[ad_1]

- Ethereum’s Open Curiosity has decreased, doubtlessly easing market tensions.

- The asset’s value reveals indicators of restoration, with a present rise to $3,585.

In current developments throughout the cryptocurrency markets, Ethereum [ETH] has proven indicators of a modest restoration after a turbulent interval.

Over the past 24 hours, ETH has seen an increase of 1.5%, marking a possible turnaround from its week-long downtrend which has now culminated in a 2.5% drop.

This resurgence has allowed Ethereum to cross the numerous value threshold of $3,500, buying and selling round $3,585 at press time.

This enchancment in value accompanies a notable lower in market stress, as evidenced by modifications in Ethereum’s Open Curiosity (OI).

Open Curiosity, which aggregates the whole of all open positions out there, whether or not lengthy or brief, serves as a barometer for market exercise and sentiment.

Market eases as Ethereum’s OI dips

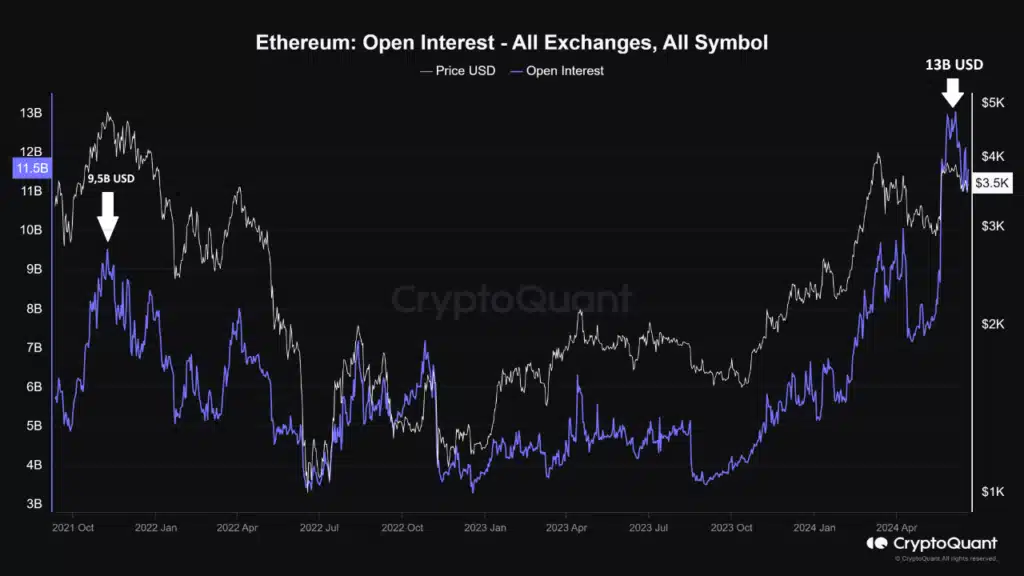

Just lately, knowledge from CryptoQuant has highlighted a big discount in Ethereum’s Open Curiosity, which dropped from a excessive of $13 billion to $11.5 billion.

This discount grants the market much-needed respiratory house, doubtlessly assuaging a number of the speculative pressures which have overheated the market in current instances.

The CryptoQuant analyst notably famous,

“Whether or not this pullback in OI knowledge is enough can be decided by market makers, however we will say that the boiling water has cooled down a bit.”

In the meantime, the height in Ethereum’s Open Curiosity beforehand coincided with its all-time excessive value of $4,891 in 2021, reaching as much as $9.5 billion throughout that bull run.

In distinction, the present cycle noticed the OI escalate to a document $13 billion with out renewing the all-time excessive, indicating a heightened stage of market leverage and speculative curiosity.

This excessive stage of Open Curiosity led to important market corrections, with about $400 million in Ethereum positions liquidated since early June.

$285 million of those had been lengthy positions, and $113 million had been shorts, the analyst revealed.

Buyers trudge on

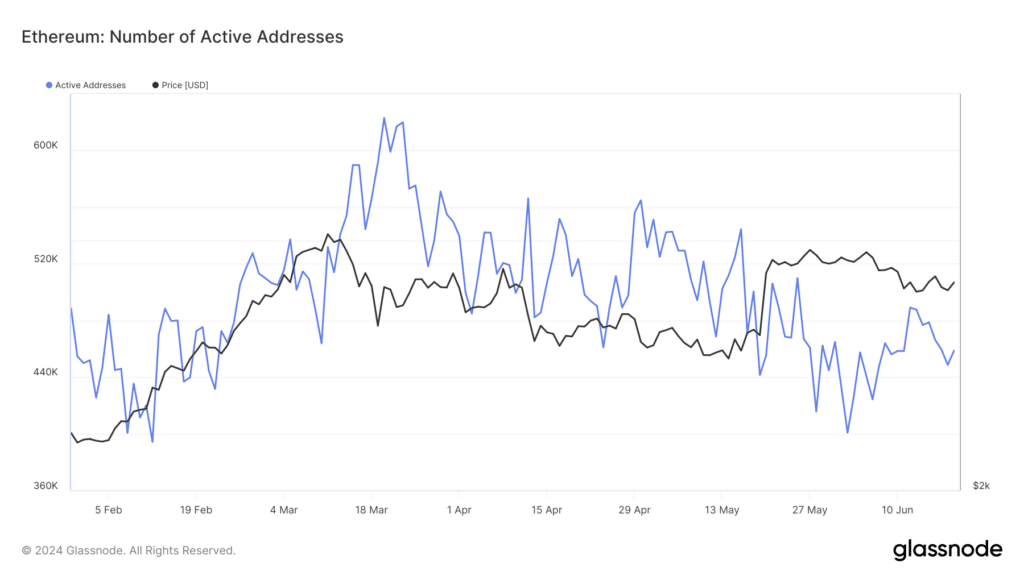

Including complexity to the market’s conduct, Ethereum’s lively addresses have proven a decline, suggesting a lower in person engagement or community exercise.

This, per Glassnode, just lately dipped from a excessive of 489,000 lively addresses, reflecting potential shifts in investor conduct and market participation.

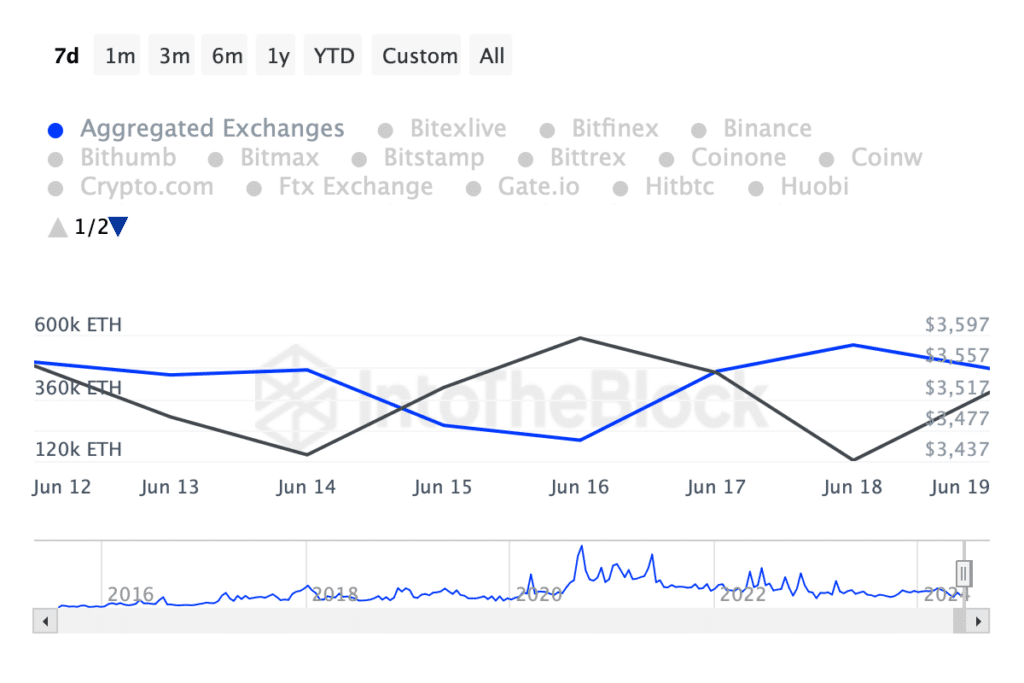

Concurrently, IntoTheBlock’s data indicated ongoing accumulation actions amongst Ethereum buyers, regardless of the market’s challenges.

Over the previous week, Ethereum noticed a internet outflow from exchanges exceeding 400,000 ETH, signaling sturdy investor confidence and potential anticipation of value appreciation.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

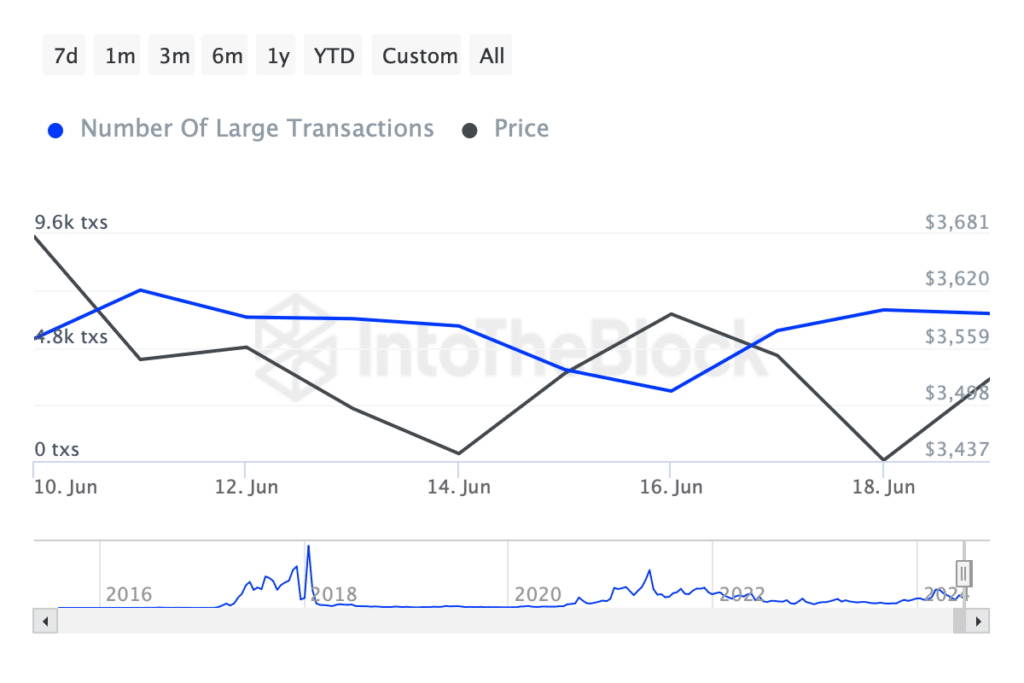

The development is supported by a report from AMBCrypto, which noted that Ethereum’s trade provide has hit an eight-year low.

This coincided with a surge in giant transactions (over $100k), which have elevated considerably in simply the previous week.

[ad_2]

Source link