[ad_1]

- Grayscale’s ETHE noticed $1.51 billion outflows within the first week of buying and selling

- Coinbase analysts imagine outflows might ease after two weeks

Ethereum’s [ETH] value depreciated by over 7% due to an enormous exodus of traders from Grayscale’s ETHE. Shortly after U.S spot ETH ETFs started buying and selling, Grayscale noticed weekly outflows totaling $1.51 billion, pushing ETH to $3k from $3.5k.

Nonetheless, at press time, the world’s largest altcoin had bounced again above $3.2k. Therefore, the query – Can further Grayscale outflows nonetheless subdue ETH’s value into the brand new week?

When will Grayscale outflows ease?

Effectively, on the brilliant facet, Coinbase analysts imagine that reduction from the ETHE bleedout might occur after subsequent week. Evaluating GBTC and ETHE’s outflows, they noted,

“On its first two buying and selling days, ETHE noticed outflows of -$484M and -$327M respectively. In distinction, GBTC noticed outflows of -$95M and -$484M, whereas having almost 3 times the AUM ($28B vs $8.6B).”

The analysts, David Duong and David Han, added that the heavy outflows from ETHE imply that the pattern might be ‘short-lived,’ in comparison with GBTC’s three-month-long outflow streak.

If ETHE follows the GBTC pattern, as per Duong and Han, then it might see its first internet inflows when its AUM (belongings beneath administration) drops by 53%.

“If ETH value stays fixed and ETHE outflows proceed to common $400M, ETHE would attain 53% of its July 24 AUM in roughly two weeks because of its smaller dimension.”

On Friday, ETHE noticed extra outflows value $356 million, bringing complete weekly outflows to $1.51 billion.

To place it merely, the aforementioned projection signifies that Grayscale’s bleeding might ease after subsequent week.

By extension, meaning the ETH ETF might repeat the U.S spot BTC ETF’s playbook. The truth is, according to some market observers, ETH might bounce again with a possible 90% rally to $6.5k in such a state of affairs.

Blended views from QCP Capital analysts

Nonetheless, QCP Capital analysts aren’t as bullish on ETH as they have been earlier than the spot ETF launch. In response to him, the shortage of a staking characteristic makes the ETF merchandise much less fascinating to traders.

On Grayscale’s outflows, QCP Capital analysts blamed its hefty 2.5% payment fees as the rationale for the outflows. Even Grayscale’s Mini ETF model hasn’t helped ease the bleed out as some initially anticipated.

In consequence, the ETH ETF has turned out to be a ‘purchase the hype, promote the information’ occasion.

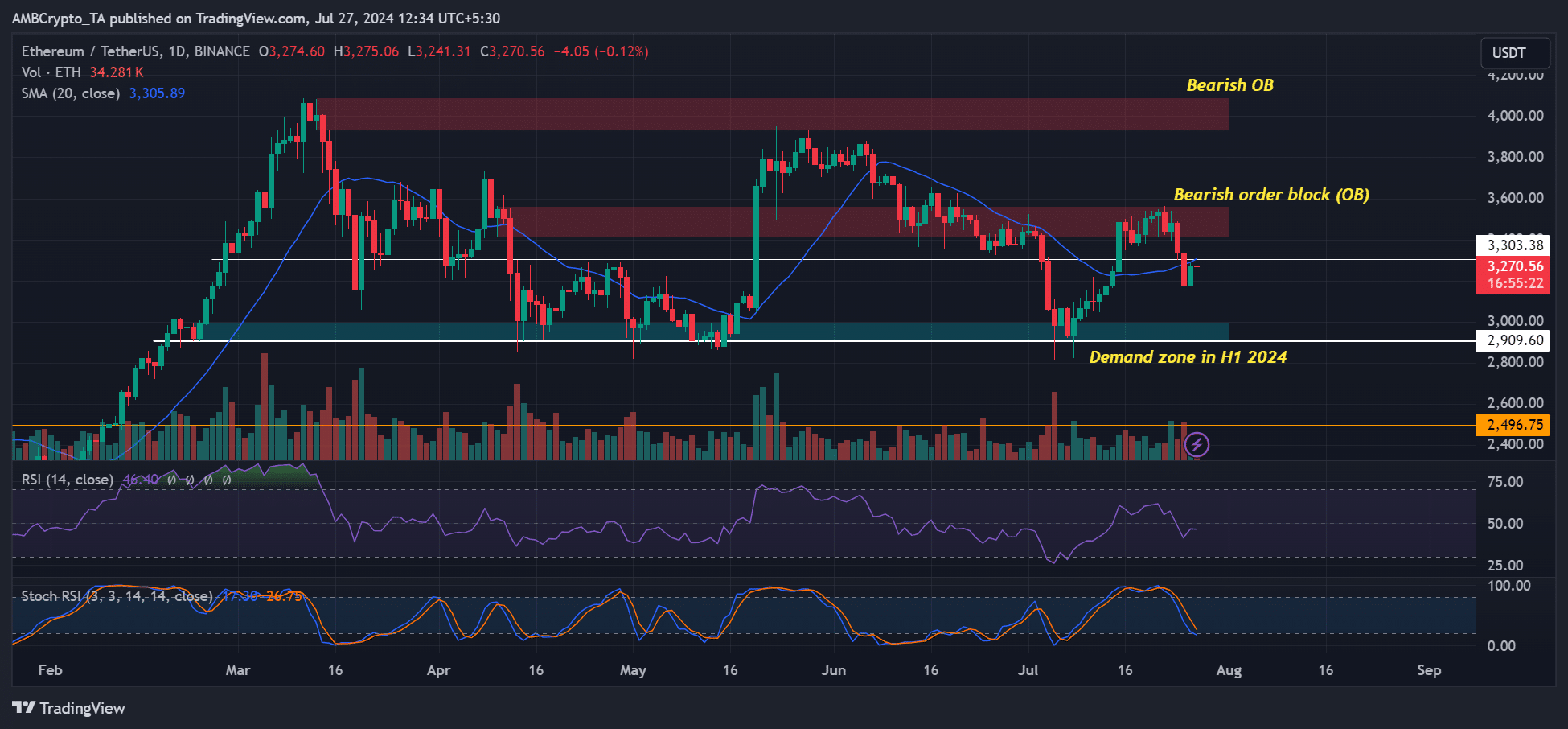

In the meantime, ETH might be nearer to a value reversal, as denoted by the Stochastic RSI (Relative Power Index), easing into oversold territory.

Nonetheless, the RSI’s latest dip under the common indicated {that a} convincing rebound might be delayed. If that’s the case, a retest of $3.0k can’t be overruled earlier than ETH bulls try to rebound to clear the overhead resistance ranges at $3.5k and $4k.

[ad_2]

Source link