[ad_1]

The optimistic sentiment is pushed by the world’s largest property supervisor agency BlackRock lately asserting its tokenized fund targeting Ethereum’s BUIDL merchandise.

The cryptocurrency market commenced the Asian buying and selling session bullishly, propelled by favorable occurrences and an immense brief squeeze. Bitcoin (BTC) and Ethereum (ETH), the main cryptocurrencies, soared, with over $100 million in leveraged brief positions liquidated throughout the previous 24 hours.

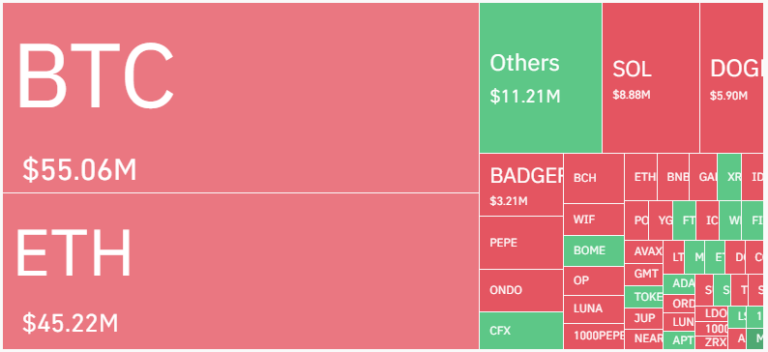

CoinGlass knowledge revealed a considerable liquidation prevalence. Leveraged futures positions price over $100 million confronted pressured closure over the last 24 hours, with roughly $55 million stemming from brief bets on Bitcoin and $45 million from brief positions on Ether. These brief sellers, anticipating worth declines, were caught unawares by the abrupt uptick and face considerable losses.

Picture: CoinGlass

Easing Cycle Bodes Effectively for Crypto

Cryptocurrency’s future seems promising because of the broader financial panorama. The Swiss Nationwide Financial institution’s unexpected rate reduction signifies international central banks adopting looser monetary insurance policies. This easing cycle benefits the premier cryptocurrencies like Bitcoin and Ethereum.

Equally, dovish stances from Mexico’s central financial institution, coupled with hints from main establishments just like the Federal Reserve, European Central Financial institution, and Financial institution of England, recommend potential liquidity injections within the coming months, fostering a bullish environment for cryptocurrencies.

Jeroen Blokland, The Founding father of Blokland Good Multi-Asset Fund, commented on present investment tendencies, emphasizing optimistic outlooks for cryptocurrencies, shares, gold, and actual estate. Regardless of anticipating a market correction, He expressed confidence within these numerous assets’ medium-term efficiency.

Quick Squeeze Fuels Bullish Outlook for Bitcoin and Ethereum

The cryptocurrency’s current worth surge and brief squeeze stress the sector’s transformative panorama. Whereas short-term volatility persists, rising institutional curiosity and favorable financial situations recommend potential for long-term progress. Quick-term swings are typical, yet extra stakeholders and a supportive surroundings might foster sustained development.

According to CoinMarketCap, Bitcoin surged 3.15% up to now 24 hours, reaching $67,970. Whereas the Ethereum mirrored this optimistic sentiment with a 2.60% acquire, at the moment buying and selling above $3,500. The CoinDesk 20 (CD20), a benchmark for the highest 20 most liquid cryptocurrencies, mirrored this broader market optimism, climbing roughly 3% on the time of writing.

Regardless of the potential for short-term volatility, but cryptocurrencies present potential for long-term beneficial properties. A worldwide easing cycle may increase liquidity and investments in digital assets, doubtlessly boosting costs additional. However, this outlook depends on anticipated financial situations unfolding as expected.

[ad_2]

Source link