[ad_1]

Decentralized finance (DeFi) strives to supply international entry to monetary merchandise via decentralized blockchain networks.

That is achieved by eradicating intermediaries, lowering transaction charges, and regularly providing yield-generating alternatives for increased returns.

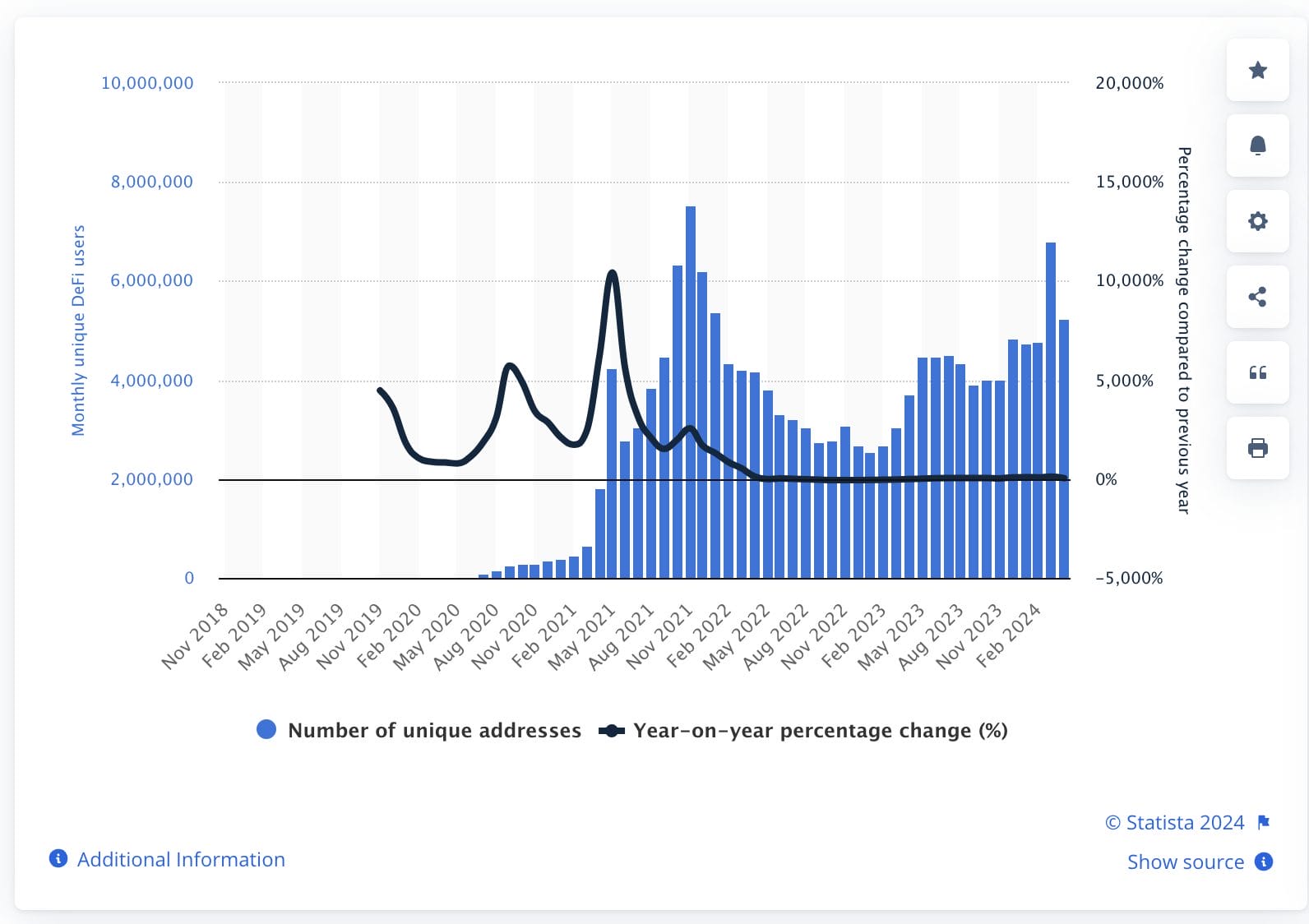

Nonetheless, regardless of its potential, DeFi faces main obstacles to mainstream adoption. DeFi user numbers peaked at 7.5 million in 2021 however skilled a notable decline the next yr.

This downturn is additional mirrored within the complete worth locked (TVL) inside DeFi protocols, collapsing from $175 billion on the finish of 2021 to a mere $50 billion by November 2023.

Decentralized Finance At this time Is Difficult and Misunderstood

The primary issues hindering Decentralized Finance adoption right this moment are an absence of accessibility and understanding.

For example, when in comparison with conventional finance (TradFi), DeFi is usually difficult for mainstream and crypto customers alike.

Adam Simmons, CMO of Layer-1 community Radix, advised Cryptonews that whereas the imaginative and prescient of DeFi is engaging, the idea round it fails to ship.

Simmons defined that DeFi ideas – like self-custody of assets, seed phrases and security measures – have created adoption limitations for customers.

“Self-custody of belongings could sound nice on paper — nonetheless, outdoors of the crypto bubble, the thought of placing giant sums of cash or belongings right into a system the place a single seed phrase solely controls entry is terrifying to most shoppers,” he stated.

Simmons added that if a person loses their seed phrase, all of their cash or belongings might shortly disappear.

In 2023 the DeFi industry witnessed substantial losses. A total loss of approximately $1.95 billion occurred last year alone.

According to a De.Fi blog post, these losses could be attributed to a steady battle in opposition to safety breaches, fraudulent actions and a bull or bear market.

“Hacks, exploits, and unhealthy actors lead to billions of {dollars} of belongings being misplaced or stolen annually,” Simmons stated. “In lots of conditions, frequent patterns in DeFi right this moment, comparable to spend approvals or blind-signing transactions, can drain all of your belongings, generally even months or years after you clicked one thing you shouldn’t have.”

Fixing DeFi Challenges By Transparency

Simmons acknowledges these hurdles current appreciable challenges for the typical client. Luckily, blockchain tasks are actively working to deal with these points.

For instance, Simmons defined that Radix helps make sure that customers can signal and approve DeFi transactions simply and confidently.

“The most typical expertise right this moment is being offered with a display that claims one thing like ‘Affirm Transaction: 0xd12345aaa…. Approve / Decline.’ For 99.99% of the inhabitants, they’re fully trusting that their pockets or dApp UI has accurately created the transaction they’re anticipating once they faucet ‘approve,’” Simmons defined.

Simmons shared that Radix solves this downside with a function referred to as “transaction manifests and transaction evaluation.” Simmons defined that it is a default operate of Radix, permitting customers to simply see which belongings are being eliminated and deposited from their Radix accounts.

Wouldn’t or not it’s good if there aren’t any token approvals, and whenever you signal a transaction you”ll perceive what occurs. Which tokens go away the pockets and which are available, and also you get assured no less than X quantity of tokens are available, if not tx fails?

That is reside on radix! pic.twitter.com/7UPwIU3oXA

— Jelthebest (@jelthebest_Cryp) July 5, 2024

One other problem the DeFi sector faces entails real-time pricing from the time between creating and signing a transaction. Crypto prices fluctuate quickly, typically leading to totally different costs.

Simmons identified that Radix has a function referred to as “ensures,” which ensures that customers will obtain the transaction quantities anticipated.

“Ensures are conceptually easy; if the transaction evaluation on the Radix pockets reveals 100 xUSDC being withdrawn out of your account, and an estimated 100 XRD being deposited, the person can set a customized Assure within the transaction of, say, 99.5%,” Simmons stated. “Which means that when the transaction is signed, if the ensuing transaction doesn’t return no less than 99.5 XRD, the transaction shall be rejected.”

Democratizing Liquidity Entry

In TradFi, liquidity refers to how simply an asset could be transformed into money with out impacting its market worth.

But this idea differs in DeFi. For example, in DeFi liquidity refers back to the ease with which tokens could be traded on a decentralized alternate (DEX) or used inside a DeFi protocol.

Excessive liquidity implies that there are quite a few quantities of tokens out there for buying and selling, but this nonetheless presents challenges.

Tim Wang, COO of Elixir – a liquidity infrastructure layer – advised Cryptonews that though on-chain liquidity stays at a premium, liquidity provisioning to orderbooks requires specialised data.

“This inefficiency results in exchanges having to pay exorbitant charges or tokens to draw centralized market makers to their platform,” Wang stated. “This creates worse execution for merchants on their platform, and basic attrition of capital.”

Wang defined that Elixir sekks to enhance alternate liquidity effectivity by integrating into wallets and client functions like Robinhood.

“The tip state for Elixir is to combine into institutional funds as sources of liquidity with yield targets which are commensurate with the danger of the last word finish asset (e.g. Bitcoin being the bottom threat / lowest yielding) the place the liquidity is getting used,” he stated.

Wong remarked that on the again finish, Elixir’s infrastructure would assist route the liquidity to the highest-yielding pairs throughout all exchanges that make the most of the platform’s liquidity.

“Exchanges shall be free to incentivize liquidity to their pairs and ‘compete’ for liquidity with different exchanges,” Wong added.

Layer-2’s Will Allow Bitcoin DeFi

Bitcoin DeFi has started gaining traction because of the emergence of Bitcoin layer-2 (L2) networks. In response to Rena Shah, COO of TrustMachines – a workforce centered on rising the Bitcoin financial system – Bitcoin DeFi is important to the crypto sector.

She advised Cryptonews that Bitcoin (BTC) is bigger than all the opposite chains mixed. “There’s $1 trillion in worth ready to be unlocked via Bitcoin DeFi. It’s the largest alternative that may ever exist in crypto,” Shah stated.

Whereas notable, Bitcoin DeFi stays largely inaccessible. Shah identified that that is doubtless as a result of the truth that Bitcoin doesn’t have a digital machine (VM) or good contracts platform like different blockchain networks.

“Layers should be the protocols that improve the performance and scalability of the Bitcoin blockchain,” she stated. “By shifting sure features to the L2, we’re capable of work with the present performance of the L1 with out altering the core ethos of Bitcoin.”

Shah added that she hopes the lately permitted Bitcoin spot ETF in the United States will drive extra customers to undertake Bitcoin DeFi.

Within the meantime, Shah is conscious that the crypto sector continues to be within the early days of constructing the infrastructure wanted for Bitcoin DeFi.

Shopper DeFi Inevitable, However Will Take Time

Whereas DeFi stays an ongoing problem, shoppers will doubtless have the ability to leverage decentralized finance ideas sooner or later.

“Shopper adoption of DeFi shall be gradual and regular,” Simmons remarked.

He added that though technical improvements go a protracted solution to making DeFi accessible, different elements should be taken under consideration.

For instance, Simmons pointed out that regulatory frameworks are still evolving and can necessitate many adjustments. “This ranges from how DeFi front-ends could function to how these shoppers on-ramp and off-ramp from crypto,” he stated.

Trade specialists consider that tokenized real-world belongings will ultimately dominate the blockchain business over cryptocurrencies.#Tokenization #RWA https://t.co/E6uZY3YE2M

— Cryptonews.com (@cryptonews) June 21, 2024

Moreover, Simmons remarked that whereas real-world assets (RWAs) are gaining traction, the vast majority of DeFi is solely crypto-native belongings that the overwhelming majority of shoppers aren’t actively wanting to make use of of their day by day funds.

“Most DeFi dApps right this moment are centered on relative area of interest actions for common shoppers, with maybe the exception of DEXs,” he stated. “Over collateralized lending, perpetuals buying and selling, and yield farming could also be fashionable with subtle customers seeking to maximize earnings, however basic shoppers sometimes interact with monetary merchandise like funds, deposits, direct debits, and many others.”

Challenges apart nonetheless, Simmons believes that DeFi adoption is inevitable. “From a practical standpoint, DeFi helps the worldwide monetary system allocate capital extra effectively based mostly on alternative and threat,” he stated. “In a lot the identical approach that the web made information freely circulate throughout a world, unified community, bringing large new alternatives with it, DeFi does the identical for belongings. We’re simply within the early 2000’s period.”

[ad_2]

Source link