[ad_1]

- ETH bears imagine that low charges, L2 fragmentation, and competitors from BTC and SOL may dent worth prospects.

- Nonetheless, ETH bulls foresee a long-term demand and worth appreciation for the altcoin.

Ethereum [ETH] has had a bittersweet worth motion within the present market cycle. Between late 2023 and early 2024, the most important altcoin rallied over 150%, leaping from $1600 to $4K.

Nonetheless, total market headwinds and the SEC’s combined alerts on ETH’s safety standing in Q2 2024 dented its sentiment. Regardless of a last-minute pivot by the SEC and the profitable launch of US spot ETH ETF, the altcoin’s worth has remained muted.

ETH’s bull vs bear case

On the time of writing, ETH’s worth was under $3K, and the crypto group appears divided on its worth prospects. As highlighted by Flip Analysis, the bull and bear camps have sturdy and compelling arguments.

ETH’s bear case

For the bear case camp, the market analysis analyst famous that ETH’s decreased earnings, L2 fragmentation, and direct competitors from Bitcoin [BTC] and Solana [SOL] didn’t bode effectively for the altcoin’s worth.

For context, after the Dencun improve, charges dropped, and extra customers migrated to L2s.

‘Profitability has dropped off a cliff post-Dencun, and it doesn’t appear to be that may change quickly’

Nonetheless, L2s’ fragmentation has intensified, giving Solana’s monolithic chain a aggressive edge and additional denting ETH’s worth outlook. Per Flip Analysis,

‘At present @l2beat is monitoring 71 L2s, 20 L3s, and an unimaginable 82 upcoming launches. That is considerably degrading UX, and turning into a big barrier to widespread adoption. In the meantime, SOL has proven the potential of a monolithic chain & ecosystem.’

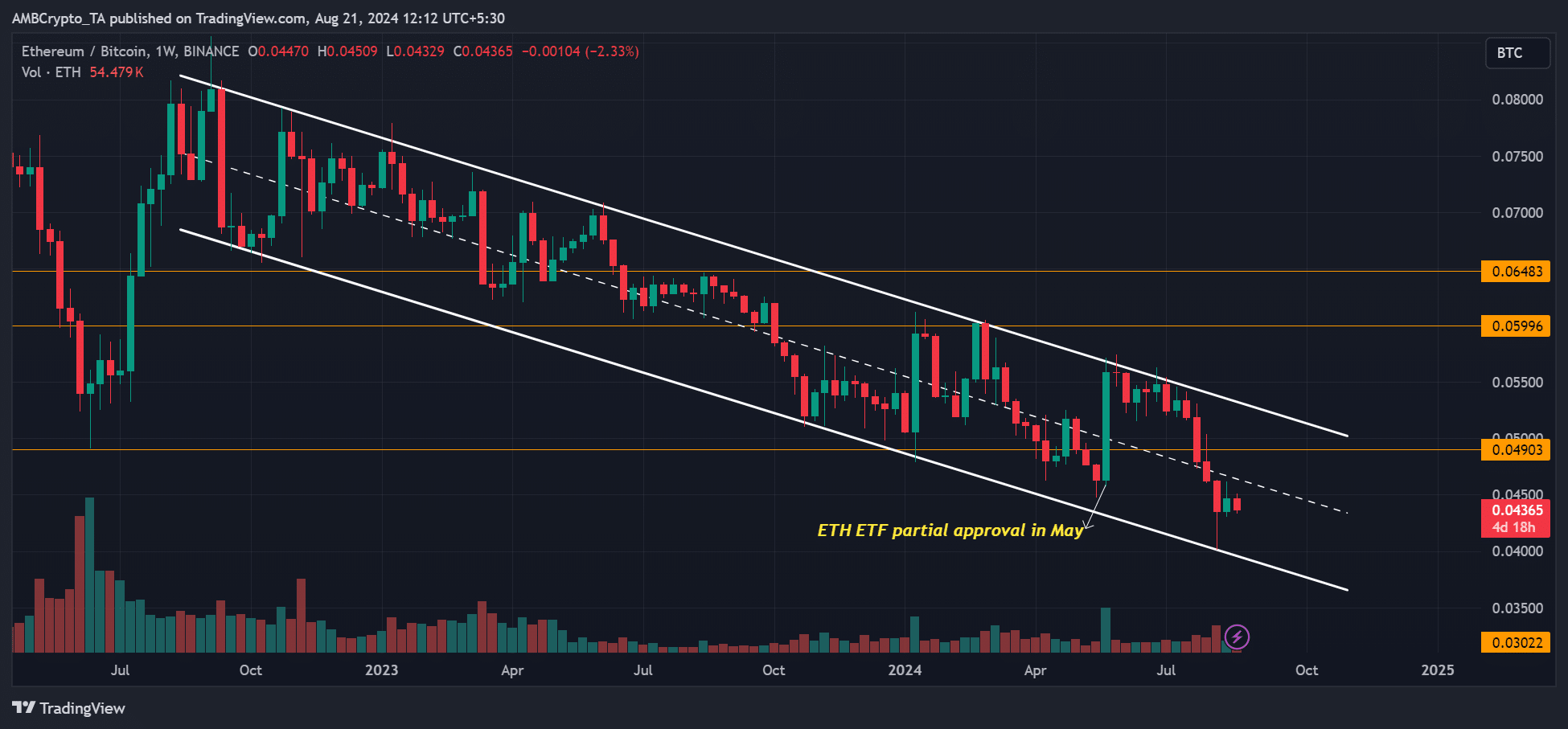

Moreover, ETH has been underperforming SOL and BTC, as proven by the declining SOLETH and ETHBTC ratios. This underscored weak sentiment on the main altcoin, per Flip Analysis.

The ETHBTC ratio, which tracks ETH’s relative efficiency to BTC, has decreased regardless of the US spot ETH ETF approvals. This meant that ETH underperformed BTC over the identical interval.

ETH’s bull case

Nonetheless, ETH bulls have countered the bear camp with strong arguments. Flip Analysis famous that memes eclipsed the DeFi narrative. However a story shift was underway.

‘ETH’s underperformance this yr has coincided with a rotation from DeFi to memes. Nonetheless, it appears to be like just like the narrative could also be shifting.’

One other important level was that ETH was the one institutional-grade and battle-tested chain. BlackRock’s curiosity within the chain for on-chain tokenization additional supported this argument.

‘Lots of the smartest minds within the area are collaborating on the ETH roadmap. Any institutional onboarding can be achieved on ETH, whether or not it’s RWAs and on-chain tokenisation, prediction markets and so on.’

Coinbase analysts additionally projected a continued demand for ETH in the long term as utilization in L2 protocols surges.

‘Present traits lead us to anticipate continued power in ETH demand from different protocol-based avenues equivalent to collateral in cash markets or buying and selling pairs in DEXs’

Nonetheless, on his half, Ali Muneeb, one of many pioneers of Bitcoin DeFi and Stacks [STX] founder, said that he would choose Solana over Ethereum.

‘I’d choose Solana over Ethereum any day.’

In the meantime, ETH has been consolidating above $2500 for the second week as total crypto market sentiment stays weak. With strong arguments on either side, whether or not ETH’s sentiment will enhance or not stays to be seen.

[ad_2]

Source link