[ad_1]

- Each longs and shorts skilled a turbulent time after ETH’s worth went up and down

- Realized Income elevated, indicating that the worth might fall beneath $3,400

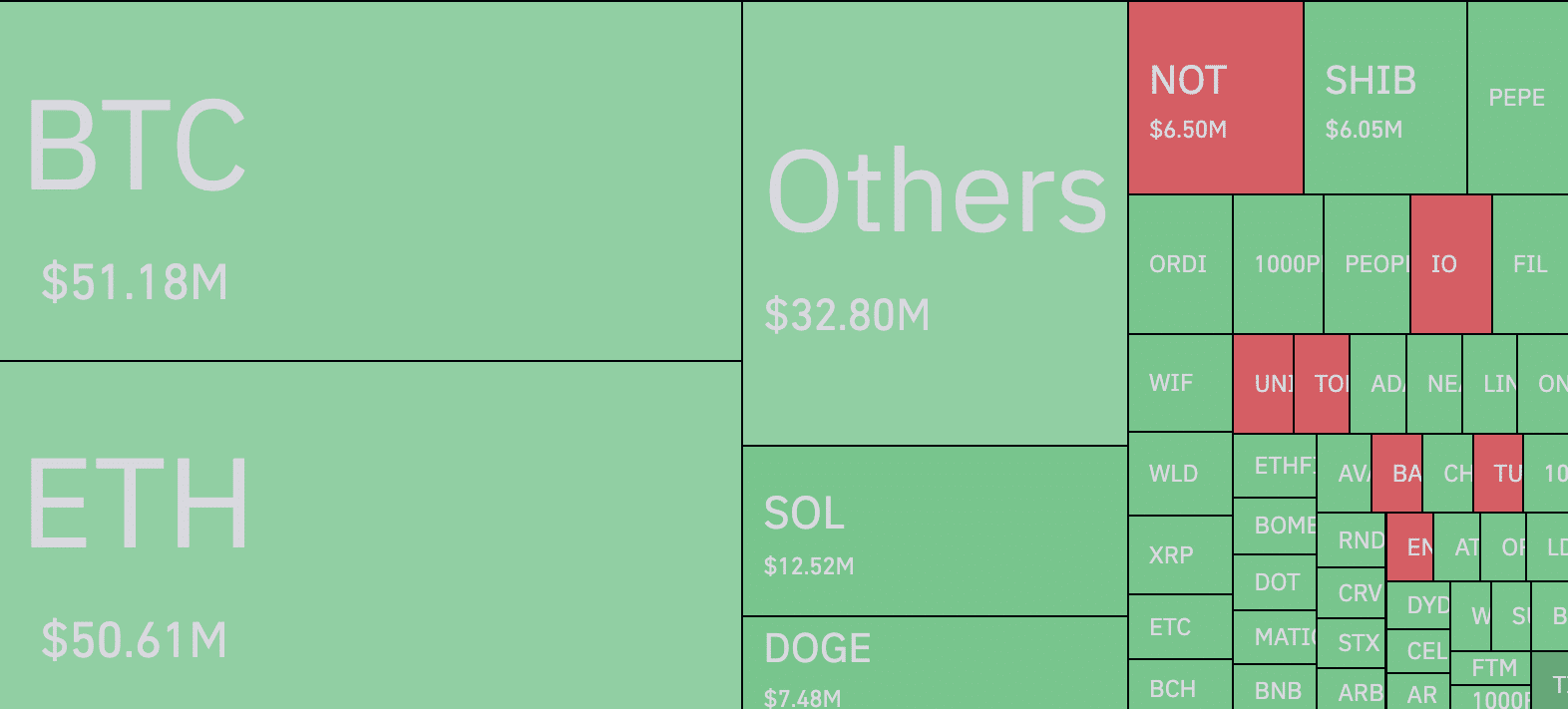

The excessive volatility out there brought on liquidations out there to hit $215 million. Out of this, Ethereum [ETH] contracts accounted for $50.61 million, in response to information from Coinglass.

Liquidations happen when a dealer doesn’t have a ample margin steadiness to maintain a place open. The forceful closure is important to keep away from additional losses.

Stormy season for the market

For ETH, the excessive liquidations could possibly be linked to the cryptocurrency’s worth. A have a look at the worth motion revealed that it dropped to $3,368 sooner or later on 14 June. Afterward, the worth rose to $3,512, earlier than settling above $3,500 at press time.

On account of these worth swings, each longs and shorts weren’t spared. Longs discuss with merchants betting on the worth of an asset to hike. Shorts, alternatively, are merchants with stakes on a worth decline.

Nonetheless, merchants appeared to anticipate the depreciation in worth. This, due to the Put/Name ratio earlier than Friday’s choices of expiry. In response to Deribit, the derivatives change, Ethereum’s Put/Name Ratio was 0.37.

For the reason that ratio was beneath 0.50, it meant that expectations have been bearish. Nonetheless, it didn’t appear the individuals anticipated the excessive stage of volatility.

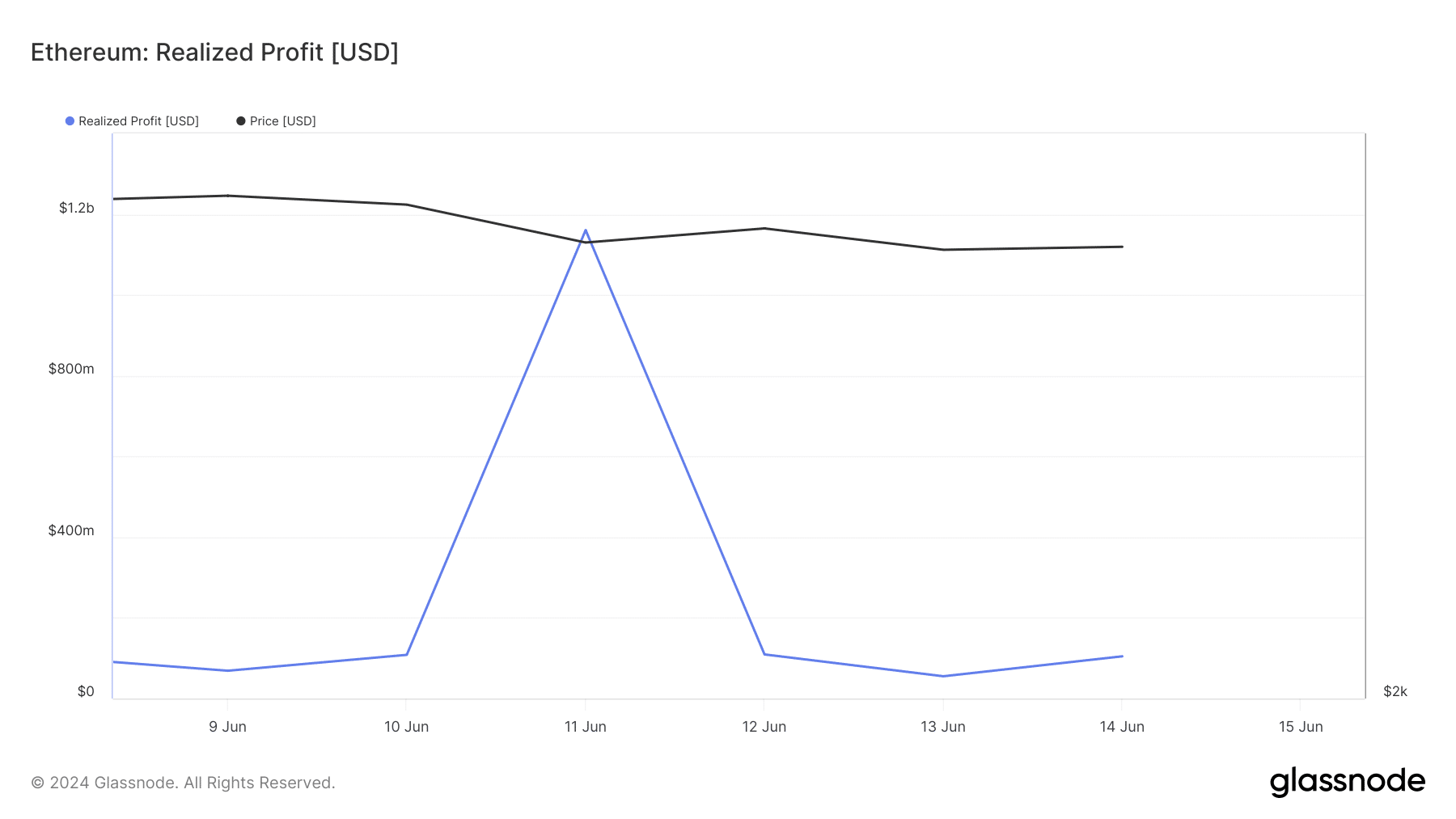

By way of the worth, AMBCrypto seemed on the Realized Revenue too. Because the title implies, this denotes the entire of all moved cash whose final worth was decrease than its press time worth.

ETH plans to swing between $3,400 and $3,600

On 12 June, ETH’s Realized Profit was $55.18 million. By 14 June, the worth had risen to $104. 58 million. A rise on this metric implies that holders are reserving income, and this might result in a worth fall on the charts.

Nonetheless, if the metric stabilizes itself, promoting stress reduces throughout the market. For Ethereum, Realized Revenue appears to have settled across the aforementioned worth. Due to this fact, it is perhaps possible for the altcoins to commerce between $3, 400 and $3,600 over the following few days.

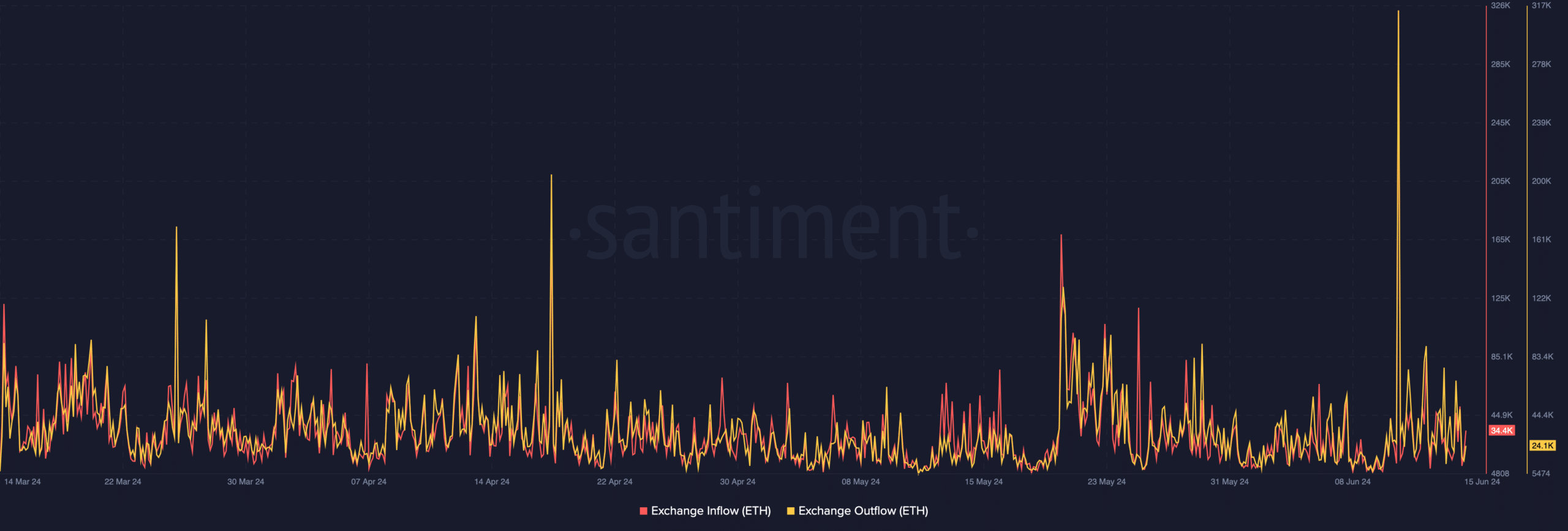

AMBCrypto additionally analyzed Alternate inflows and outflows to evaluate ETH’s subsequent motion. Alternate inflows observe the variety of cash despatched into exchanges.

If this will increase, it signifies that holders are planning to promote. When this occurs, the worth of a cryptocurrency normally decreases. Alternate outflows, alternatively, measures the variety of cash despatched out of exchanges.

At press time, ETH’s Alternate inflows had been $34,400 whereas the altcoin’s outflows had been 24,100. The distinction within the flows implied that there have been extra ETH up on the market, than these retired to cold wallets.

Learn Ethereum’s [ETH] Price Prediction 2024-2025

If this continues, the worth of the cryptocurrency would possibly drop beneath $3,400 prefer it did on 14 June. Alternatively, a fall in promoting stress may halt this decline and ETH would possibly maintain consolidating on the charts.

[ad_2]

Source link