[ad_1]

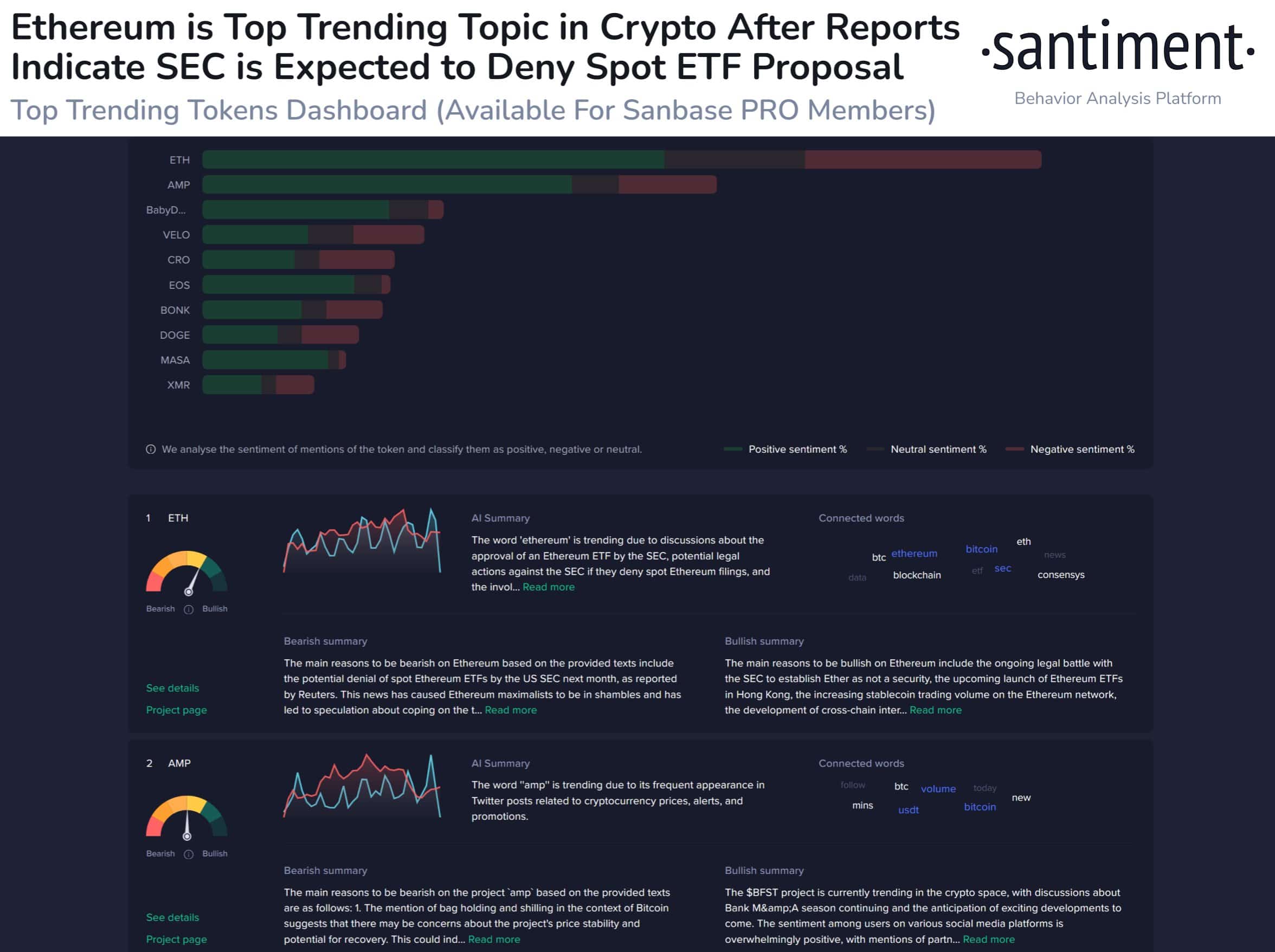

- Cynicism round Ethereum grew on social media as a result of expectation of the rejection of Ethereum’s spot ETF.

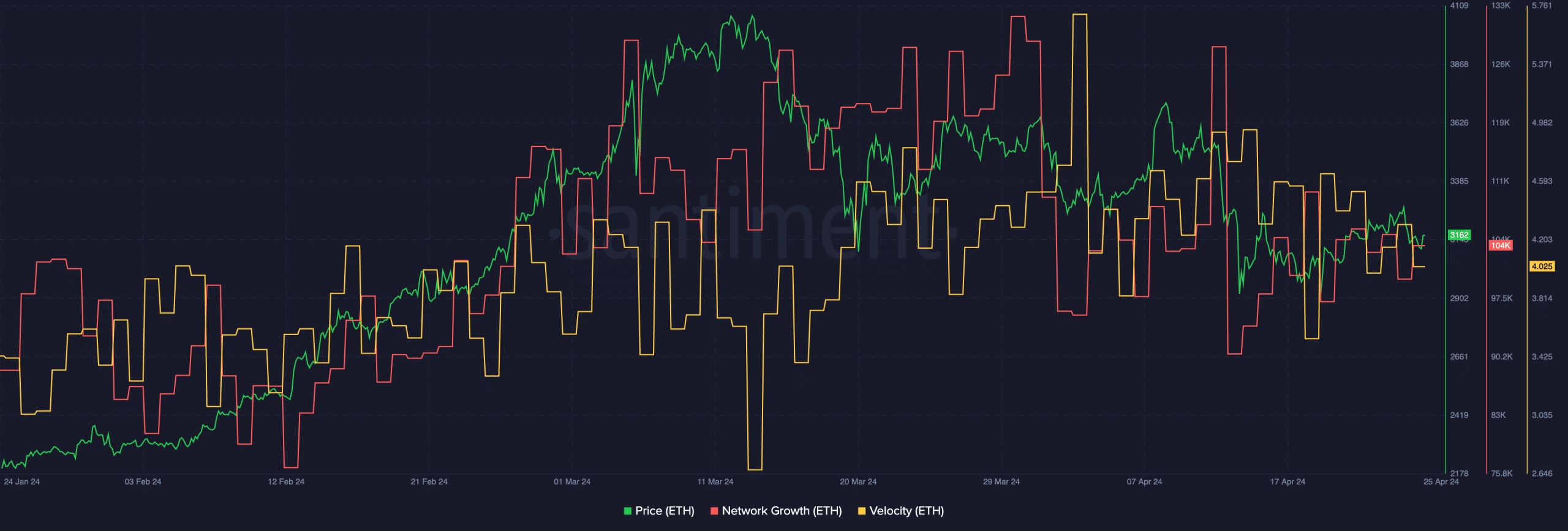

- Worth motion of ETH remained secure, and velocity and community development remained the identical.

Ethereum [ETH] has been struggling across the $3,100 to $3,200 mark over the previous few weeks after its latest crash.

Phrase on the road

Regardless of these elements social exercise round Ethereum grew, however not all of it comprised of constructive discussions.

Santiment’s information indicated that merchants have been specializing in latest reviews which recommended that the SEC might reject proposals for spot Ethereum ETFs in Might.

A lot of the neighborhood believes that the numerous improve in cryptocurrency worth since mid-October may be attributed to the constructive sentiment ensuing from the approval of spot Bitcoin ETFs in January.

Nevertheless, present indications recommend that the SEC is probably not able to approve different belongings at the moment.

As recurrently noticed, historic information means that costs usually transfer counter to common expectations. Growing worry, uncertainty, and doubt (FUD) as a result of dealer impatience may truly profit non-Bitcoin belongings.

There has already been a notable improve in bearish sentiments amongst merchants, as most belongings have retraced significantly since Bitcoin’s all-time excessive on 14th April. Subsequently, there’s a increased probability of aid bounces occurring within the subsequent week.

Whereas a softened stance or a shock approval may initially enhance Ethereum’s worth, overly keen merchants’ worry of lacking out might result in a mid-term drop, offering alternatives for big holders to decrease costs.

Regardless, if mainstream sentiment is promoting the rumor, there traditionally tends to be a justification for getting the information.

What’s subsequent for ETH?

At press time ETH was buying and selling at $3,151.30 and its value had fallen by 0.35% within the final 24 hours. The amount at which it was buying and selling at had additionally fallen by 4.04% throughout the identical interval.

The community development had moved sideways over the previous few days, implying that new addresses weren’t significantly displaying curiosity in ETH on the time of writing.

Learn Ethereum’s [ETH] Price Prediction 2024-25

The speed at which ETH was buying and selling was additionally transferring sideways indicating that the frequency at which ETH was being traded at had remained stagnant.

The community development and velocity transferring sideways recommend that there is probably not any vital fluctuations in value within the close to brief time period for ETH.

[ad_2]

Source link