[ad_1]

- Buying and selling volumes for prime Ethereum-based cash ebbed considerably.

- Ethereum’s weekly DEX volumes plunged 25%.

Ethereum [ETH] witnessed a pointy fall in price income this week, suggesting decreased community visitors and person participation.

Ethereum’s meme coin exercise slows down

In accordance with on-chain analytics agency IntoTheBlock, Ethereum validators collected a complete of $116 million in charges over the week, representing a major drop of 41.2%.

The stoop got here amidst reducing meme coin buying and selling on the community, an area which Ethereum has traditionally dominated.

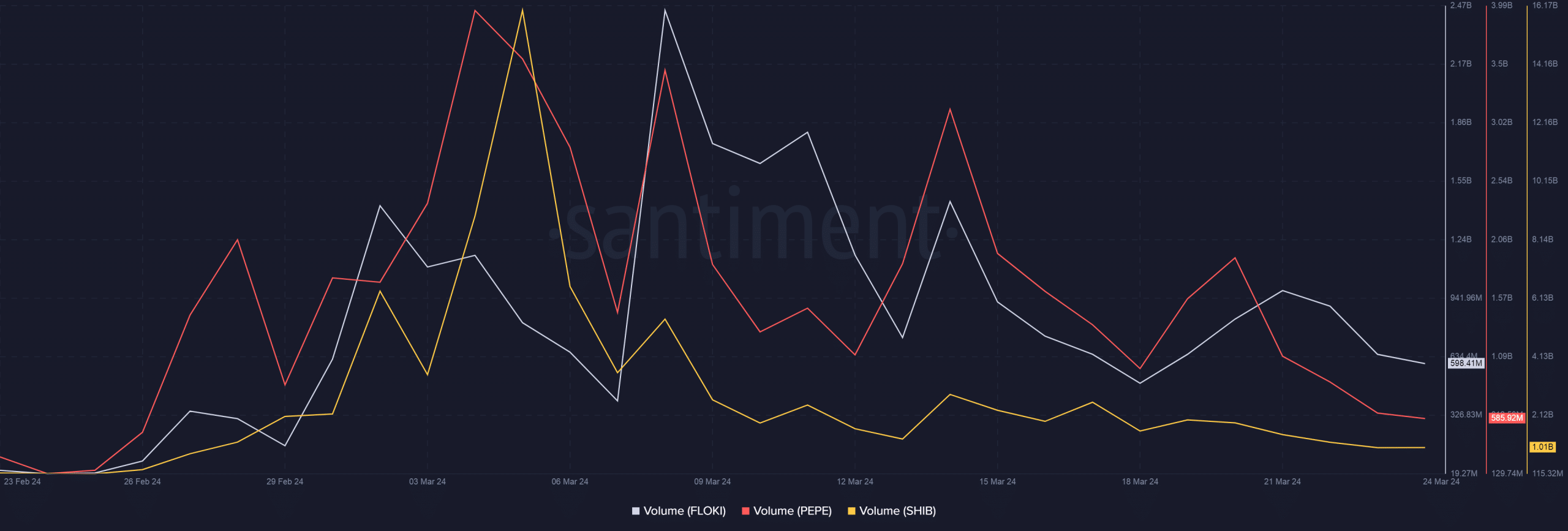

Buying and selling volumes for prime Ethereum-based cash reminiscent of Pepe [PEPE], Shiba Inu [SHIB], and Floki Inu [FLOKI] ebbed considerably over the week.

This occurred put up a frenzied demand within the first half of the month, as per AMBCrypto’s evaluation of Santiment’s knowledge.

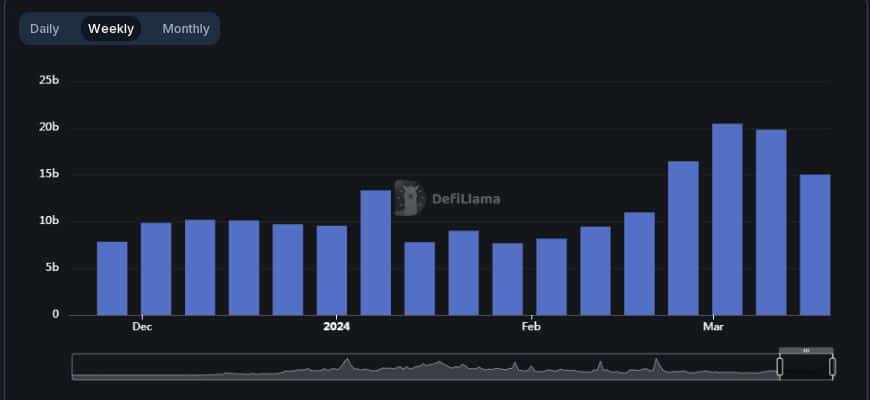

The fading meme coin mania was additionally mirrored within the drop in buying and selling quantity of Ethereum-based decentralized exchanges (DEXs) — platforms often utilized by crypto degens to swap tokens.

In accordance with AMBCrypto’s evaluation of DeFiLlama’s knowledge, volumes of simply over $15 billion have been facilitated on Ethereum DEXes within the week, marking a 25% drop from the week prior.

Ethereum’s loss is Solana’s acquire

The decline occurred as traders turned to the Solana [SOL] blockchain to satiate their meme coin urge for food. Solana’s complete DEX volumes rose 3% over the week.

An avalanche of latest meme cash created on the community over the week, introduced in additional customers, and consequently extra income.

Solana supplied a sooner and cheaper various for degens to flip cash compared to Ethereum.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

The typical transaction price paid by Solana’s customers within the final 24 hours was $0.027, as per SOL’s market worth at press time. Then again, Ethereum charged $1.19 on common to validate a transaction.

The diminished on-chain visitors meant that fewer native ETH tokens moved, in flip implying decrease demand. This partly contributed to a decline of 5% in its worth over the week, in line with CoinMarketCap.

[ad_2]

Source link