[ad_1]

The massive ETH withdrawal by validators has raised safety issues for Ethereum. With fewer cash staked, the community is extra susceptible to assaults.

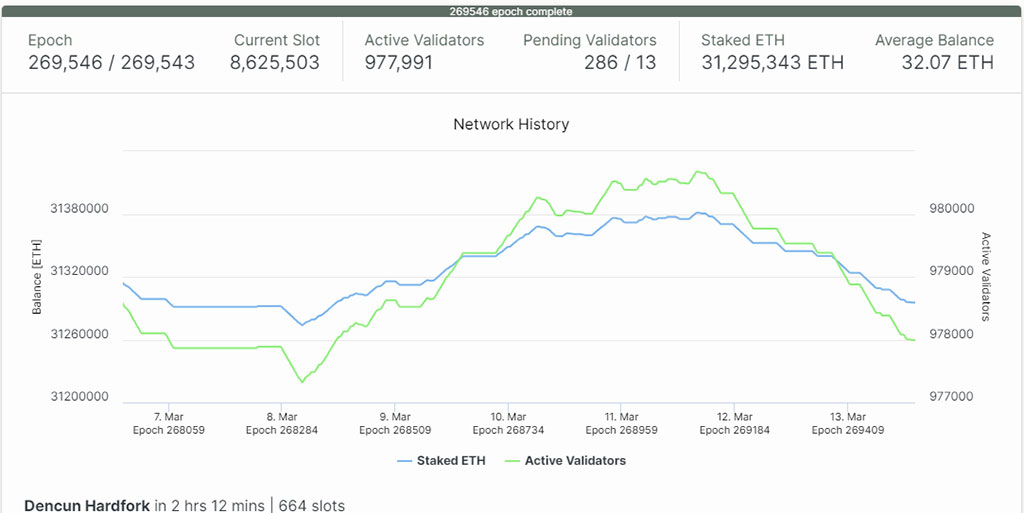

The Ethereum community is dealing with a major occasion as a lot of node validators withdraw a considerable quantity of ETH, totaling $320 million. This withdrawal has raised issues in regards to the safety and stability of the community, particularly with the extremely anticipated Dencun improve on the horizon.

The timing of this mass exodus is especially noteworthy, as Ethereum’s worth has been experiencing a bullish development. On March 13, the value of Ethereum reached a day by day excessive of $4,078, representing a 15% enhance for the month.

ETH staking deposits vs validators. Photograph: Beaconcha.in

Withdrawals Increase Community Safety and Worth Issues

The massive ETH withdrawal by validators has raised safety issues for Ethereum. With fewer cash staked, the community is extra susceptible to assaults.

On the identical time, there was a surge in ETH deposits on exchanges. On March 11 alone, 62,096 ETH was deposited, indicating a rising provide obtainable for buying and selling as per data by Santiment. This enhance in deposits is commonly related to bearish worth actions, suggesting extra willingness by traders to promote their ETH holdings.

ETH trade deposit transactions vs worth. Photograph: Santiment

Downward Strain on ETH Costs

The current withdrawal of ETH by node validators and a surge in trade deposits elevate issues about potential downward strain on ETH costs.

With over $320 million value of ETH coming into the market, there’s a risk of elevated promoting strain and a short-term worth correction. Nonetheless, Ethereum’s sturdy fundamentals, together with the upcoming Dencun upgrade, assist long-term progress.

Regardless of these issues, Ethereum’s worth has remained secure round $4,000, supported by bullish sentiment within the cryptocurrency market pushed by elements like institutional adoption and the recognition of DeFi functions.

Analyst Eye ETH Worth to $5,000 Regardless of Resistance Issues

Utilizing IntoTheBlock’s knowledge, analyst Ali Martinez has identified a considerable accumulation of purchase orders inside a provide zone. Roughly 600,000 addresses have acquired 1.63 million ETH on this space, creating a major impediment for Ethereum’s upward momentum.

Regardless of the problem posed by the provision wall, market sentiment stays optimistic about Ethereum’s potential to succeed in $5,000. Some patrons could intention to interrupt even, which might briefly decelerate Ethereum’s upward momentum. Nonetheless, the prevailing perception is that Ethereum has a powerful likelihood of reaching the $5,000 mark.

Coinspeaker’s evaluation of the Liquidation Heatmap helps this optimistic outlook. This software forecasts the place massive liquidations may happen, offering perception into potential market actions. In response to HyblockCapital’s knowledge, breaching the $4,205 degree might set off vital liquidations. Conversely, a profitable shut above this degree might pave the way in which for additional worth appreciation.

Ethereum’s worth chart signifies minimal resistance as much as $4,310 and a transparent path to $4,860, probably pushing it towards $5,000 with sturdy bullish momentum.

The Funding Price, a key dealer sentiment metric, stands at 0.068%, suggesting aggressive quick positions however no rewards, indicating a probable upward worth motion. Furthermore, Ethereum’s community exercise exhibits a major uptrend, with 537,000 lively addresses, reflecting rising curiosity and adoption.

[ad_2]

Source link