[ad_1]

- Ethereum noticed an enormous drop in Open Curiosity in April following the rejection at $3.7k

- The on-chain metrics have been nonetheless wholesome, hinting at the opportunity of an uptrend

Ethereum [ETH] was buying and selling at $3.2k at press time. The $3k psychological degree was breached a number of occasions because the thirteenth of April on the decrease timeframes, and sentiment behind the altcoin king has weakened significantly.

This was evident by the sheer drop within the Open Curiosity behind ETH. Mixed with the worth trajectory of the previous couple of weeks, it appeared {that a} downtrend was attainable.

But, with $3k defended on the upper timeframes, there was additionally the opportunity of a resurgence for the bulls. AMBCrypto investigated on-chain metrics to grasp which path is extra doubtless.

Similarities to Feb 2021

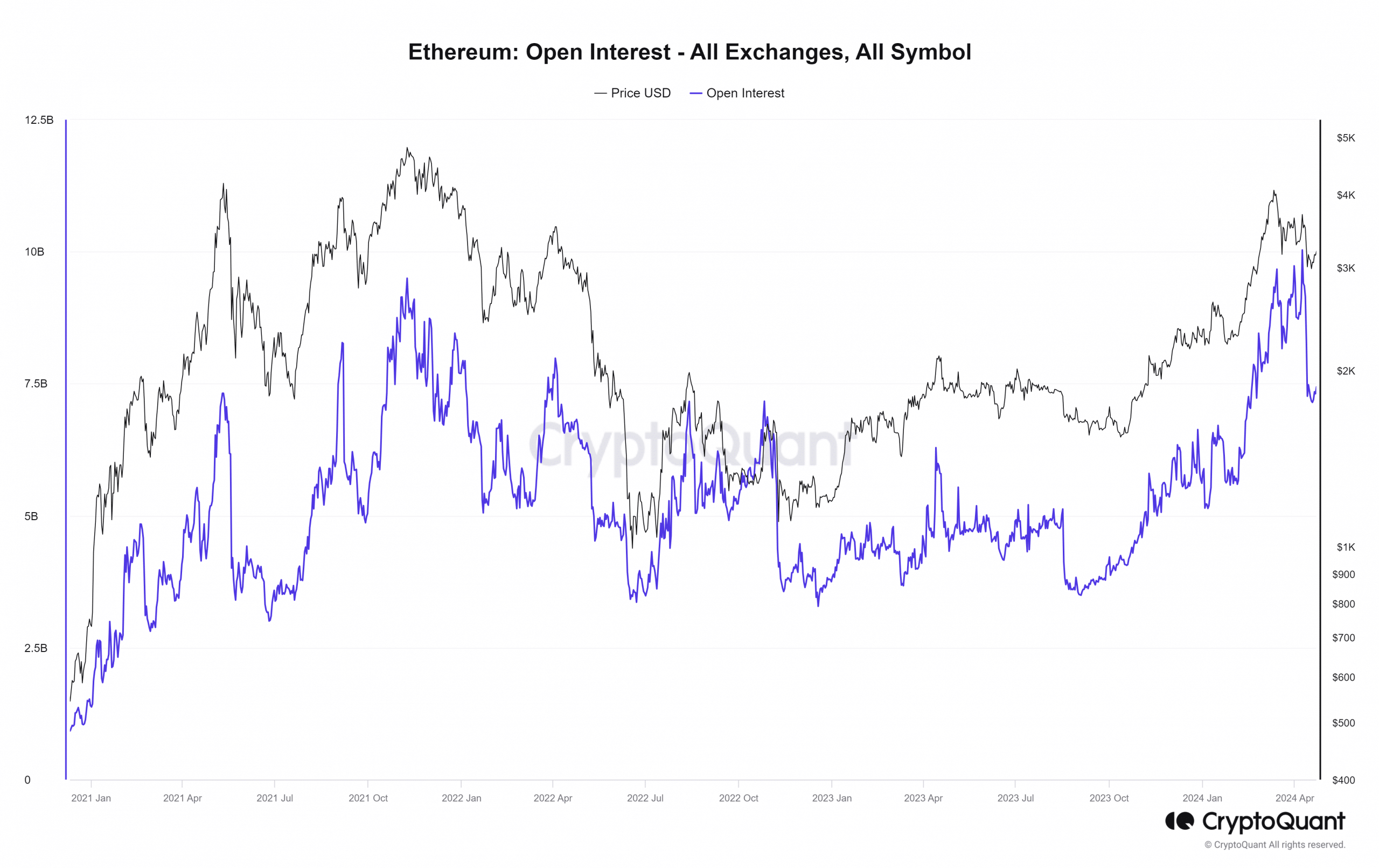

Supply: CryptoQuant

Through the earlier bull run, in mid-February 2021, the worth of Ethereum corrected from $1.9k (an ATH at the moment) to $1.4k. It was adopted by a V-reversal, however it confirmed that there are various occasions when the futures market will get overheated.

Impatient bulls wish to make a fast buck going lengthy on leverage. This does work, however after some extent, the shortage of spot demand and the overwhelming longs within the futures market get reset.

The drop in OI from $10 billion to $7.17 billion in April was doubtless yet one more such reset. It’s unclear whether or not the same V-reversal would start, given the promoting strain behind Bitcoin additionally in current weeks.

Person adoption has fallen alongside costs, sentiment

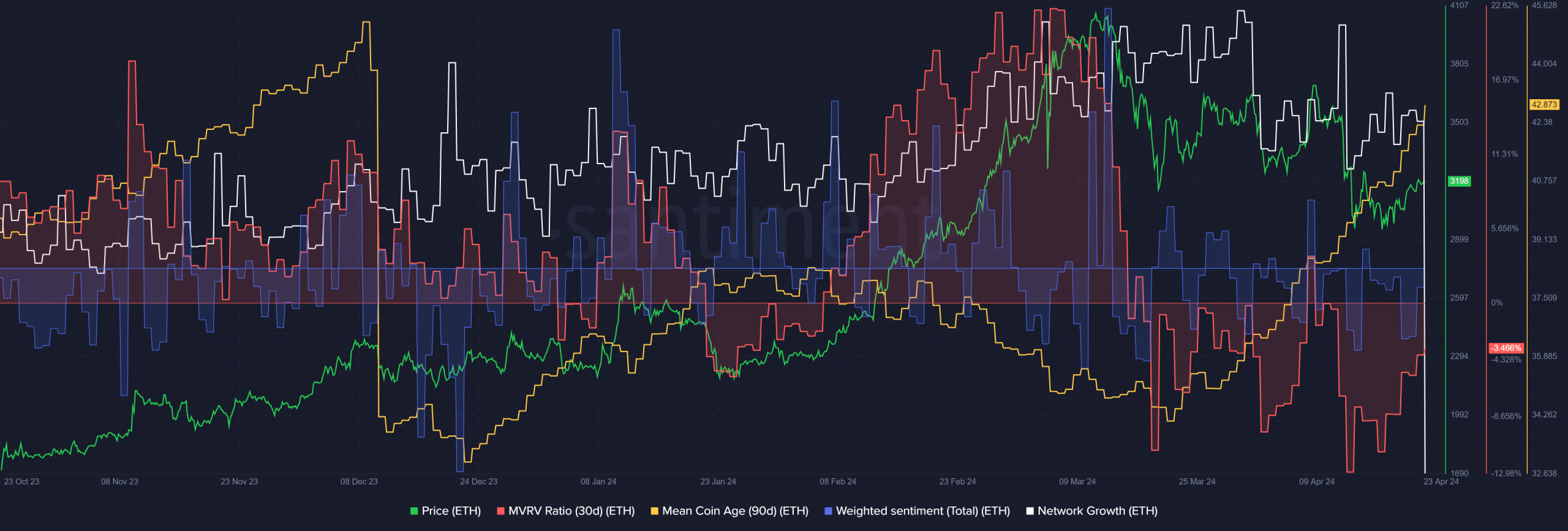

Supply: Santiment

The weighted social sentiment had been strongly constructive in February and for a few days in mid-March. Since then, it has been destructive for essentially the most half as costs entered a correction. The sentiment earlier than the worth peak may additionally revolve across the excessive fuel charges on the community.

The community progress metric additionally slowed down previously three months. An uptick could be an indication of rising demand, however it’ll extra doubtless observe an uptrend than precede it.

Is your portfolio inexperienced? Verify the Ethereum Profit Calculator

The 90-day imply coin age has trended steadily greater since twenty seventh March. This confirmed a network-wide accumulation of ETH. In the meantime, the 30-day MVRV ratio has been destructive for practically a month now, exhibiting holders at a loss.

It introduced a great shopping for alternative, however some uncertainty remained. If ETH can climb again above the $3.3k resistance, swing merchants and buyers can be extra assured of continued positive aspects.

[ad_2]

Source link