[ad_1]

Ethereum has surged 10% since final Friday, marking a notable bounce because the crypto market reacts to native demand ranges. Regardless of this uptick, ETH has been lagging behind Bitcoin and different altcoins in current months.

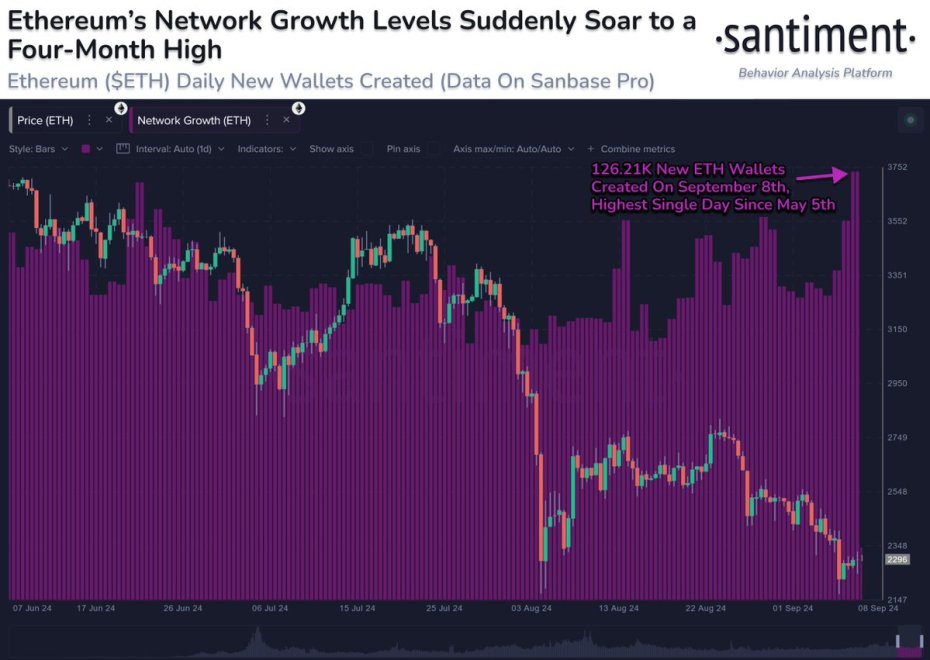

Key knowledge from Santiment, nevertheless, highlights an uptick in community exercise, hinting at a possible shift in Ethereum’s efficiency. Though ETH continues to face challenges in reclaiming the essential $2,500 zone, this era of volatility may current a strategic alternative.

Buyers would possibly wish to think about this second as an opportunity to place themselves for anticipated future positive aspects. With the present momentum and rising community engagement, Ethereum’s rally could possibly be on the horizon, providing a promising outlook for these able to capitalize on its rebound.

Ethereum Community Progress: A Signal Of Reduction

Ethereum has been struggling just lately, with merchants and buyers awaiting affirmation that the worst promoting stress and unfavourable sentiment has handed. One optimistic sign is the increased network activity reported by Santiment on X, which could possibly be an indication of enhancing circumstances.

On Sunday, a day sometimes recognized for decrease buying and selling volumes, Ethereum noticed a big spike in community development. The variety of new wallets created reached a four-month excessive, with 126,210 new wallets added. This uptick in community utility suggests rising curiosity in Ethereum and should sign a shift in market sentiment.

To take care of this momentum, Ethereum’s worth should goal and take a look at greater ranges, significantly within the native provide zone, which is round $2,550. This worth degree might be essential for Ethereum to regain energy and set up a stable upward development.

Buyers and merchants intently look ahead to additional indicators of energy because the broader market enters a consolidation section. The elevated community exercise could possibly be an early indicator of a possible rally, making it important to observe Ethereum’s worth actions and general market traits.

ETH Value Efficiency

Ethereum is buying and selling at $2,349, following a ten% rebound from yearly lows of $2,150. This surge comes after weeks of persistent promoting stress, positioning ETH at a pivotal degree in its worth motion.

The main focus now shifts to the 4-hour 200 exponential moving average (EMA) at $2,576. For Ethereum to maintain its bullish momentum, it should not solely push above this key technical degree but in addition shut above it convincingly.

Since late July, ETH has struggled to keep up a place above this EMA, a big resistance level. The failure to shut above the EMA throughout this era has highlighted a bearish development within the brief time period. A profitable breakout and shut above this degree would counsel a possible development reversal and will signify the beginning of a extra sustained upward motion.

Nevertheless, the state of affairs may worsen if Ethereum fails to carry its present worth ranges and dips beneath $2,349. A drop beneath this assist may result in a deeper correction, doubtlessly revisiting yearly lows and even decrease ranges within the close to time period. Such a situation may adversely impression ETH holders, introducing elevated volatility and threat.

Maintaining an in depth eye on ETH’s interplay with the 200 EMA and its capability to carry above present ranges might be essential for assessing the near-term outlook and potential development shifts.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link