indicated that the minted USDT final 12 months pushed Bitcoin to succeed in above the $70,000 vary.

“These minted USDT drove the value of BTC from $27,000 to $73,000,” it wrote.

Learn extra: Bitcoin Price Prediction 2024/2025/2030

Regardless of this hypothesis, Bitcoin’s value has stabilized between $64,000 and $66,000 within the final 24 hours. Final week, BTC fluctuated between $60,000 and $62,000 till the release of US inflation data. BeInCrypto reported a bounce in Bitcoin’s value from $62,000 to $66,000 after April’s inflation knowledge launch suggests inflation might be slowing.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link