[ad_1]

- ETH’s Futures Open Curiosity touched an all-time excessive.

- Its Funding Fee throughout exchanges remained constructive.

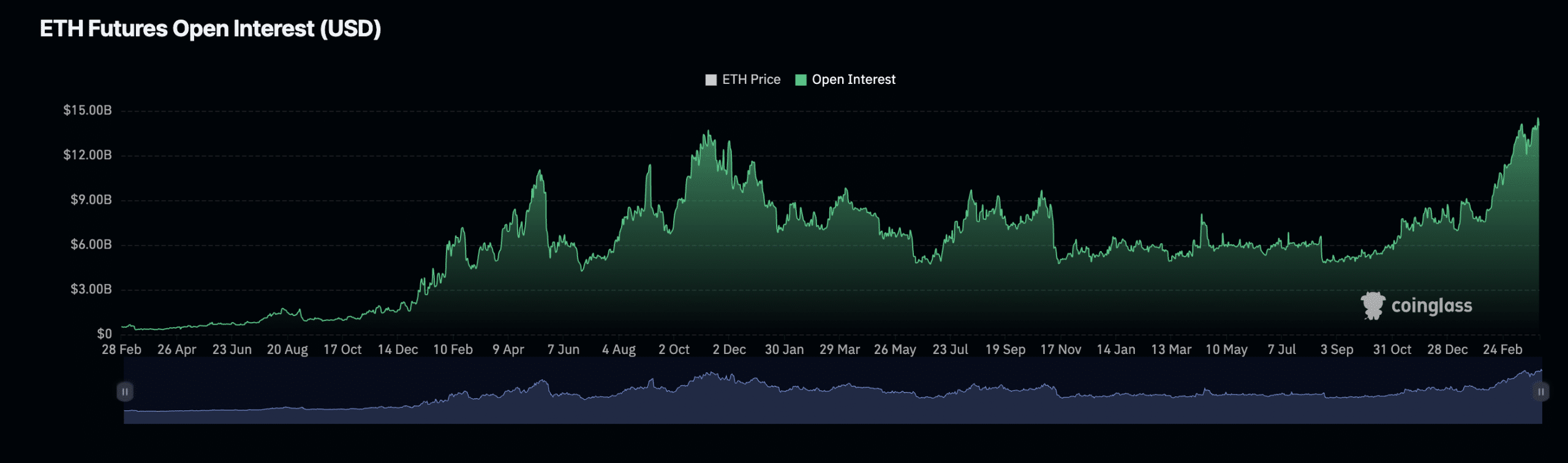

Ethereum [ETH] Futures Open Curiosity climbed to an all-time excessive because the uncertainty across the potential approval of a spot Ether exchange-traded fund (ETF) within the U.S. deepened.

Futures Open Curiosity refers back to the complete variety of a coin’s Futures contracts which have but to be settled or closed. When it rises, it signifies a rise within the variety of market members getting into new positions.

In accordance with AMBCrypto’s evaluation of Coinglass’ knowledge, ETH’s Futures Open Curiosity totaled $14.53 billion on the first of April, having risen by 86% year-to-date.

For context, ETH’s Futures Open Curiosity was beneath $10 billion initially of the yr.

March was good for Ethereum’s Futures market

ETH’s Futures market recorded vital success in March, on-chain knowledge has revealed.

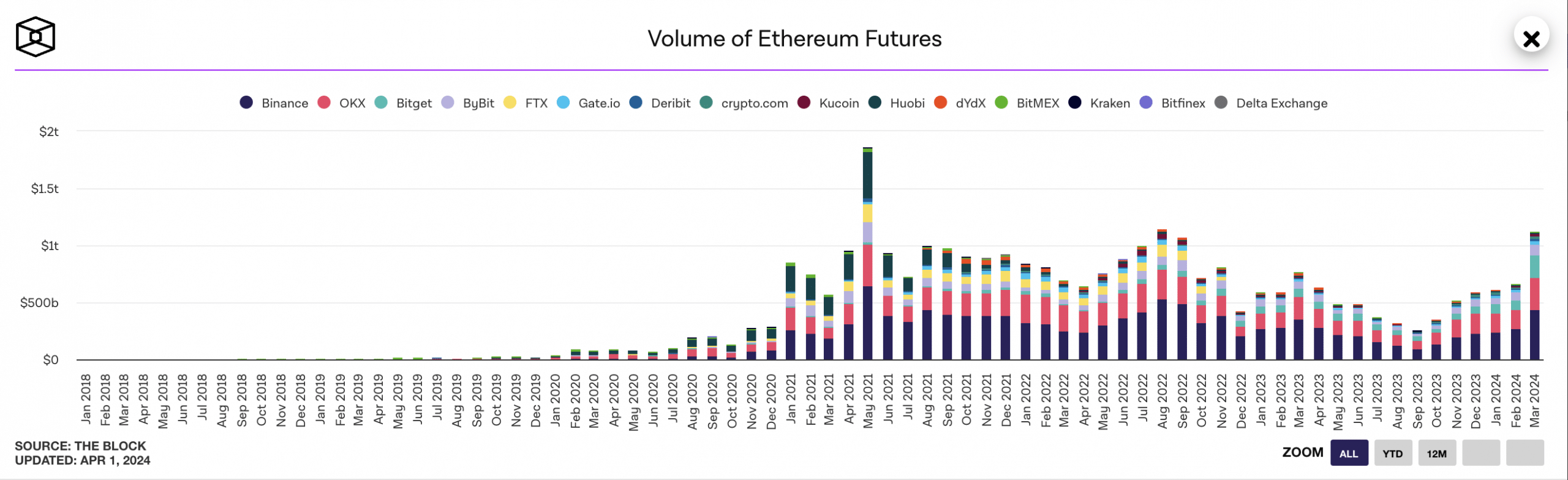

In accordance with AMBCrypto’s evaluation of The Block’s data dashboard, ETH Futures’ month-to-month buying and selling quantity throughout the most important cryptocurrency exchanges touched a three-year in the course of the 31-day interval.

Our take a look at The Block additional confirmed that ETH Futures buying and selling quantity throughout these platforms exceeded $1 trillion. The final time the coin’s month-to-month buying and selling quantity was that prime was in Might 2021.

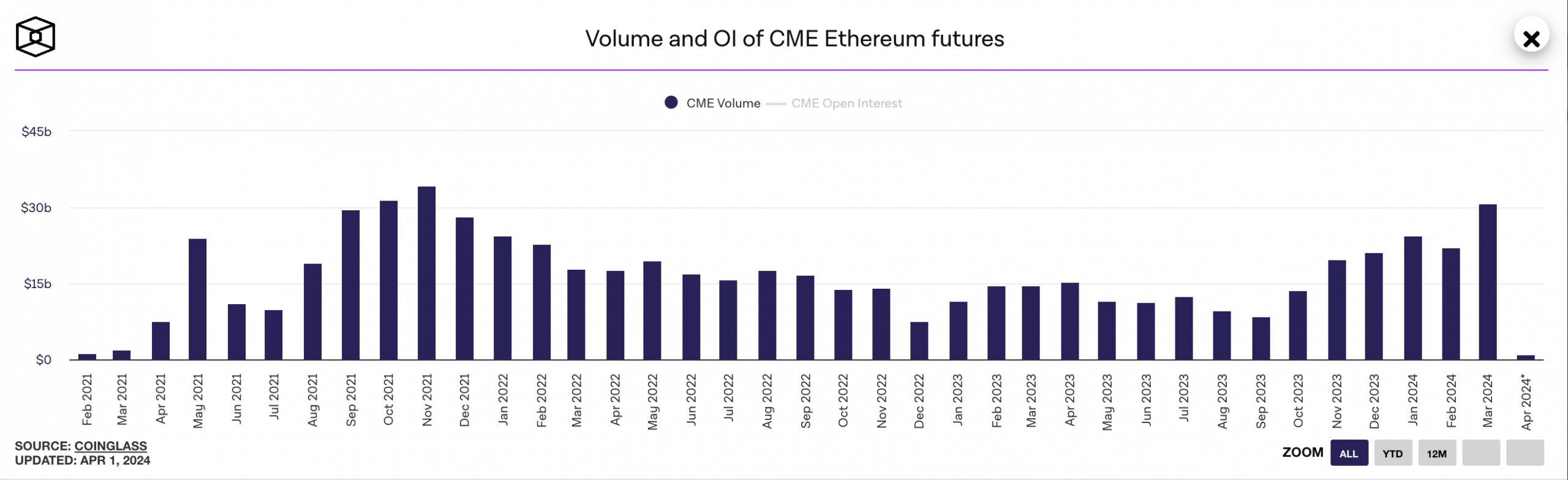

Following the same development, the coin’s month-to-month futures buying and selling quantity on the Chicago Mercantile Alternate (CME) market additionally rose to a three-year excessive.

With over 120,000 energetic customers unfold throughout 60 nations, CME is without doubt one of the world’s largest derivatives marketplaces.

When the buying and selling quantity on the alternate climbs on this method, it alerts a spike in market participation by institutional traders resembling hedge funds and huge asset managers.

AMBCrypto discovered that in the course of the 31-day interval, the aggregated month-to-month buying and selling volumes of CME Ethereum Futures totaled $30 billion. The final time it was this excessive was in November 2021.

Market unmoved by current headwinds

ETH’s worth has confronted vital headwinds within the final month because it continued to face resistance on the $3500 stage at press time.

In truth, on the twentieth of March, the coin’s worth plummeted to a 30-day low of $3100 earlier than reclaiming its beneficial properties to alternate arms at $3354 at press time.

Regardless of this, the coin’s Funding Charges throughout cryptocurrency exchanges remained constructive at press time.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

A constructive Funding Fee is an efficient signal, because it suggests a surge in market demand for bullish leverage positions. This implies extra market members are getting into commerce positions in favor of a worth rally.

At press time, ETH’s Funding Fee was 0.019%

[ad_2]

Source link