[ad_1]

- Grayscale’s has a hefty 2.5% payment, 10X greater than its competitors.

- BlackRock charges are set at 0.25% because the market expects outrage flows from Grayscale.

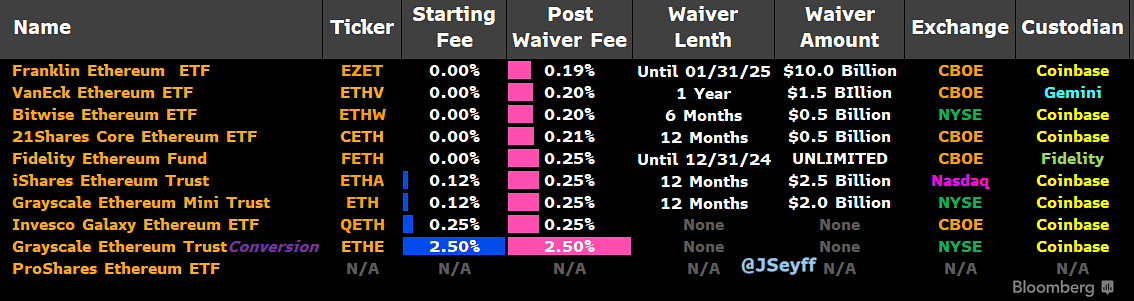

Potential Ethereum [ETH] ETF issuers up to date their payment construction on Wednesday because the market prepares for potential S-1 approvals and launch of the merchandise on July twenty third.

In response to Bloomberg ETF analyst James Seyffart, about seven issuers have waivers primarily based on both interval or property held.

Nonetheless, Grayscale’s ETHE had the heftiest charges at 2.5%, whereas BlackRock’s iShares Ethereum Belief pegged charges at 0.25% put up waiver.

Not like BlackRock’s 0.12% beginning payment for 12 months, if internet property are under $2.5 billion, Grayscale’s ETHE will keep 2.5% all through after the conversion of its belief to ETF on twenty third July.

Ethereum ETF payment wars

This has riled the market commentators. One observer, Nate Geraci of ETF Retailer, termed Grayscale’s transfer a ‘huge miss’ and that it was disappointing.

For his half, Bloomberg ETF analyst Eric Balchunas cautioned that Grayscale’s charges have been ‘10X greater than competitors’ and ‘outrage outflows’ have been possible.

“Grayscale not decreasing in any respect. This implies they 10x greater than competitors. Wow. Prob trigger some outrage outflows. My guess is the Mini ETF can be filth low cost tho, like perhaps 15bps. Attention-grabbing dynamic at play.”

For perspective, certainly, the Grayscale Ethereum Mini Belief (ETH) had an analogous payment construction as BlackRock: 0.25% with 0.12% because the beginning payment. The Mini Belief will reportedly be spun off from ETHE after the conversion.

“10% of $ETHE can be robotically spun off and into $ETH. $ETHE at the moment has $10 billion in property. So $ETH ought to basically begin it’s life with $1 billion in property.”

Nonetheless, regardless of the Mini Belief’s decrease charges, some market observers projected large outflows from ETHE.

Per HODL15 Capital estimates, ETHE outflows might hit 50%-60% following the hefty charges.

“Will Grayscale replicate the $GBTC payment mistake with $ETHE? In that case, count on 50%-60% outflows 👇 Simply over $10 Billion AUM.”

In the meantime, SEC Commissioner Hester Peirce has stated that ETH ETF staking could possibly be open for reconsideration amidst looming political change within the U.S.

On the value entrance, ETH’s current restoration hit resistance at $3.5K. The second-largest digital asset traded at $3.4K as of press time and will solely eye $4K if it cleared the $3.5K.

[ad_2]

Source link