[ad_1]

- Bitcoin’s post-halving hours noticed a 2.31% dip, however ETF inflows surged and boosted investor confidence

- Potential enlargement of crypto-ETFs past Bitcoin and Ethereum might drive mainstream adoption

Seems like Bitcoin’s [BTC] halving introduced its personal share of surprises! After all of the hype surrounding Bitcoin’s halving, BTC hit a bump on the highway, falling by 2.31% in simply 24 hours. This, regardless of the Bitcoin ETF market noting such a big change. After 5 days of outflows, there was a sudden inflow of optimistic internet inflows proper earlier than the day of the halving.

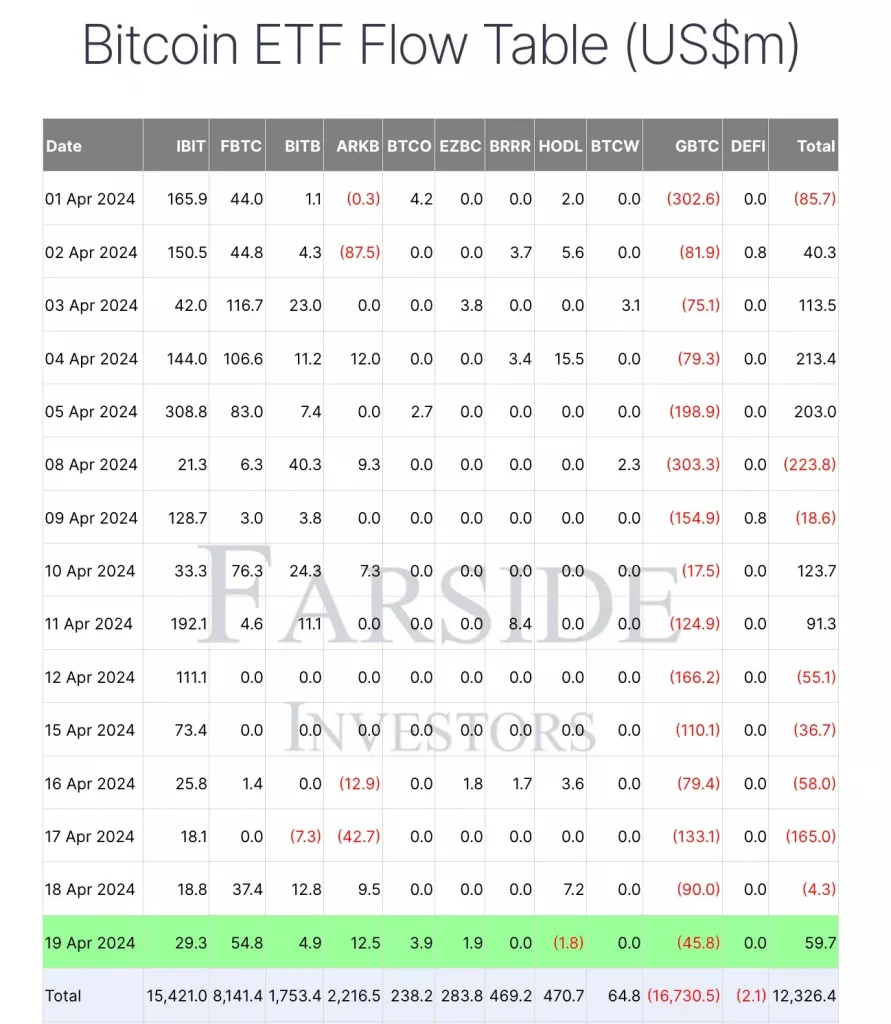

In truth, based on Farside Traders’ information, 5 out of 10 ETFs recorded optimistic inflows totaling $59.7 million.

This underlined the rising confidence in Bitcoin’s pre-halving and post-halving efficiency amongst traders within the ETF house.

Enlargement of ETFs resulting in crypto-mainstream adoption

Discussing the potential enlargement of the crypto-ETF house past Bitcoin and Ethereum [ETH], Sergey Nazarov, Co-founder of Chainlink, in a current interview claimed,

“I feel what’s subsequent is extra ETFs about cash aside from Bitcoin and Ethereum. So, I feel the ETF dynamic goes to proceed throughout this yr and simply develop and develop and develop.”

His feedback highlighted the potential for ETFs to drive broader adoption of digital property and advance the mainstream integration of Web3 applied sciences.

Right here, it’s value noting that in a separate interview, Anthony Scaramucci, Founding father of SkyBridge Capital, additionally chipped in on the topic.

“Bitcoin is on an adoption curve.”

He added,

“You received’t see this inflation hedge, or a retailer of worth as different pundits are saying till you recover from a billion customers. So, proper now it’s gonna be far more unstable than the folks like.”

All eyes on Spot Ethereum ETFs

On the again of Hong Kong’s current approval of Bitcoin and Ethereum ETFs, optimistic steps are being taken in direction of mainstream adoption. Nevertheless, whereas U.S-based ETFs have collected almost $60 billion in property since their launch, Hong Kong’s new ETFs’ success projections fluctuate.

Echoing related sentiments, senior Bloomberg ETF analyst Eric Balchunas not too long ago commented,

“Different international locations including BTC ETFs is little question additive, nevertheless it’s nickel-dime in comparison with the mighty U.S market.”

All this leads us to a query – Will the SEC reject the spot Ethereum ETF purposes?

In response to the aforementioned query, Hashkey Capital’s Head of Analysis Jupiter Zheng, responded,

“If the ETF is denied, it is not going to be that bearish, because the market isn’t pricing in it but. And, we nonetheless have Bitcoin ETFs as the doorway for conventional funds.”

What dictates entry into the crypto-market although? Effectively, based on Nazarov, adoption does.

In keeping with the exec, to deal with issues about mainstream adoption, the crypto-industry should deal with enhancing usability, scalability, connectivity, and privateness. Enhancements in these areas wouldn’t solely appeal to broader adoption, but additionally drive the {industry} ahead by pushing its boundaries, he concluded.

[ad_2]

Source link