[ad_1]

- At press time, ETH was caught in a 4-hour symmetrical triangle, exhibiting no clear directional development.

- On-chain information advised {that a} potential rally may very well be on the horizon.

Market exercise for Ethereum [ETH] has been subdued, exhibiting solely a slight improve of two.45% in value, now buying and selling across the $2,600 degree.

This sort of value conduct is typical when an asset is buying and selling inside a symmetrical triangle—a sample characterised by converging diagonal higher and decrease strains.

Earlier cases of such buying and selling patterns have typically led to important value actions, both upwards or downwards.

Analyst forecast for ETH

In a recent tweet, crypto analyst Carl Runefelt highlighted that ETH was at a crossroads, going through a call that would both set off a drop to new lows.

It may probably wipe out bullish momentum or propel ETH it to a brand new month-to-month excessive.

Runefelt shared a 4-hour chart to stipulate potential value targets, relying on the path ETH takes:

“Potential bullish goal: $2,800

Potential bearish goal: $2,350.”

At such a crucial level, it’s necessary to establish extra confluences. To this finish, AMBCrypto has launched into additional evaluation.

‘Within the cash’ merchants can drive ETH greater

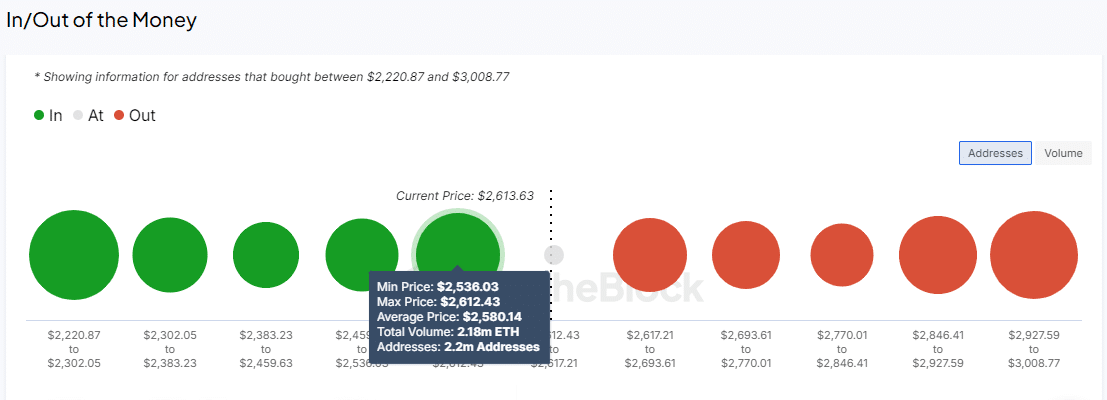

Utilizing the In and Out of Cash Round Worth (IOMAP) indicator, AMBCrypto analyzed whether or not merchants in revenue (within the cash) or at a loss (out of the cash) may affect Ethereum’s value path.

“Within the cash” signifies that trades are presently worthwhile and act as a help zone, whereas “out of the cash” denotes unprofitable trades, serving as resistance.

According to IntoTheBlock, ETH has rebounded from the $2,597.37 help, with transactions involving 2.39 million addresses holding over $8 billion in ETH.

This degree is crucial for probably propelling the worth upward. Nevertheless, important resistance from merchants which are out of the cash is anticipated at $2,677.33, $2,760.00, and $2,831.77.

Though these resistance ranges pose challenges, the press time bullish momentum, which outweighed promoting strain, advised ETH might development towards or exceed $2,800.

Consumers are fascinated by ETH

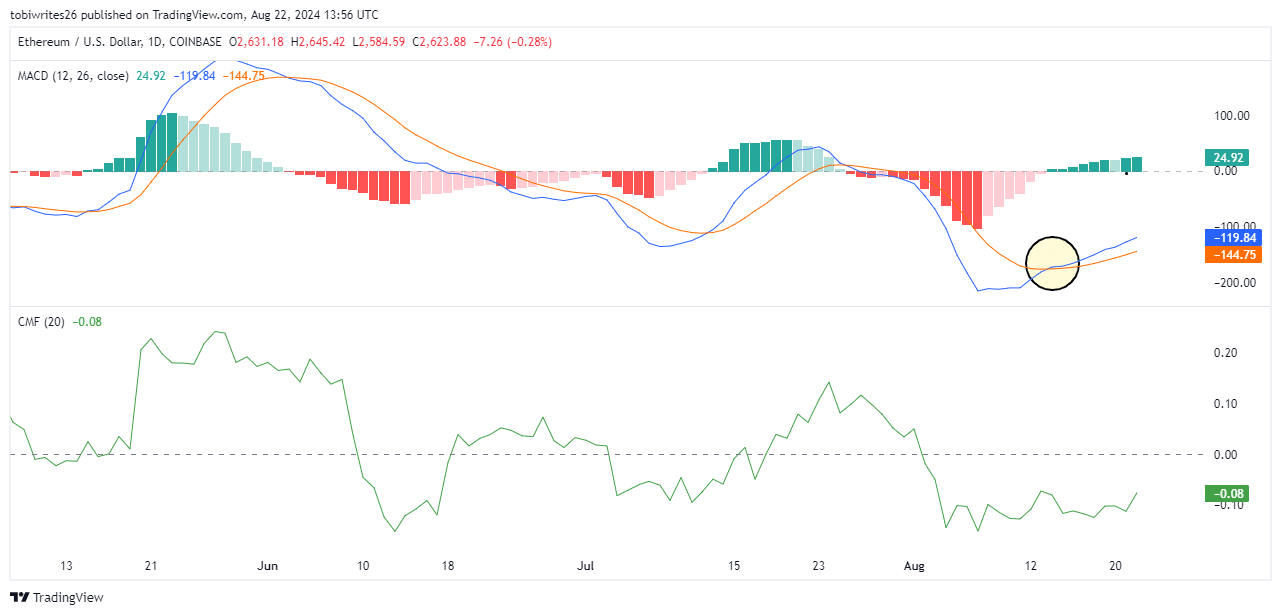

Momentum amongst Ethereum merchants is growing, as indicated by the Transferring Common Convergence and Divergence (MACD).

This instrument tracks the connection between two shifting averages of ETH’s value, serving to to identify adjustments in momentum and path.

Lately, the MACD signaled a bullish crossover, suggesting that patrons are actively getting into the market and should proceed to push the worth upward.

Moreover, Ethereum’s momentum has been on the rise, with the MACD trending towards constructive territory. This implies a powerful probability of continued value will increase.

Is your portfolio inexperienced? Try the ETH Profit Calculator

The Chaikin Cash Move (CMF) additionally helps this bullish outlook. It has been rising for the reason that 18th of August, indicating that purchasing strain was mounting.

If this development persists, it may additional propel ETH’s value greater to the $2,800 goal.

[ad_2]

Source link