[ad_1]

- Ethereum has failed to carry ranges above $2,800, with the current uptrend displaying indicators of weakening.

- Regardless of the exchange-supply ratio at report lows, ETH worth continues to wrestle.

Ethereum [ETH] jumped to a multi-week excessive above $2,800 on the twenty fourth of August because the broader cryptocurrency market rallied. ETH has since misplaced a few of these good points, dropping barely by 0.6% within the final 24 hours to commerce at $2,742 on the time of writing.

Knowledge from Whale Alert confirmed that some giant ETH holders may be trying to money in earnings after one whale not too long ago moved $34 million value of ETH to Coinbase.

With the current uptrend displaying indicators of weakening, the place is ETH headed subsequent?

Bearish alerts emerge

Ethereum buying and selling volumes had dropped by 18% at press time per CoinMarketCap knowledge. The declining volumes coincide with the slight drop in worth as fewer patrons help the uptrend.

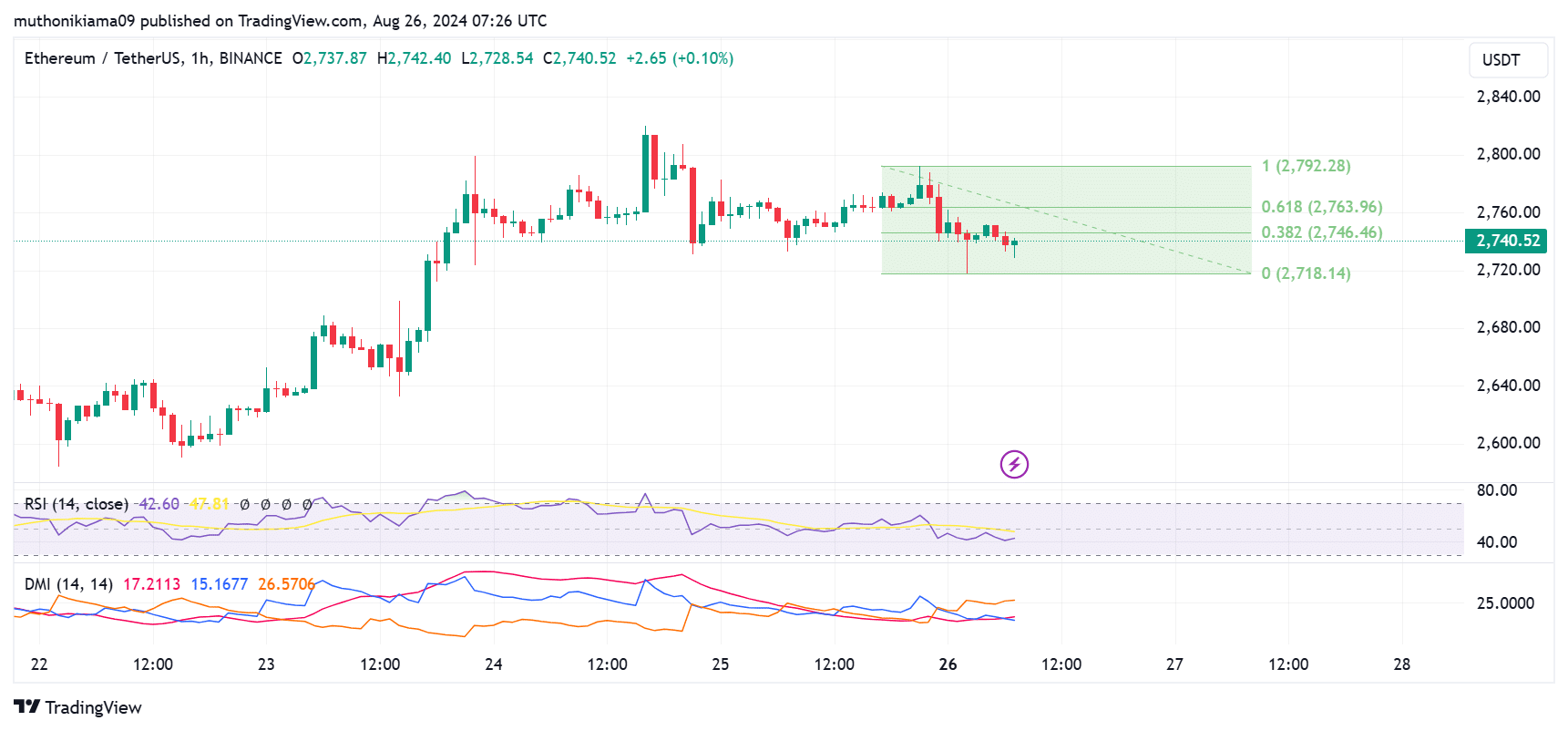

The Relative Power Index (RSI) at 42 exhibits sellers have entered the market. The RSI line has additionally been forming decrease lows on the hourly chart, additional displaying a weakening uptrend.

With the RSI line crossing under the sign line, it confirms a prevailing bearish momentum.

The Directional Motion Indicators (DMI) additionally present bears are in management. The +DI (blue) is under the -DI (orange), indicating a bearish pattern. Nevertheless, with the Common Directional Index (crimson) at 14, it exhibits that the bearish pattern is weak.

If the bearish momentum persists, ETH will probably drop decrease to check the 0% Fibonacci degree ($2,718). Failing to carry this worth may pave the best way for additional drops.

Change reserves proceed to drop

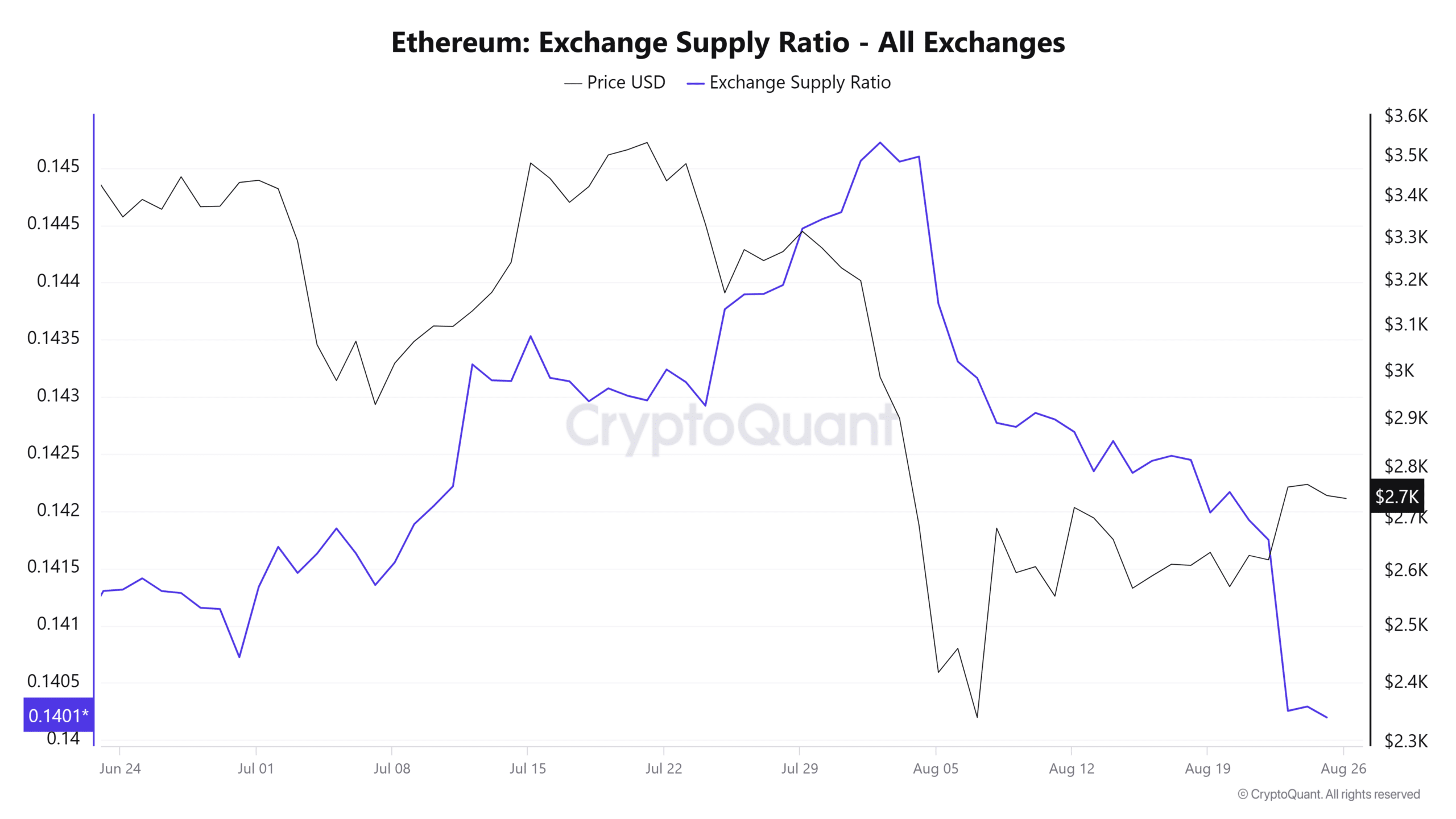

In line with CryptoQuant, Ethereum alternate reserves have dropped to report lows after spiking on fifth August as costs crashed.

Low alternate reserves recommend that few buyers are holding ETH on exchanges, lowering the short-term promoting stress and the probability of ETH registering drastic worth drops.

The Ethereum alternate provide ratio has additionally dropped sharply this month displaying that merchants are much less inclined to promote at present costs.

Elevated investor curiosity in ETH can additional be seen within the rising open curiosity.

Learn Ethereum (ETH) Price Prediction 2024-25

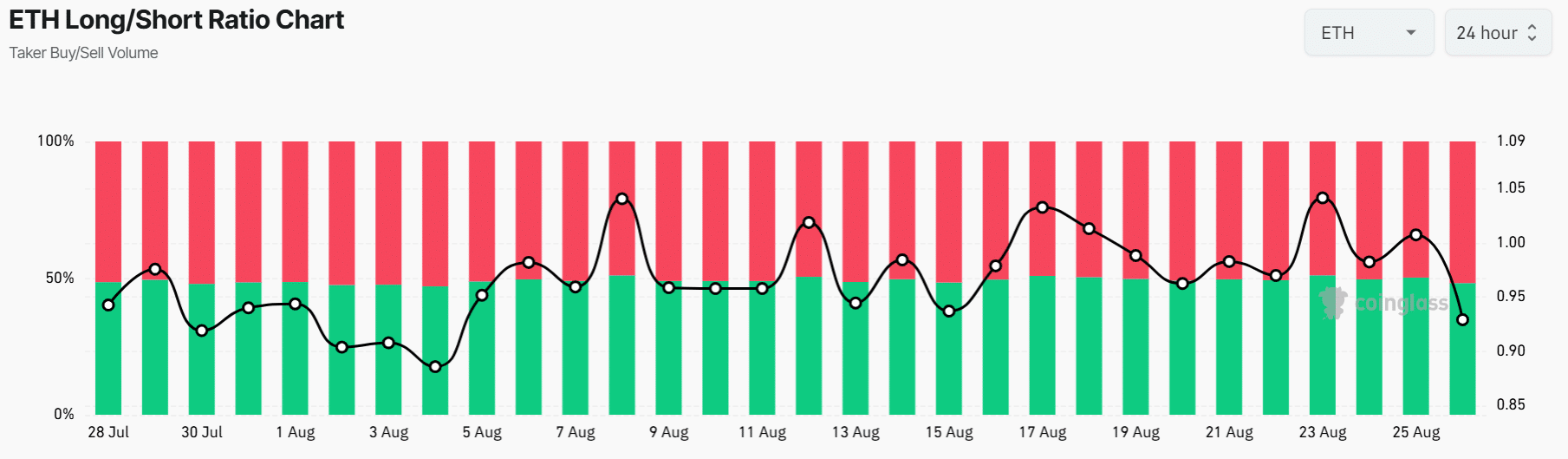

After falling under $10 billion in early August, Ethereum’s open curiosity has since elevated to greater than $11.5 billion on the time of writing per Coinglass knowledge.

Nevertheless, with the lengthy/brief ratio at 0.92, extra merchants have opened brief positions on ETH anticipating a worth drop.

[ad_2]

Source link