[ad_1]

- ETH noticed extra influx into exchanges within the final buying and selling session.

- The ETH steadiness on change has continued to say no.

A latest evaluation of Ethereum’s [ETH] market exercise revealed a sample of accumulation and sell-offs by totally different addresses over the previous couple of days.

Regardless of these combined traits, the general quantity of ETH on exchanges has decreased, which is usually a bullish sign.

Ethereum sees combined indicators

The latest Ethereum market exercise has produced combined indicators from key indicators. On one hand, there was notable accumulation by some giant holders, or “whales,” which is often a bullish signal.

Evaluation of holders’ knowledge exhibits that these whale addresses have elevated their holdings by roughly 200,000 ETH, equal to round $540 million.

Then again, some institutional gamers have been promoting, which may point out a extra cautious or bearish outlook from sure market individuals.

Knowledge from Lookonchain revealed that establishments like Amber Group and Cumberland have offered over 13,000 ETH, price greater than $35 million, within the final 24 hours.

This promoting strain from establishments contrasted with the buildup by whales, making a combined market sentiment.

Whereas the whale accumulation factors to a powerful perception in Ethereum’s future, the institutional sell-offs may mirror issues about short-term worth actions or broader market uncertainties.

Ethereum movement exhibits the dominance of sellers

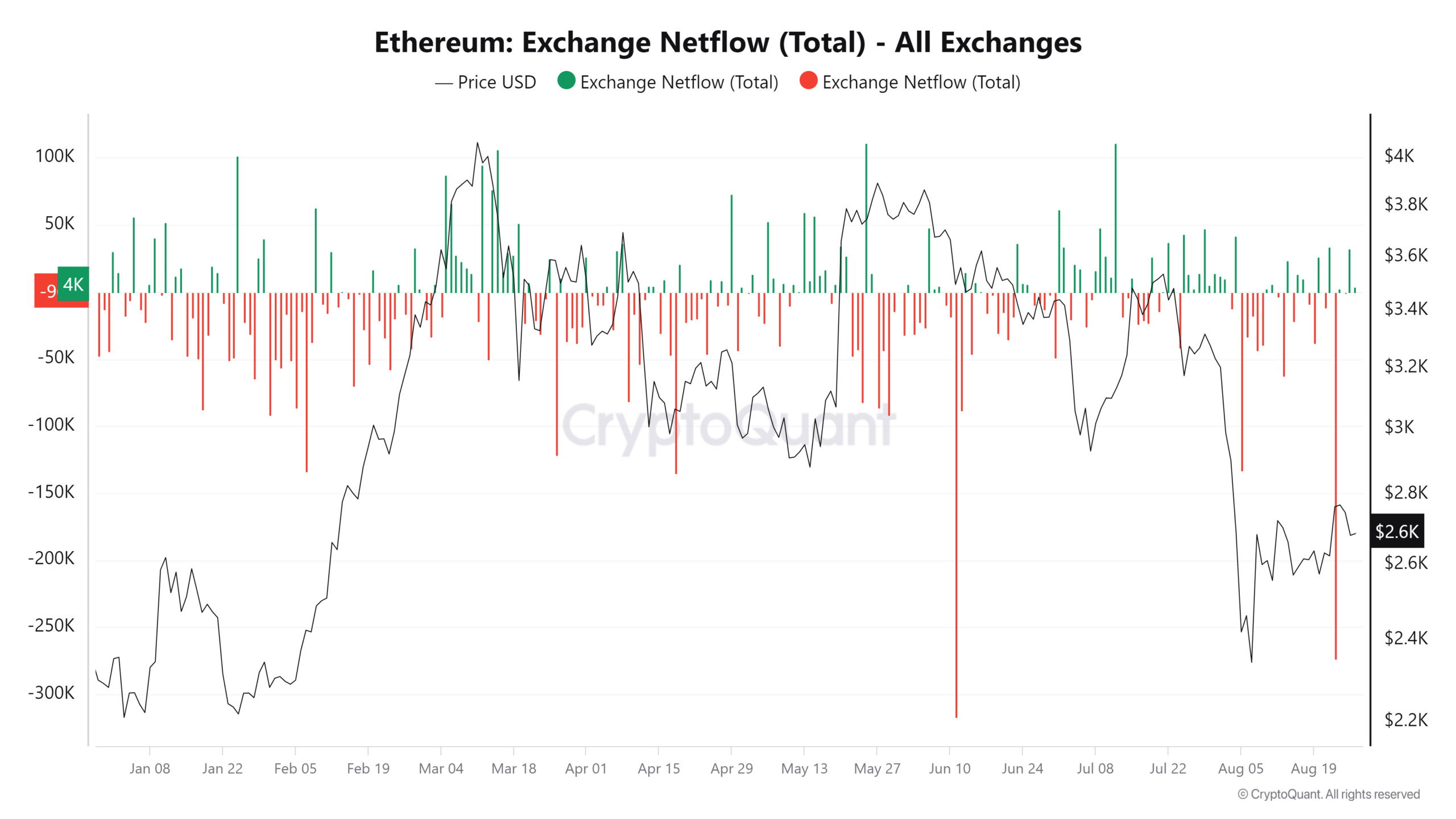

AMBCrypto’s evaluation of Ethereum’s change netflow knowledge from CryptoQuant on the twenty sixth of August revealed a constructive netflow.

This indicated that extra ETH was deposited into exchanges than was withdrawn on that day. Particularly, the netflow was over 32,000 ETH, suggesting that the amount of sell-offs outpaced the buildup throughout this era.

A constructive netflow sometimes indicators that buyers are shifting ETH onto exchanges, presumably to promote or commerce, which might create short-term promoting strain.

This aligned with the latest knowledge displaying that some establishments, resembling Amber Group and Cumberland, have been promoting important quantities of ETH.

Nonetheless, regardless of this non permanent enhance in change inflows, the broader pattern over the previous couple of weeks has seen extra outflow of ETH general.

Because of this, on an extended timescale, extra ETH has been withdrawn from exchanges than deposited, usually interpreted as a bullish indicator.

ETH’s change flight

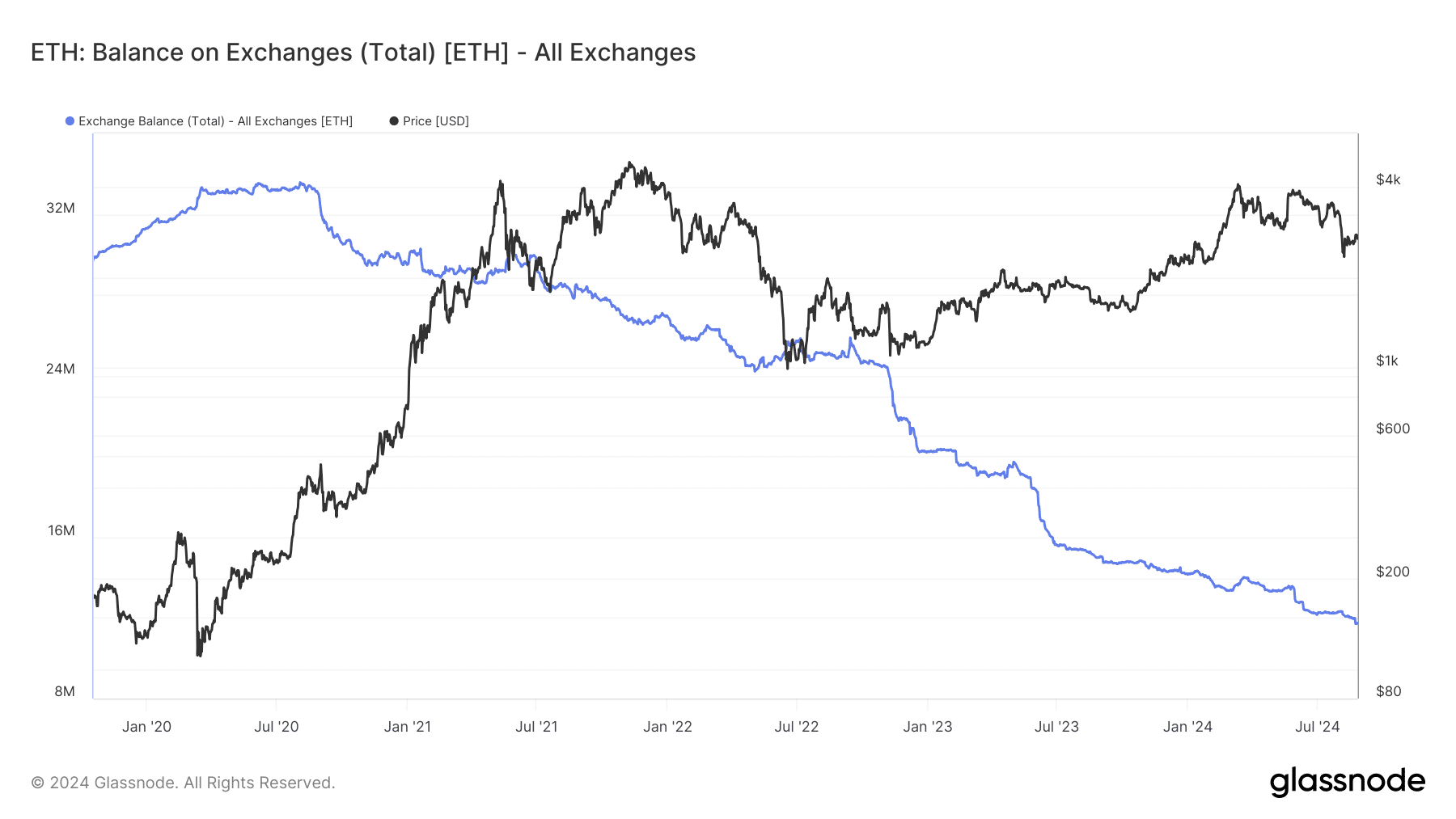

The continuing decline in Ethereum’s steadiness on exchanges is a big pattern, indicating that extra buyers are withdrawing their holdings from exchanges.

This discount in change steadiness recommended that buyers could also be shifting their ETH to chilly storage, staking, or different types of long-term holding, quite than protecting it available for buying and selling.

A declining change steadiness can result in shortage within the accessible provide of ETH on exchanges, which generally has a bullish implication for the asset’s worth.

When fewer cash can be found for buying and selling, and if demand stays robust or will increase, shortage can drive up costs as a result of fundamental financial precept of provide and demand.

This declining change steadiness provides to the record of bullish indicators for Ethereum, regardless of the combined indicators noticed in latest weeks.

ETH continues to pattern weakly

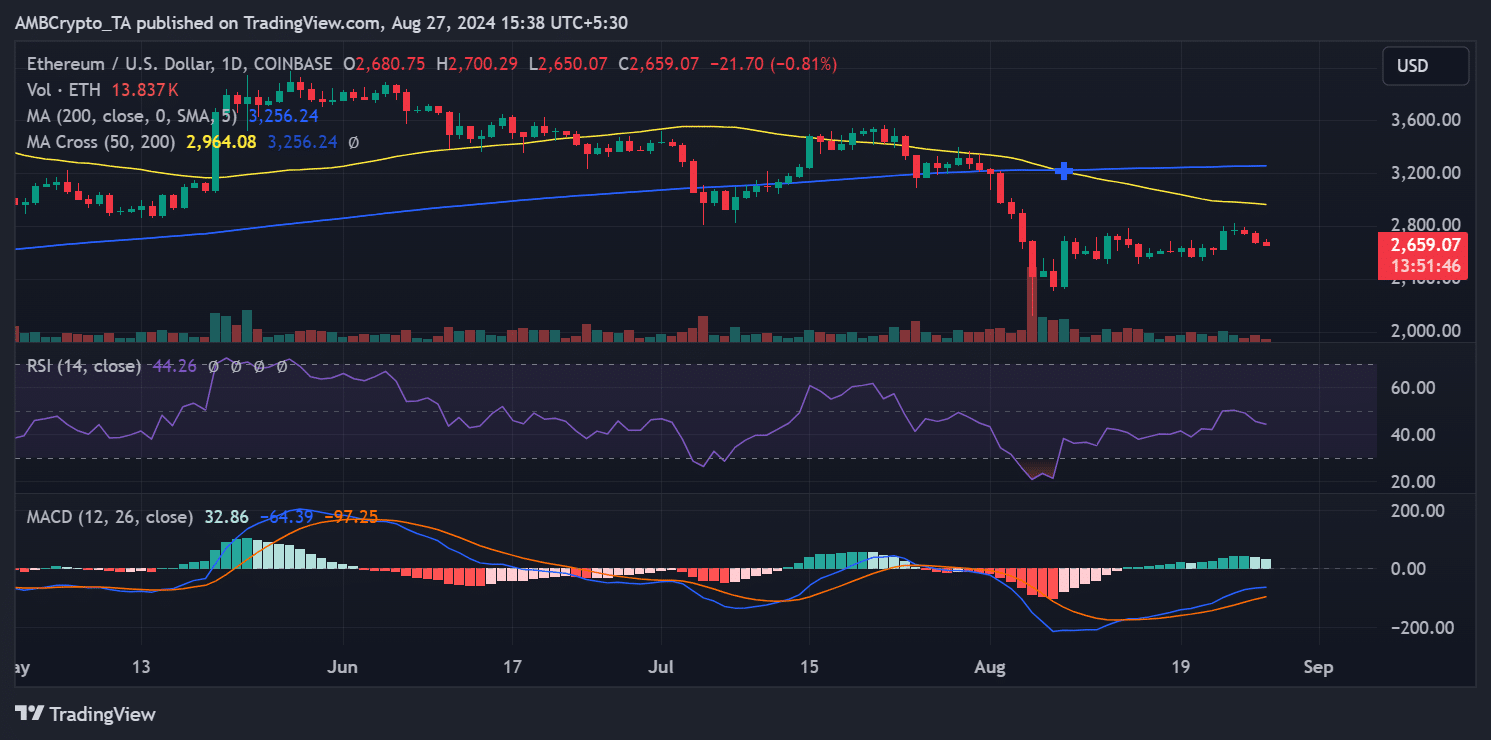

In line with AMBCrypto’s evaluation, Ethereum has not too long ago struggled to take care of constructive momentum.

Its each day worth pattern evaluation reveals that Ethereum has skilled consecutive declines during the last three days. As of this writing, Ethereum traded at roughly $2,656, reflecting an extra decline of practically 1%.

Its short-moving common (yellow line) continued to behave as a big resistance stage round $2,900.

Learn Ethereum’s [ETH] Price Prediction 2024-25

This resistance has repeatedly prevented Ethereum from breaking greater, contributing to the latest downward strain on its worth.

The continued decline in worth underscores the combined indicators which have characterised Ethereum’s market exercise in latest weeks, with short-term bearish traits contrasting with some longer-term bullish indicators, resembling declining change balances.

[ad_2]

Source link