[ad_1]

A quant has identified how the traits within the BitMEX alternate reserve have affected the Ethereum worth through the previous few years.

BitMEX Ethereum Whales Have Proven Sensible Cash Conduct In Latest Years

In a CryptoQuant Quicktake post, an analyst mentioned a sample within the ETH alternate reserve of the BitMEX platform. The “exchange reserve” right here refers to an on-chain metric that retains monitor of the full quantity of Ethereum that’s sitting within the wallets of any given centralized alternate.

When the worth of this metric rises, buyers will make internet deposits to the platform proper now. As one of many principal causes buyers switch to exchanges is for promoting functions, this development can have potential bearish implications for the asset’s worth.

Alternatively, a decline within the indicator suggests a internet quantity of the cryptocurrency’s provide is transferring off the wallets related to the alternate. Traders usually take their cash off into self-custody once they plan to carry for prolonged intervals, so such a development could possibly be bullish for the coin.

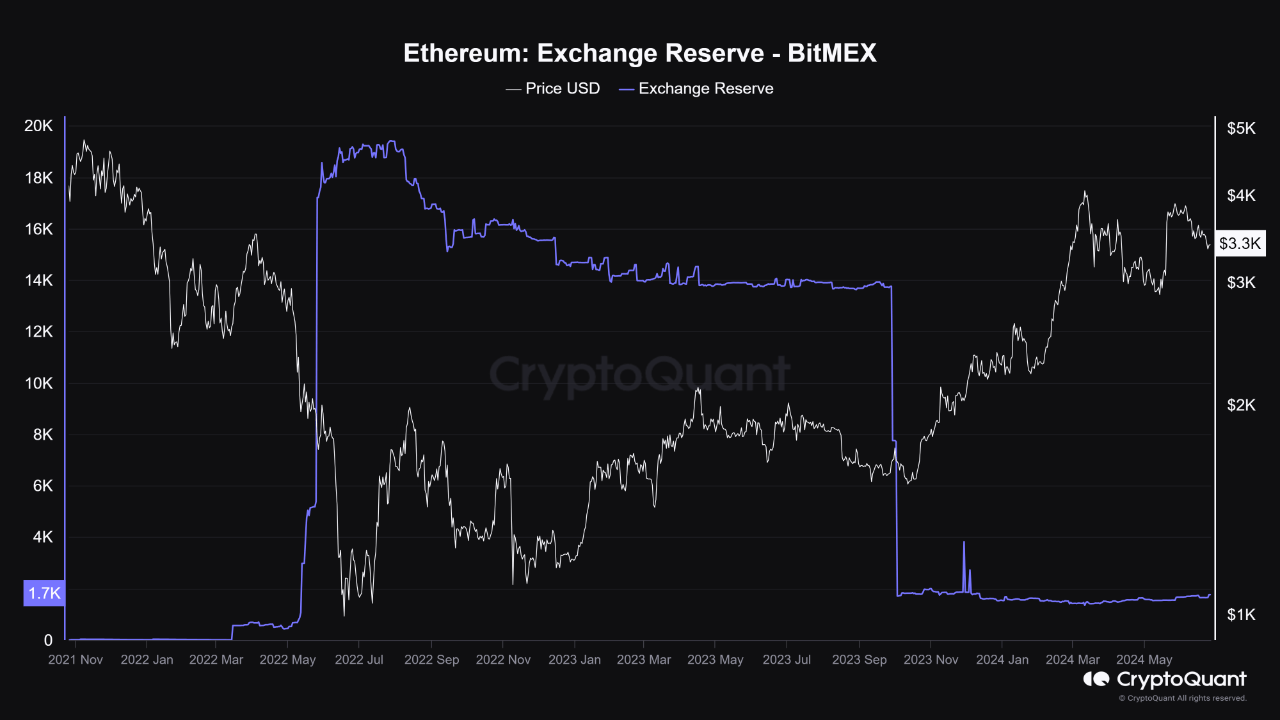

Now, here’s a chart that exhibits the development within the Ethereum alternate reserve for BitMEX over the previous couple of years:

As is seen within the above graph, the Ethereum alternate reserve on the BitMEX platform noticed a pointy improve again in mid-2022. This might recommend that the buyers had made some hefty internet deposits into the alternate.

In response to the quant, the platform homes a big variety of whales, so this massive influx exercise would replicate the conduct of those humongous buyers.

Curiously, the speedy development within the indicator had come proper earlier than ETH had crashed in the direction of its bear market lows. Thus, it might seem doable that these giant holders had anticipated that issues had been about to worsen for the asset, so that they had pulled the set off on promoting whereas they nonetheless had the possibility.

One other notable shift within the alternate reserve of BitMEX occurred in September 2023, when the whales took out an enormous quantity of Ethereum, nearly fully retracing the sooner bear market improve.

From the chart, it’s obvious that quickly after these internet outflows occurred, the cryptocurrency’s worth began on a pointy rally that may finally take it above the $4,000 degree for the primary time since December 2021.

It might seem that these sensible cash whales had been once more right of their instinct concerning the market, as they may time their buys simply in time for the rally.

Since these internet outflows in September, the indicator hasn’t displayed any important shifts, as its worth has been transferring sideways. Given the historic development, any new deviations that crop up could possibly be value watching out for, as they may probably spell one other shift for Ethereum.

ETH Worth

Ethereum confirmed a restoration push from its lows yesterday, however the run has calmed down as ETH continues to be buying and selling round $3,400 in the present day.

[ad_2]

Source link