[ad_1]

- The crypto market noticed two-way volatility in July as speculators reacted to occasions.

- The Federal Reserve held the benchmark rate of interest on the present 23-year excessive for the eighth consecutive time.

Bitcoin [BTC] traded pretty unchanged on the final day of July within the fast aftermath of the Federal Open Market Committee’s rate of interest choice.

Assembly market expectations, Fed policymakers held the benchmark federal funds charge on the 5.25%-5.50% vary. With June’s FOMC assembly within the rearview, merchants now eye the primary charge minimize this yr in September.

In his remarks after the FOMC assembly, Chair Jerome Powell hinted that there’s an ongoing dialogue of a September charge minimize, whose risk hinges on sturdy financial development figures.

A charge minimize final result would potentially boost liquidity available in the market, which might, in flip, be typically favorable for cryptocurrencies.

Traits throughout July

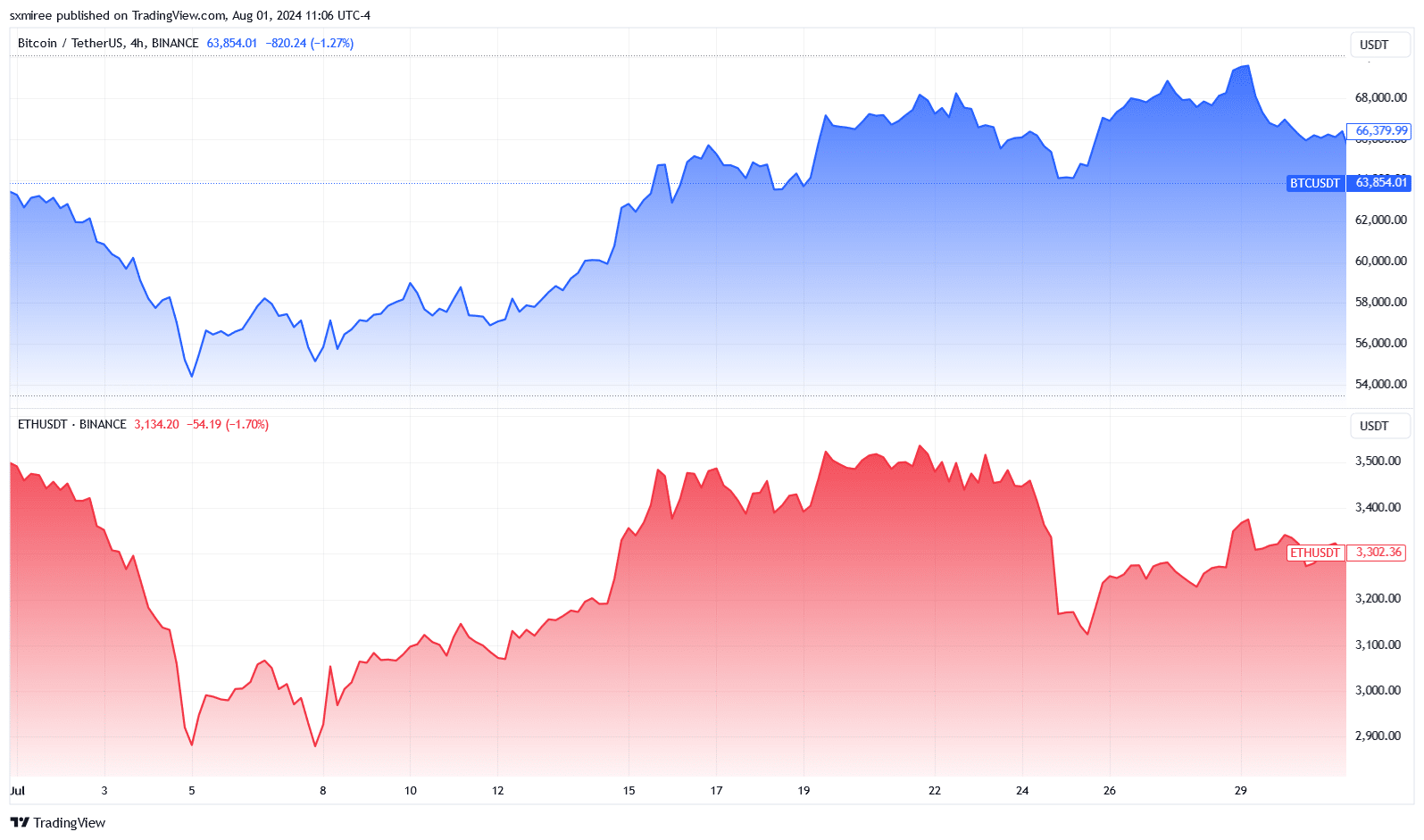

A light crypto pullback forward of the month-to-month shut erased a few of Bitcoin’s features, with Coinglass exhibiting that the flagship crypto managed solely 2.95% returns throughout July.

The meager optimistic returns nonetheless set the stage for Bitcoin to pursue new yearly value highs.

In distinction, Ethereum [ETH] fared worse, shedding 5.88% in the identical interval regardless of optimistic influences, together with US-based spot Ether ETFs going reside.

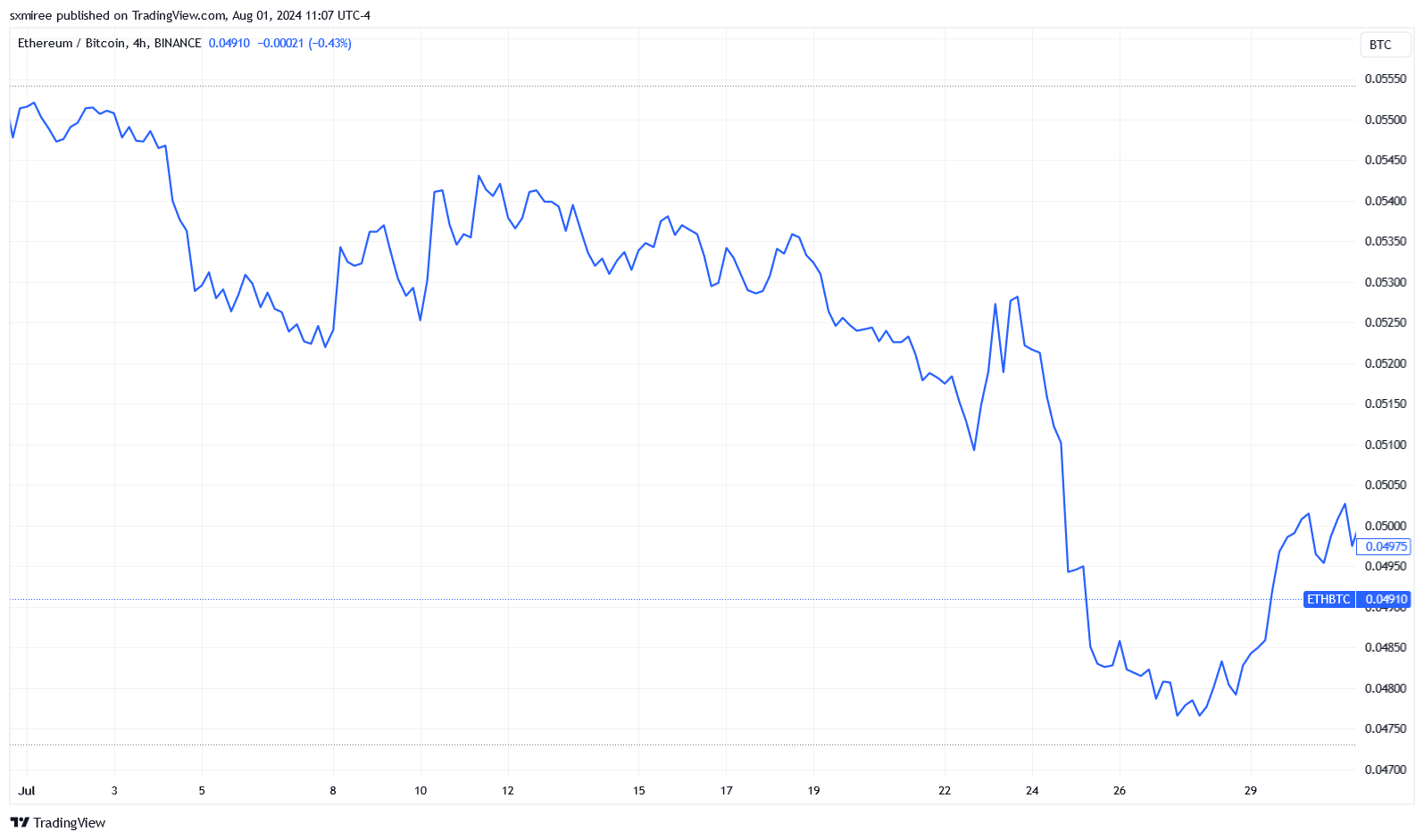

Consequently, the ETH/BTC ratio fell throughout July, shrinking by 10.72% by the tip of the month.

Amongst large-cap altcoins, MANTRA [OM] and Helium [HNT] led as finest performers in July, with returns of 44% and 36%, respectively, throughout the month.

Fantom [FTM], Flare [FLR], and Starknet [STRK], alternatively, all misplaced greater than 30%.

Expectations for August

A bargaining-hunting theme endured final month as addresses with a stability of at the very least 0.1% of BTC’s circulating provide added roughly 84,000 BTC to their stashes, in response to IntoTheBlock’s Bitcoin possession data.

The inside track marked the best accumulation tempo since October 2014.

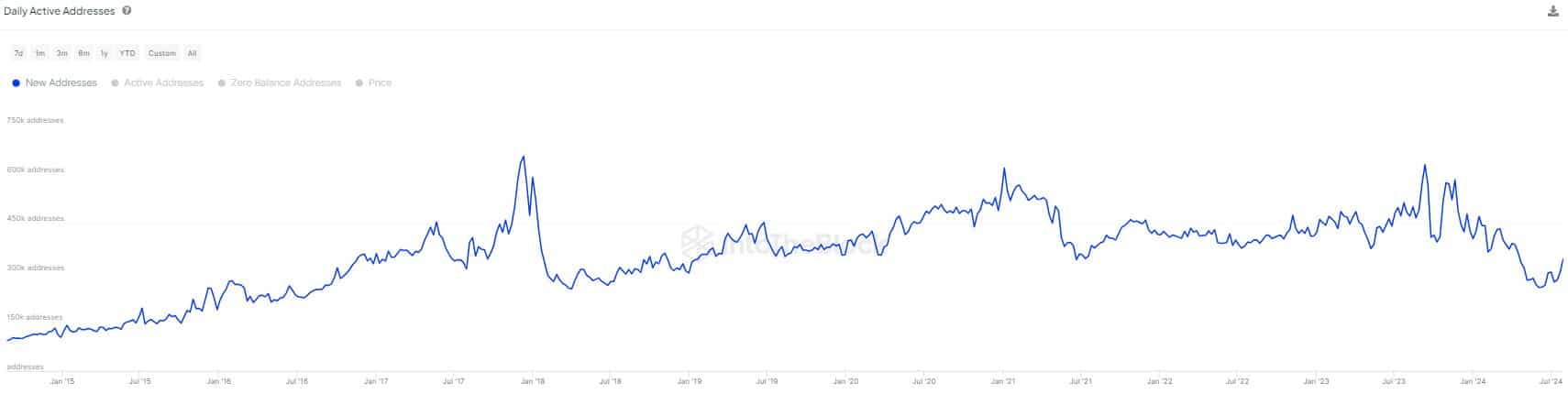

IntoTheBlock individually reported in an X (previously Twitter) post that day by day new addresses had been up by 35% on the thirtieth of July since touching multi-year lows in early June.

Strategic accumulation by whale and shark buyers has traditionally prompt anticipation of a breakout to the upside from the present ranges.

Renewed inflows of capital into the crypto market additional assist the bullish sentiment.

CCData famous in its newest Stablecoins & CBDCs report that the full market capitalization of stablecoins grew by 2.11% in July to $164 billion — its highest degree since April 2022.

Technical outlook

Bitcoin has been buying and selling between the bounded ranges of $58,000 and $70,000 for 5 months.

Bullish merchants search to flip the prevailing resistance at $69,600 as it’ll deliver into view $72,000, which offered the next significant barrier to difficult March’s all-time excessive.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

To date, bears have fiercely defended the higher boundaries of the prevailing consolidation vary, efficiently stymieing makes an attempt to crack the $70,000 mark.

A number of rejections above $69,600 since March point out that BTC value wants a powerful catalyst to beat the hurdle.

[ad_2]

Source link