[ad_1]

- ETH’s worth appreciated by over 5% on 3 Might

- This contributed to a hike within the variety of quick positions liquidated

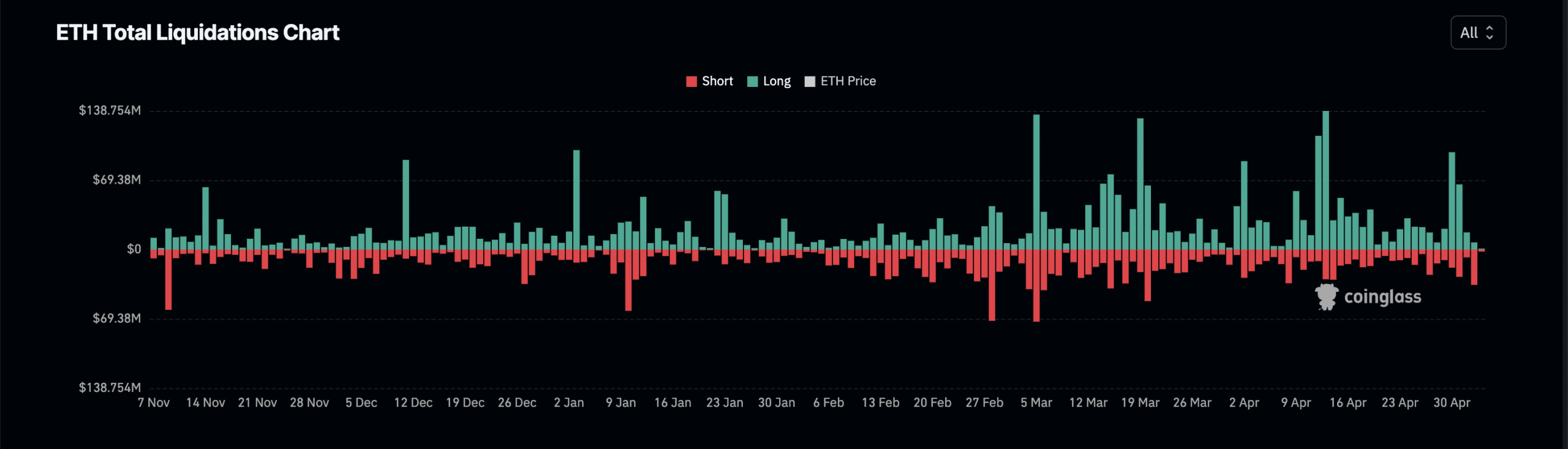

Ethereum’s [ETH] 7% worth rally through the intraday buying and selling session on 3 Might prompted quick liquidations on its derivatives market to rally to a two-month excessive, in keeping with Coinglass.

The truth is, the on-chain knowledge supplier went on to disclose that on that day, $35 million value of ETH’s quick positions had been liquidated. Compared, lengthy liquidations totalled simply $7.16 million.

Liquidations occur in an asset’s derivatives market when a dealer’s place is forcefully closed attributable to inadequate funds to keep up it. Brief liquidations happen when the worth of an asset all of the sudden rises, and merchants who’ve open positions in favor of a worth decline are pressured to exit their positions.

In keeping with Santiment’s knowledge, the altcoin closed on 3 Might above $3000 after buying and selling beneath that worth stage because the starting of the month.

Derivatives market merchants keep their arms

Nonetheless extending its features at press time, ETH’s worth was up by over 5% within the final 24 hours. On the time of writing, the market-leading altcoin was valued at $3,104.

Right here, it’s value noting that Coinglass knowledge additionally prompt that the worth rally has not instigated any important exercise in ETH’s derivatives market. The truth is, buying and selling quantity in that market grew by simply 2%.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Equally, the coin’s Futures open curiosity recorded a minor 3% hike over the identical interval. ETH’s Futures open curiosity was $10.68 billion at press time. Moreover, ETH’s Choices quantity cratered by over 50% through the interval below evaluate.

Choices buying and selling grants individuals the proper to purchase or promote an asset at a specified date. Typically, when ETH sees a decline in its Choices quantity, it means that there’s much less hypothesis on its future worth actions as market individuals wait to see the place the coin’s market could be heading subsequent.

A mixed studying of the minor hike in ETH’s Futures buying and selling quantity and its declining Choices quantity means that the coin’s derivatives market individuals have adopted a “wait and see” strategy. Merely put, they aren’t inserting important bets on the place its worth may head subsequent.

[ad_2]

Source link