[ad_1]

- ETH was down by greater than 2% within the final 24 hours.

- Market indicators appeared bearish on Ethereum.

Ethereum [ETH] lately managed to go above $3.6k mark because it closed final week. Throughout that point, buyers’ confidence within the king of altcoins rose sparkly as a key metric hit an all-time excessive. Nevertheless, their confidence didn’t assist ETH, as its every day chart turned purple.

Ethereum buyers are growing

Santiment lately posted a tweet highlighting the truth that ETH took a leap this weekend, rebounding above $3.6K after dropping as a lot as 25% between eleventh and nineteenth March.

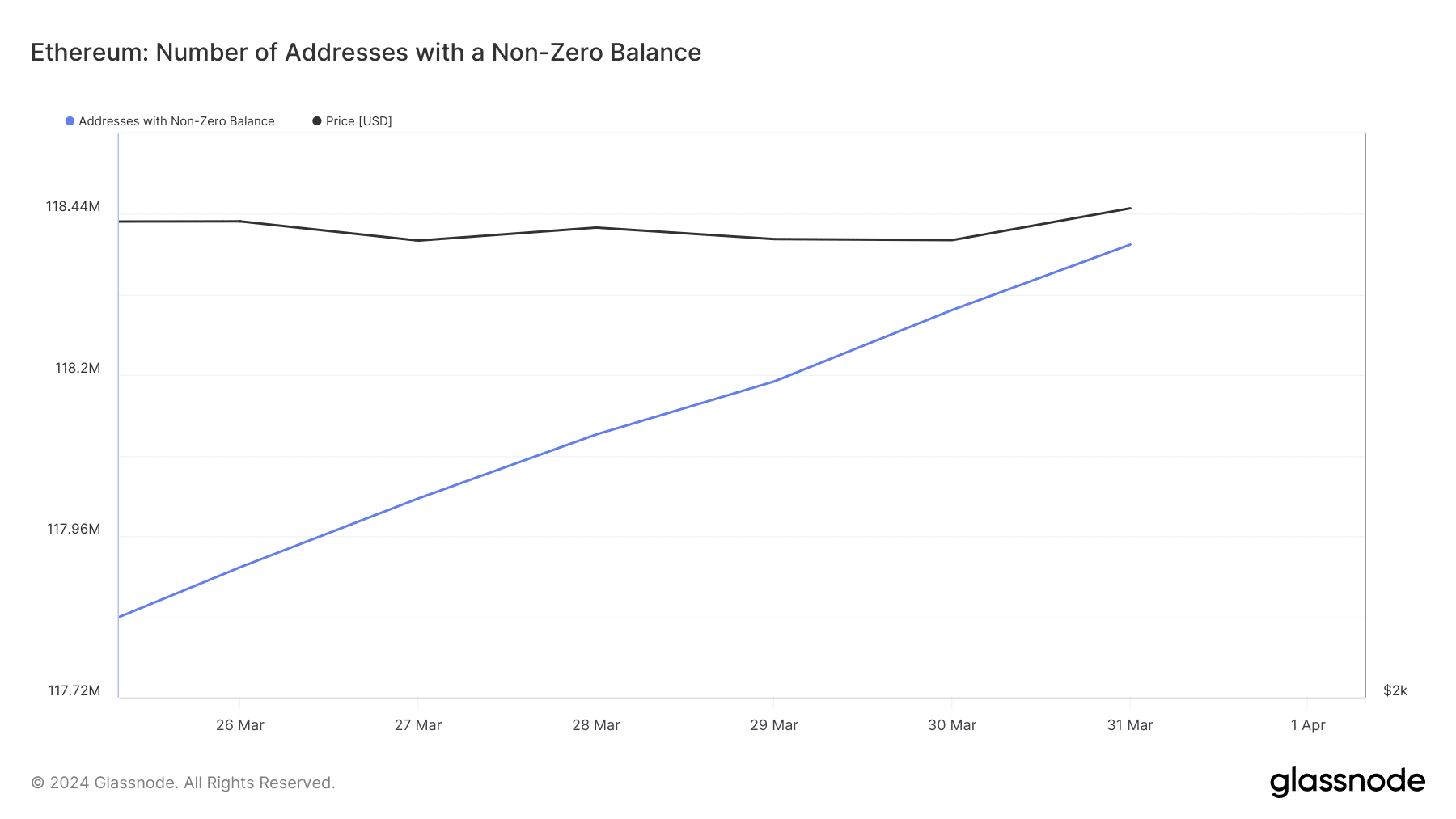

Whereas the king of altcoin’s value recovered, its whole variety of addresses with non-zero addresses surged and exceeded 118.23K. Moreover, its mid-term MVRV ratio gave a slight bullish sign.

Nevertheless, the fact turned out to be completely different as ETH’s value dropped by greater than 2.4% within the final 24 hours because it plummeted below $3.6k in accordance with CoinMarketCap.

On the time of writing, Ethereum was buying and selling at $3,547.34 with a market capitalization of over $425 million. Regardless of the drop in value, it was attention-grabbing to notice that ETH’s variety of addresses with non-zero balances nonetheless continued to rise.

What to anticipate from Ethereum

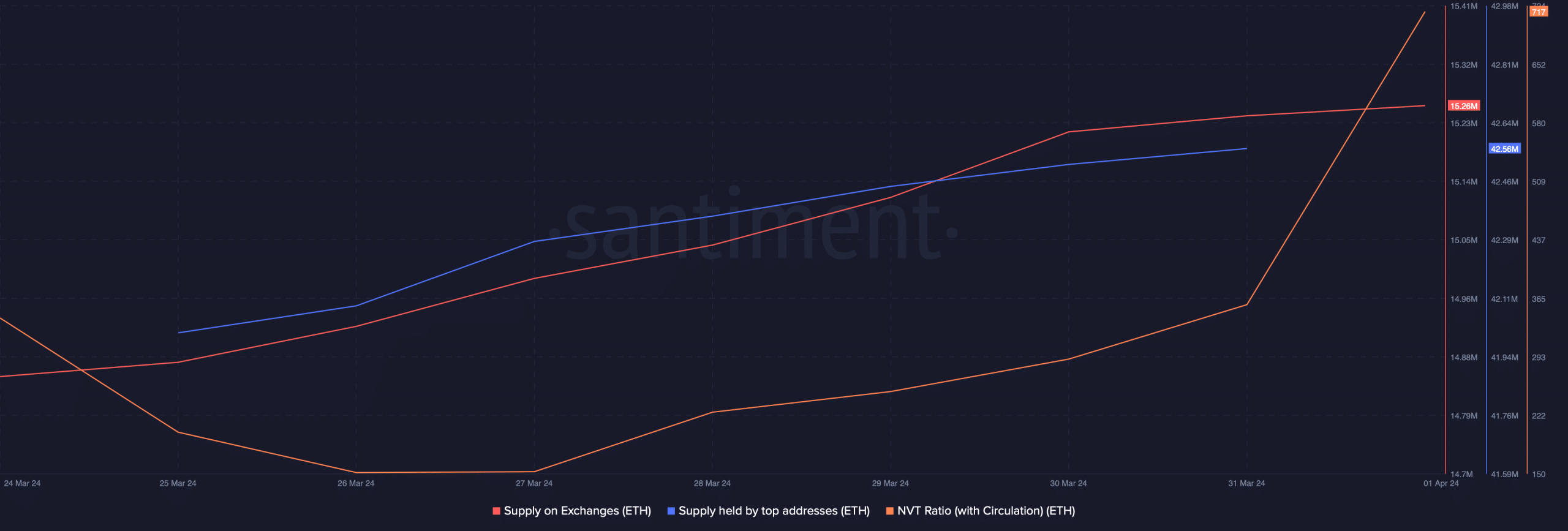

For the reason that token’s worth dropped within the final 24 hours, AMBCrypto checked its metrics to see which manner it was headed in April. We discovered that regardless of the rise in non-zero addresses, its provide on exchanges elevated. This meant that promoting strain was excessive.

As per CryptoQuant’s data, ETH’s web deposit on exchanges was excessive in comparison with the final seven-day common, additional suggesting that buyers have been promoting ETH.

Curiously, whales had confidence in Ethereum as its provide held by prime addresses elevated. Nonetheless, Ethereum’s network-to-value ratio registered a pointy uptick.

An increase within the metric implies that an asset is overvalued, which means that the potential for a value correction is excessive.

Learn Ethereum’s [ETH] Price Prediction 2024-25

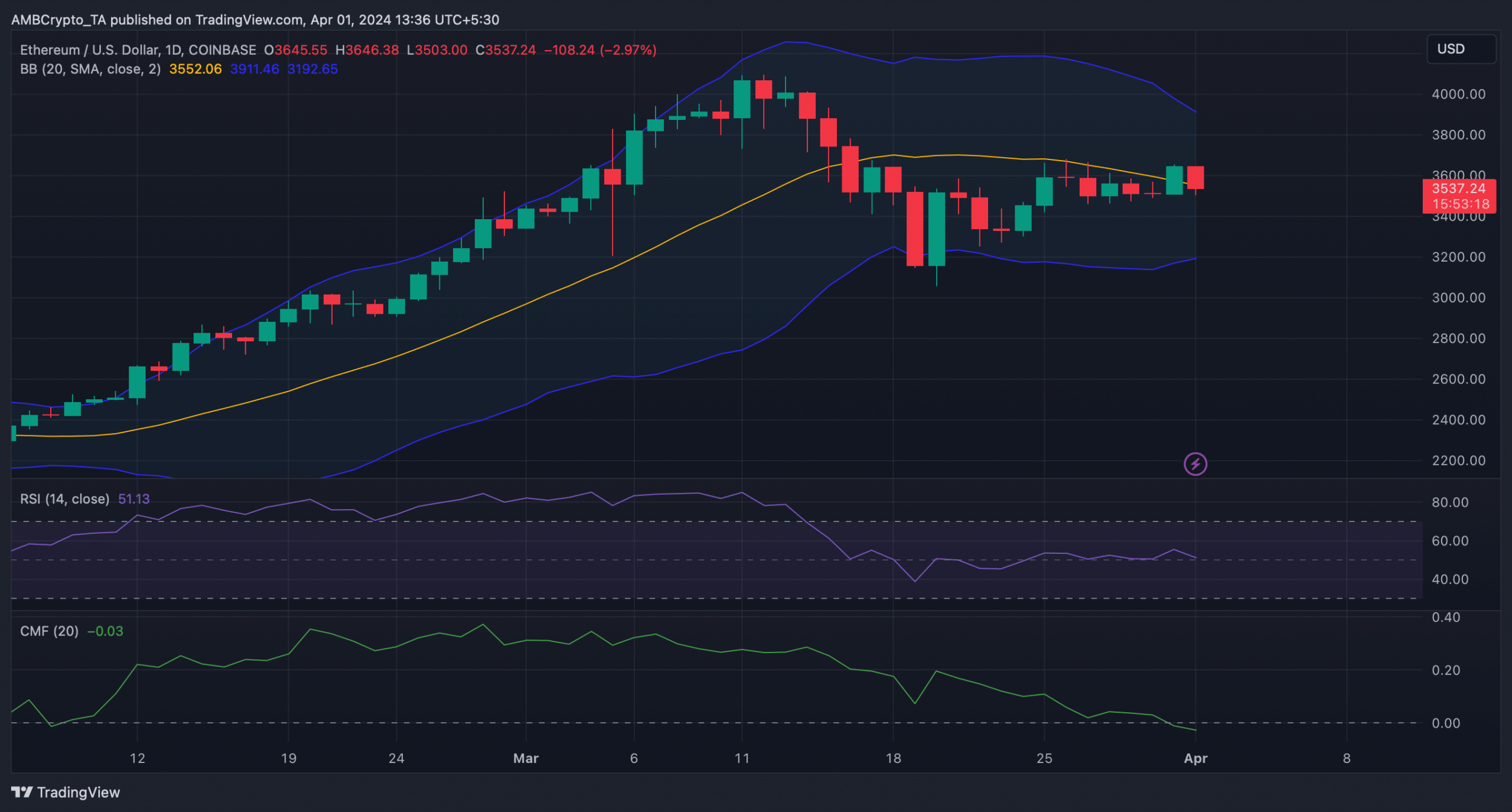

Our evaluation of Ethereum’s every day chart revealed that its Relative Energy Index (RSI) went southward from the impartial mark. Its Chaikin Cash Circulation (CMF) additionally adopted RSI and registered a pointy downtick.

Furthermore, its Bollinger Bands revealed that ETH’s value was coming into a much less risky zone, reducing the probabilities of an unprecedented value uptick within the quick time period.

[ad_2]

Source link