[ad_1]

- ETH has struggled to provoke an uptrend on the charts

- Most market indicators and metrics appeared bearish

At press time, Ethereum’s [ETH] each day and weekly worth charts remained inexperienced. Nonetheless, the development could be short-lived. In actual fact, as per a current evaluation, there could also be possibilities of ETH dropping to $2.7k earlier than it even begins a bull rally. Therefore, AMBCrypto checked ETH’s present state to higher perceive what to anticipate within the short-term.

Bears v. Bulls for Ethereum

Ethereum was considerably bullish on the charts within the final 24 hours, with its worth mountaineering by simply over 1%. Based on CoinMarketCap, on the time of writing, ETH was buying and selling at $3,035.04 with a market capitalization of over $364 billion.

Nonetheless, bears may quickly step up, with a current evaluation suggesting that ETH may drop to $2.7k. Crypto Tony, a preferred crypto-analyst, just lately shared this projection, highlighting ETH’s doable future trajectory. As per the tweet, ETH’s worth will first attain its assist stage of $2.7k, earlier than starting a rally, which could permit it to the touch $5.4k.

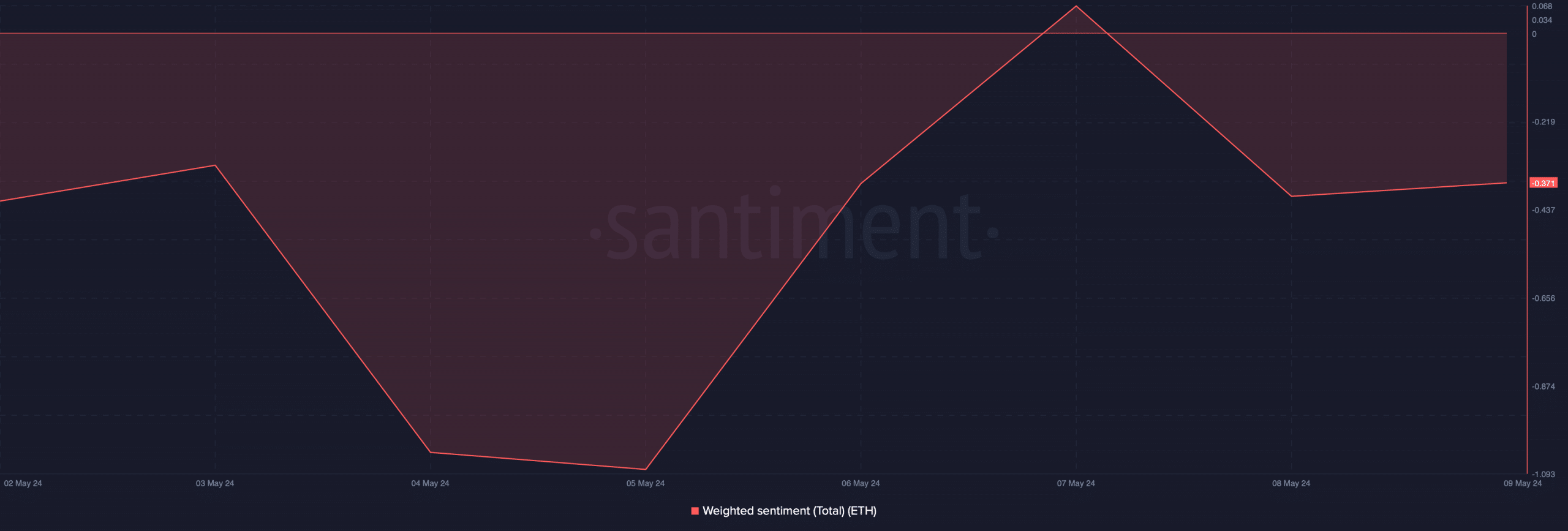

The opportunity of ETH dropping to $2.7k appears seemingly since traders’ confidence within the token has fallen dramatically. AMBCrypto’s evaluation of Santiment’s knowledge additionally revealed that ETH’s weighted sentiment was within the unfavorable zone – An indication that bearish sentiment retained its dominance out there.

Aside from that, fairly a number of different metrics additionally appeared considerably bearish too.

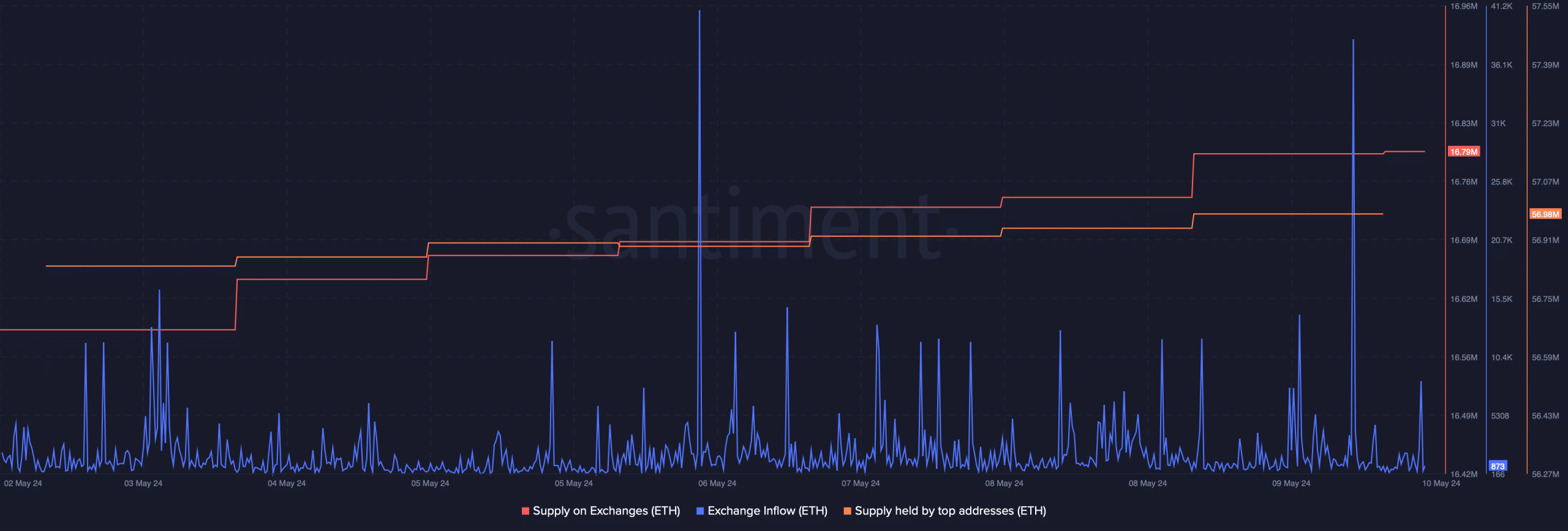

For instance, ETH’s change influx spiked, reflecting a hike in promoting stress. The truth that traders have been promoting ETH was additional confirmed by its provide on exchanges, which elevated over the previous week.

Notably, whereas traders bought their holdings, whales went the opposite route as they stored accumulating – As evidenced by the slight rise within the provide held by prime addresses.

Future targets

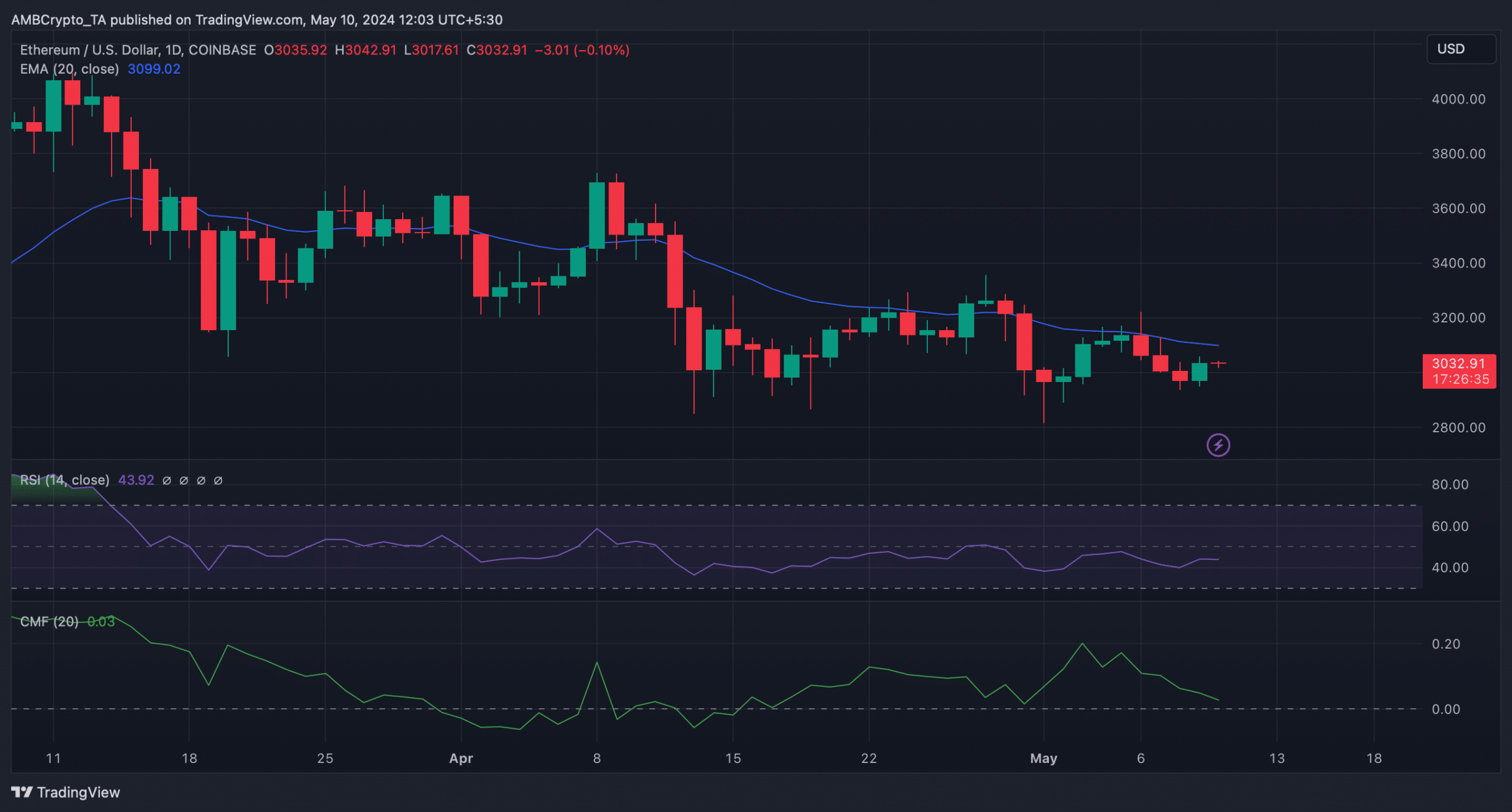

AMBCrypto reported beforehand that the crypto-market was bearish on Ethereum. To see whether or not that was nonetheless the case, we then analyzed ETH’s each day chart. As per our evaluation, market indicators continued to stay bearish.

The token’s worth was resting decrease than its 20-day Exponential Transferring Common (EMA). The Relative Power Index (RSI) was beneath the impartial stage. Moreover, ETH’s Chaikin Cash Circulation (CMF) additionally went south, suggesting that the possibilities of ETH dropping to $2.7k had been excessive.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

That being stated, traders shouldn’t fear about ETH’s worth development being all dangerous since there’s a risk of a development reversal earlier than $2.7k.

If ETH manages to check its assist close to $3k, then the state of affairs may flip bullish. A drop beneath that stage would end in ETH touching yet one more resistance close to $2.92k, relying on whether or not it would rebound if issues fall into place.

[ad_2]

Source link