[ad_1]

- Bullish Ethereum whales bought liquidated resulting from extremely unstable value actions.

- Holders remained unprofitable regardless of rising costs.

Ethereum [ETH] has skilled large volatility over the previous week, inflicting merchants to lose cash left proper and heart.

Whales see pink

Not solely retail buyers, however some whales have additionally been topic to liquidations over the previous few days.

In accordance with Lookonchain’s knowledge, a whale, regardless of earlier losses totaling $4.5 million, doubled down on its ETH place, demonstrating confidence within the asset’s potential, and ended up dropping cash.

The investor additionally made a transfer involving the withdrawal of 8,249 ETH from Binance [BNB], changing it to Compound [COMP], and borrowing 17.3 million Tether [USDT] from the platform to make the sizeable wager.

Different merchants bought liquidated as nicely. In accordance with Coinglass’ knowledge, $6.28 million value of lengthy Ethereum positions had been liquidated inside a 24-hour window.

Regardless of these setbacks, the rising variety of lengthy positions taken in direction of ETH grew considerably.

This prompt a rising optimism amongst merchants, reflecting a bullish sentiment in direction of Ethereum’s future prospects.

Implied Volatility for ETH additionally surged in current days, mirroring the heightened uncertainty and threat prevailing available in the market.

Although a excessive IV is extra bearish in nature and most merchants favor to brief an asset in periods of excessive IV, the general sentiment in direction of ETH has remained constructive.

Trying on the knowledge

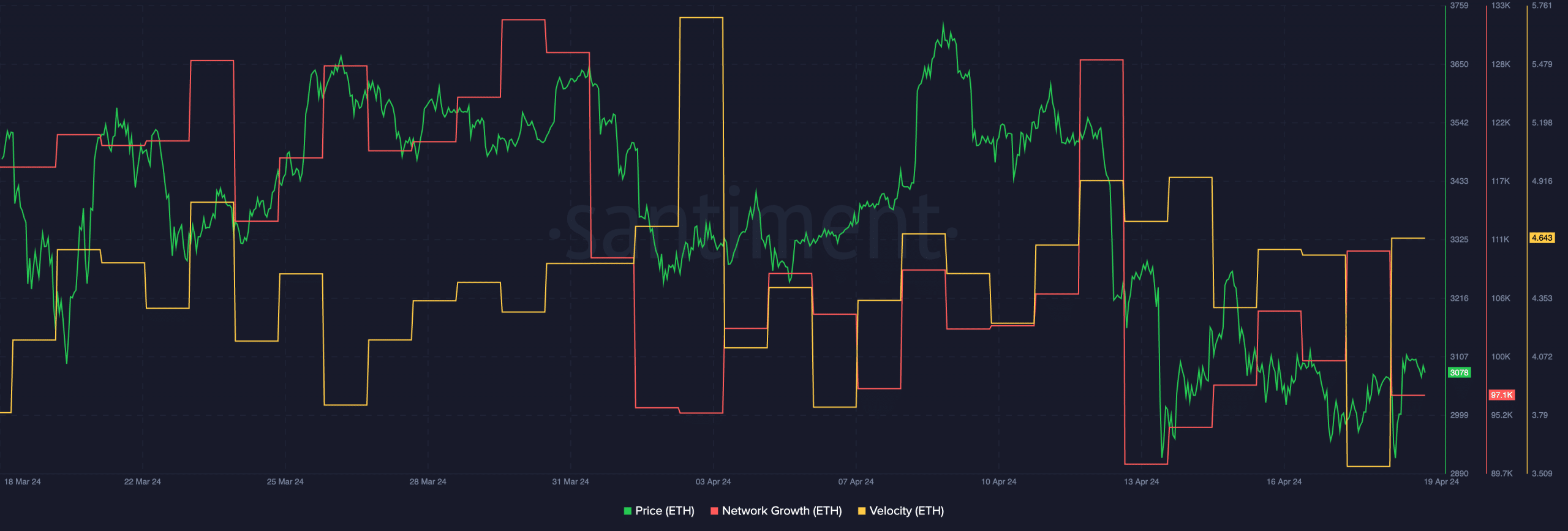

Within the final 24 hours, ETH’s value grew by 3.78% signifying short-term bullish momentum. Nonetheless, in line with AMBCrypto’s evaluation of Santiment’s knowledge, the community development round ETH declined.

This indicated that new addresses had been dropping curiosity within the ETH token.

Whereas Community Progress had declined, indicating a possible slowdown in new person adoption, the rise in velocity prompt elevated buying and selling exercise and liquidity available in the market.

Learn Ethereum [ETH] Price Prediction 2024-2025

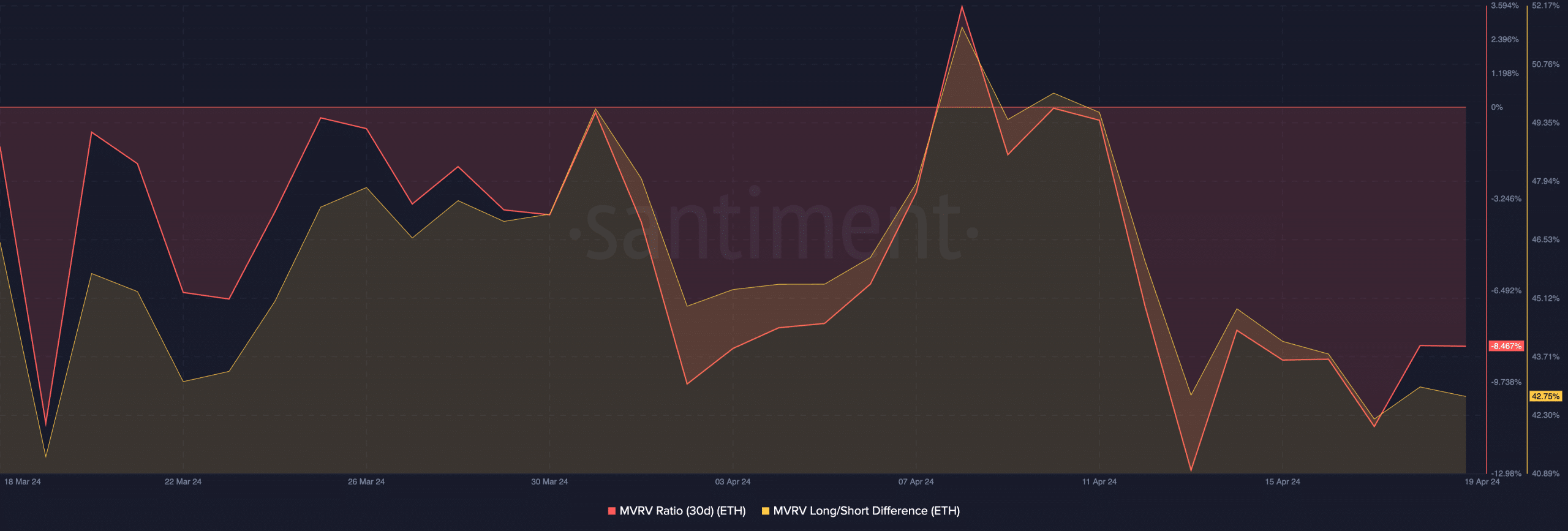

Regardless of the surge in value, the MVRV ratio for ETH remained damaging at press time, signaling that Ethereum holders had been but to appreciate income.

This situation implied a continued holding sample amongst Ethereum buyers, doubtlessly supporting additional upward momentum for ETH’s value as holders awaited extra favorable market situations.

[ad_2]

Source link