[ad_1]

- Like BTC ETFs, Ethereum ETFs additionally witnessed outflows over the previous few days

- Metrics and market indicators advised that Bitcoin’s bear rally may finish quickly although

Regardless of the bearish market circumstances, Bitcoin [BTC] ETFs witnessed promising inflows a number of days in the past. Nonetheless, the pattern modified during the last 24 hours.

Therefore, it’s value taking a more in-depth have a look at what’s occurring with ETFs, whereas additionally drawing a comparability with the state of Ethereum [ETH] ETFs.

How are Bitcoin ETFs doing?

In accordance with latest information, Bitcoin ETFs noticed inflows value $200 million on 8 August, which appeared optimistic. Alas, this pattern didn’t final because the figures turned adverse simply the following day.

As per SoSoValue, BTC ETFs netflows dropped below -$90 million on 9 August. Right here, it was attention-grabbing to notice that whereas Blackrock elevated its holdings, Grayscale selected to promote, based on Dune’s data.

Like Bitcoin, Ethereum ETFs additionally witnessed the same scenario over the previous few days. To be exact, ETH ETFs netflows reached $98 million on 6 August. Nonetheless, the quantity dropped to -$15.7 million on 9 August.

A doable motive for the drop in netflows could possibly be the bearish market circumstances, as each BTC and ETH noticed value declines on the charts.

Actually, based on CoinMarketCap, whereas BTC’s value dropped by 1.2% final week, ETH’s worth plunged by greater than 12% throughout the identical interval. On the time of writing, BTC was buying and selling at $60.4k whereas ETH had a price of $2.6k.

What to anticipate from Bitcoin?

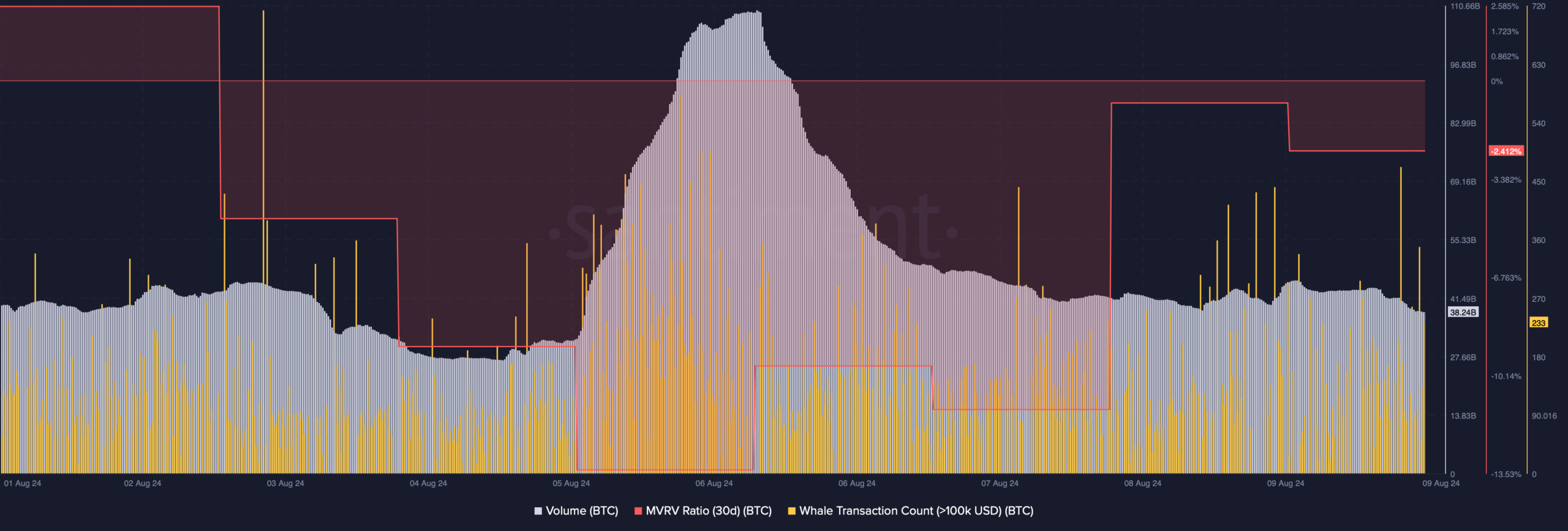

AMBCrypto then deliberate to have a more in-depth have a look at BTC’s present state to see whether or not it might probably showcase a bullish comeback within the coming days. As per our evaluation of Santiment’s information, BTC’s MVRV ratio improved – A bullish sign.

One other optimistic metric was the quantity, which dropped. A decline within the metric throughout a bear market signifies that the bearish pattern may finish quickly. Moreover, Bitcoin’s whale transaction rely additionally remained excessive final week, that means that whales have been actively buying and selling BTC.

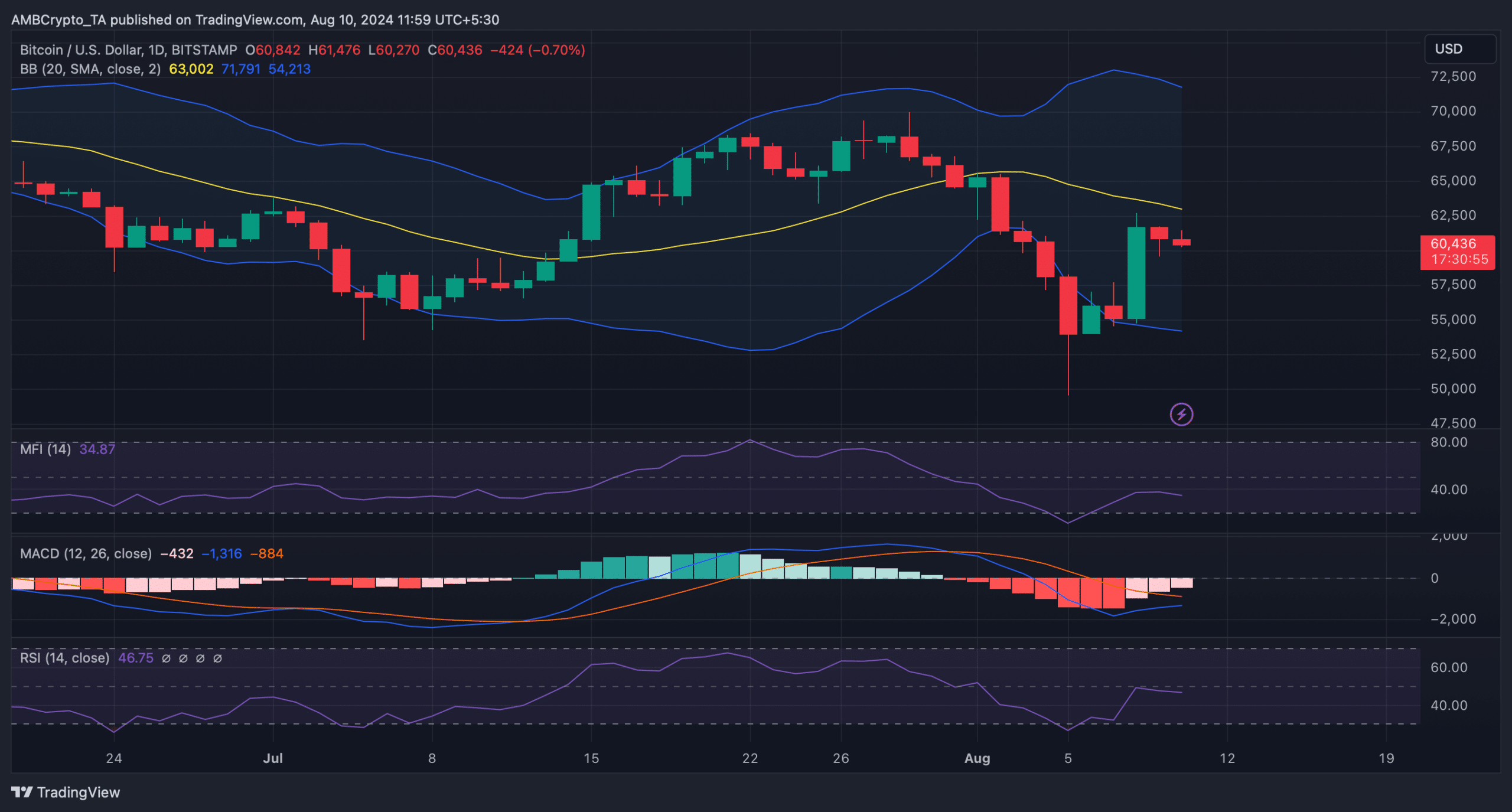

Quite the opposite, our have a look at Bitcoin’s each day chart revealed that its Relative Energy Index (RSI) registered a downtick. The Cash Circulation Index (MFI) went south too – An indication that BTC’s value may drop additional.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

Even so, the MACD displayed the potential for a bullish crossover. Furthermore, the Bollinger Bands revealed that it was about to check its resistance close to the 20-day Easy Shifting Common (SMA).

A profitable breakout above that stage would guarantee the start of a bull rally.

[ad_2]

Source link