[ad_1]

- Ethereum’s worth solely moved marginally within the final 24 hours.

- Market indicators hinted that Ethereum’s bull rally may resume quickly.

Ethereum [ETH] efficiently broke above a bullish falling wedge sample just a few days in the past. Since then, the king of altcoins has been on monitor and has earned buyers revenue.

If the pattern lasts, then ETH has an extended strategy to go.

Ethereum bulls are slowing down

World Of Charts, a well-liked crypto analyst, just lately posted a tweet highlighting how ETH managed to interrupt out of a falling wedge sample.

The token’s worth has consolidated contained in the sample since March and at last broke out just a few days in the past. Since then, ETH appeared to be heading in the right direction, as its worth elevated by nearly 5%.

Nonetheless, this acquire may simply be the start, because the breakout has the potential to push ETH’s worth by 45%. Nonetheless, the previous couple of hours showcased much less volatility, which considerably paused ETH’s gaining spree.

In line with CoinMarketCap, ETH’s worth solely moved up marginally within the final 24 hours. On the time of writing, ETH was buying and selling at $3,131.77 with a market capitalization of over $376 billion.

To see whether or not this sluggish 24-hour worth motion may result in a worth correction, AMBCrypto checked Ethereum’s on-chain metrics.

Our evaluation of CryptoQuant’s data revealed that ETH’s web deposit on exchanges was low in comparison with the final seven days’ common.

This meant that promoting strain on ETH was low. Moreover, each its Switch Quantity and Energetic Addresses remained excessive, which was an optimistic signal.

Troubles nonetheless persist for Ethereum

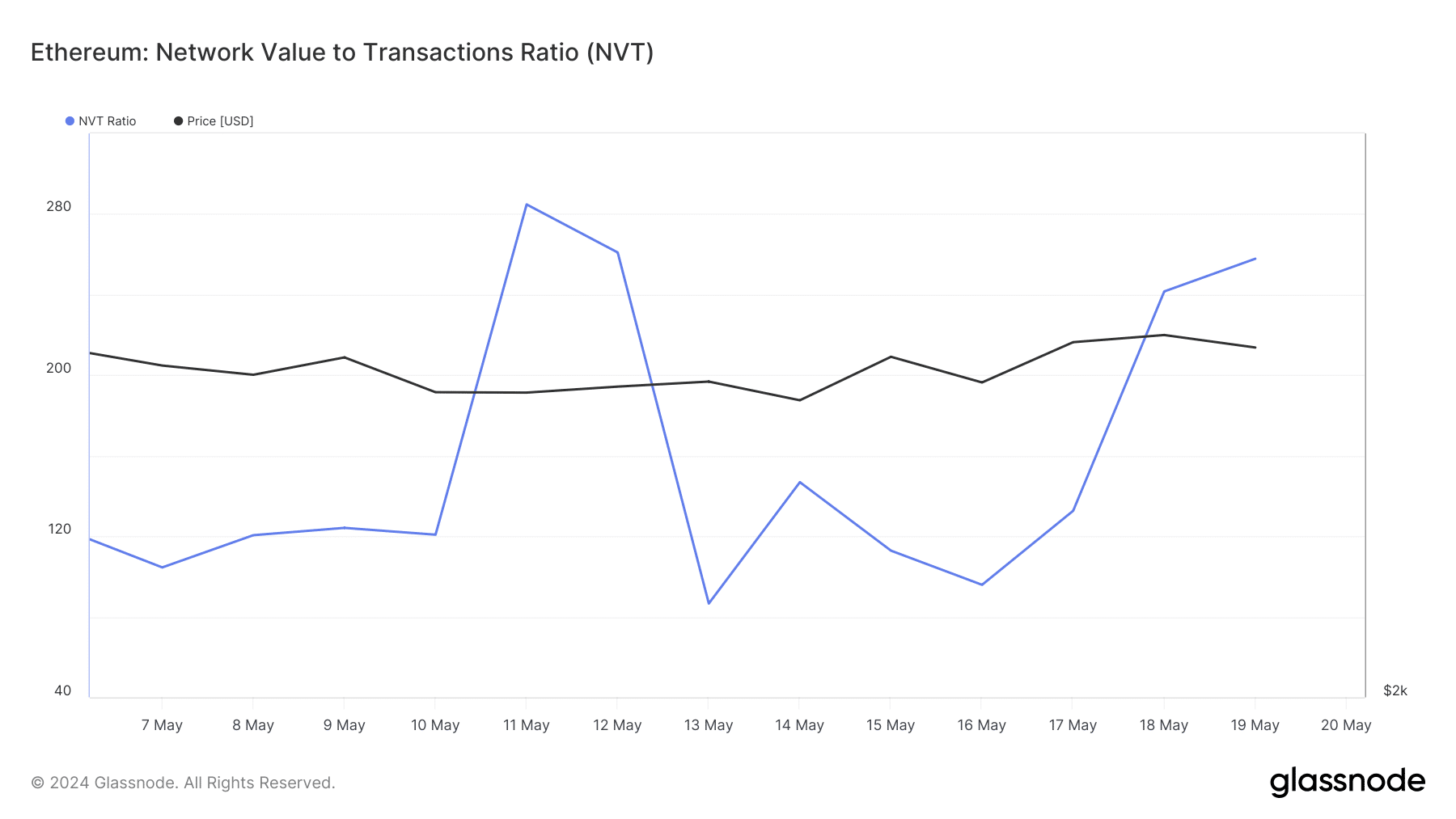

Although the aforementioned metrics seemed promising, just a few of the others raised considerations. AMBCrypto’s have a look at Glassnode’s knowledge revealed that ETH’s NVT ratio had elevated sharply over the previous couple of days.

For the uninitiated, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity, measured in USD.

An increase within the metric meant that ETH was overvalued, which indicated a doable worth correction quickly.

Aside from this, one other key indicator seemed bearish. Ethereum’s fear and greed index had a worth of 83% at press time, which means that the market was in an “excessive worry” part.

Every time the metric hits such ranges, it means that an asset’s worth has excessive probabilities of dropping.

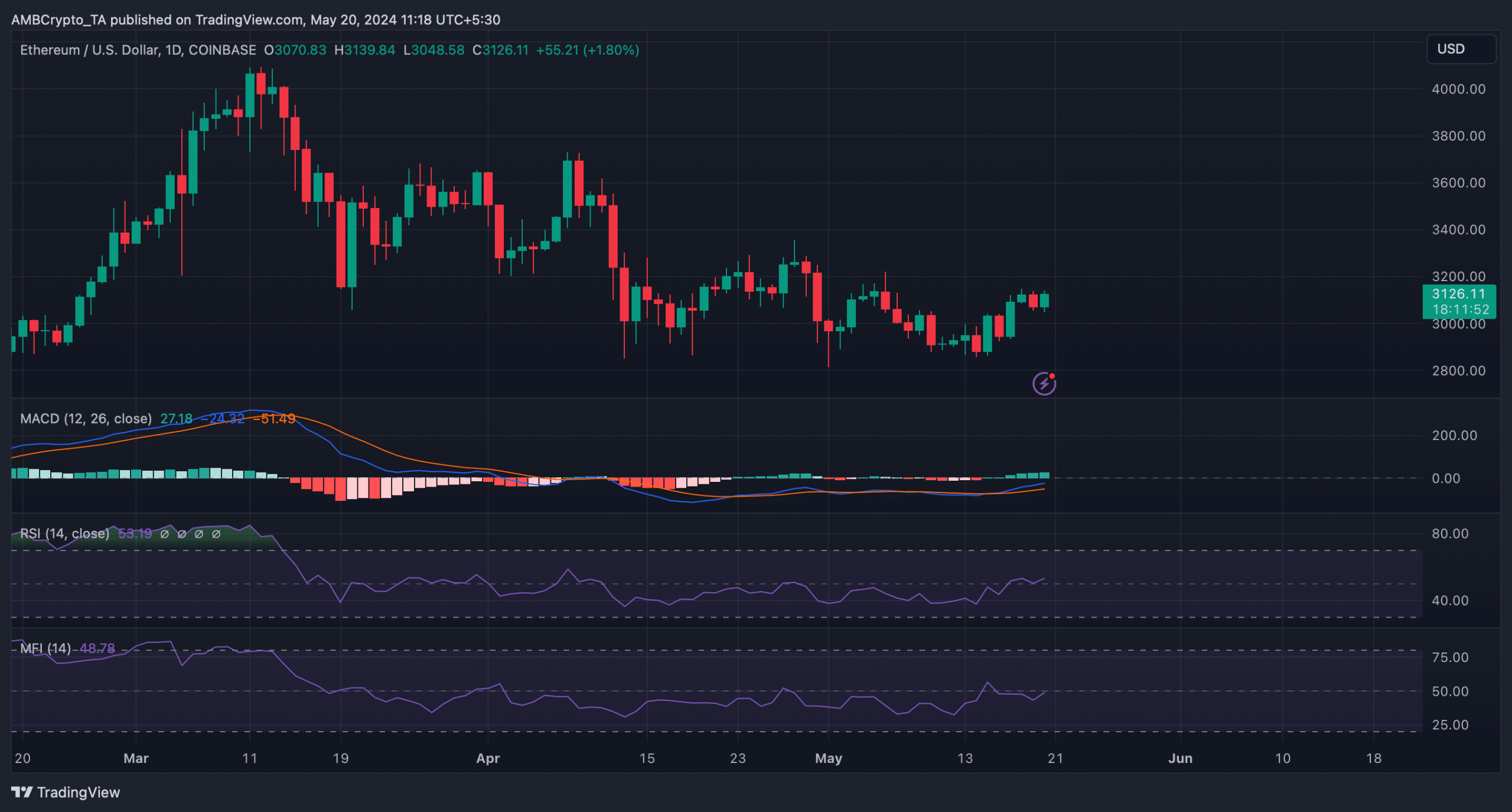

Due to this fact, AMBCrypto deliberate to test ETH’s every day chart to raised perceive whether or not a worth correction was across the nook.

Is your portfolio inexperienced? Test the Ethereum Profit Calculator

The MACD displayed a bullish crossover. Moreover, ETH’s Relative Power Index (RSI) registered an uptick from the impartial mark. Its Cash Circulate Index (MFI) additionally adopted the same pattern.

These indicated that the probabilities of a significant worth correction had been slim.

[ad_2]

Source link