[ad_1]

On Feb. 26, MATIC’s value crossed $1.05 for the primary time in 2024; the regular rise in Polygon community exercise in correlation to the defi market growth suggests extra bullish motion might comply with.

Layer-2 networks like Polygon (MATIC) and Optimism (OP) have been on a tear in latest weeks as buyers pile billions of {dollars} into Ethereum (ETH) main defi protocols.

Defi market growth driving MATIC value rally

Amid widespread expectations of Fed price cuts, buyers are more and more switching focus in direction of threat property. Because the S&P 500 soared to historic peaks following NVIDIA’s bullish earnings, defi markets within the crypto sector have additionally recorded vital capital inflows.

L2 networks like MATIC, OP, and Arbitrum (ARB) are trade leaders in facilitating lending, borrowing, funds, and different smart-contract-based decentralized finance actions.

Final week, the Optimism value got here near hitting a new all-time high, whereas MATIC’s value reached a six-month peak of $1.05 on Feb. 27.

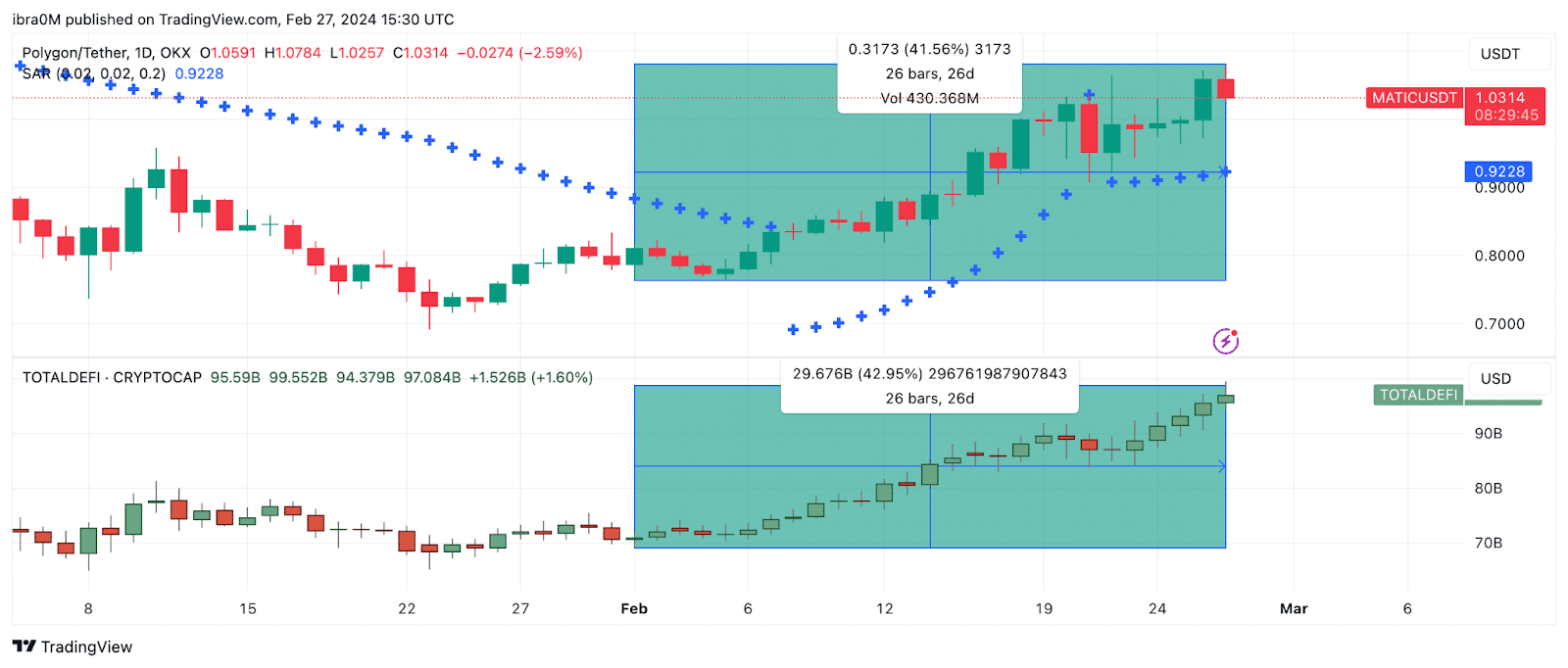

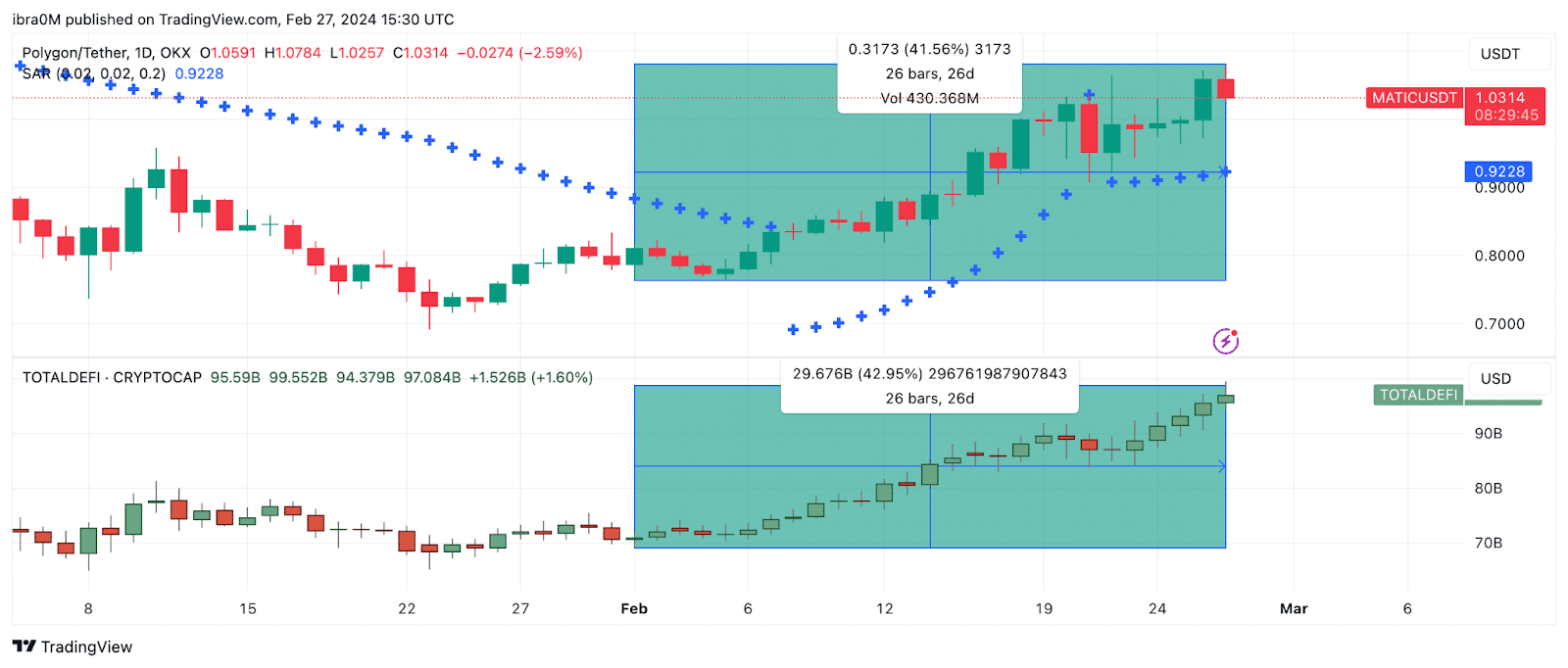

TradingView’s whole defi market cap charts monitor the cumulative valuation of decentralized finance-related tokens. When plotted subsequent to the overall defi market cap developments for February 2024, MATIC value motion has displayed a stark comparable outing for the month.

The chart reveals that the overall defi market cap has attracted $30 billion in inflows between Feb. 1 and Feb. 27, representing a 43% growth. This intently correlates to MATIC’s 42% value development efficiency throughout that interval.

The defi market has now ballooned to a 22-month high. Contemplating Ethereum liquidity staking deposits are receiving historic-level deposits, extra inflows might be recorded within the coming days, probably creating a chronic bullish demand cycle for Layer-2 scaling tasks like Polygon.

Polygon community exercise developments at a 5-month peak

The extent of consumer exercise recorded on the Polygon community in latest weeks additional affirms the correlation between the defi growth and MATIC value motion.

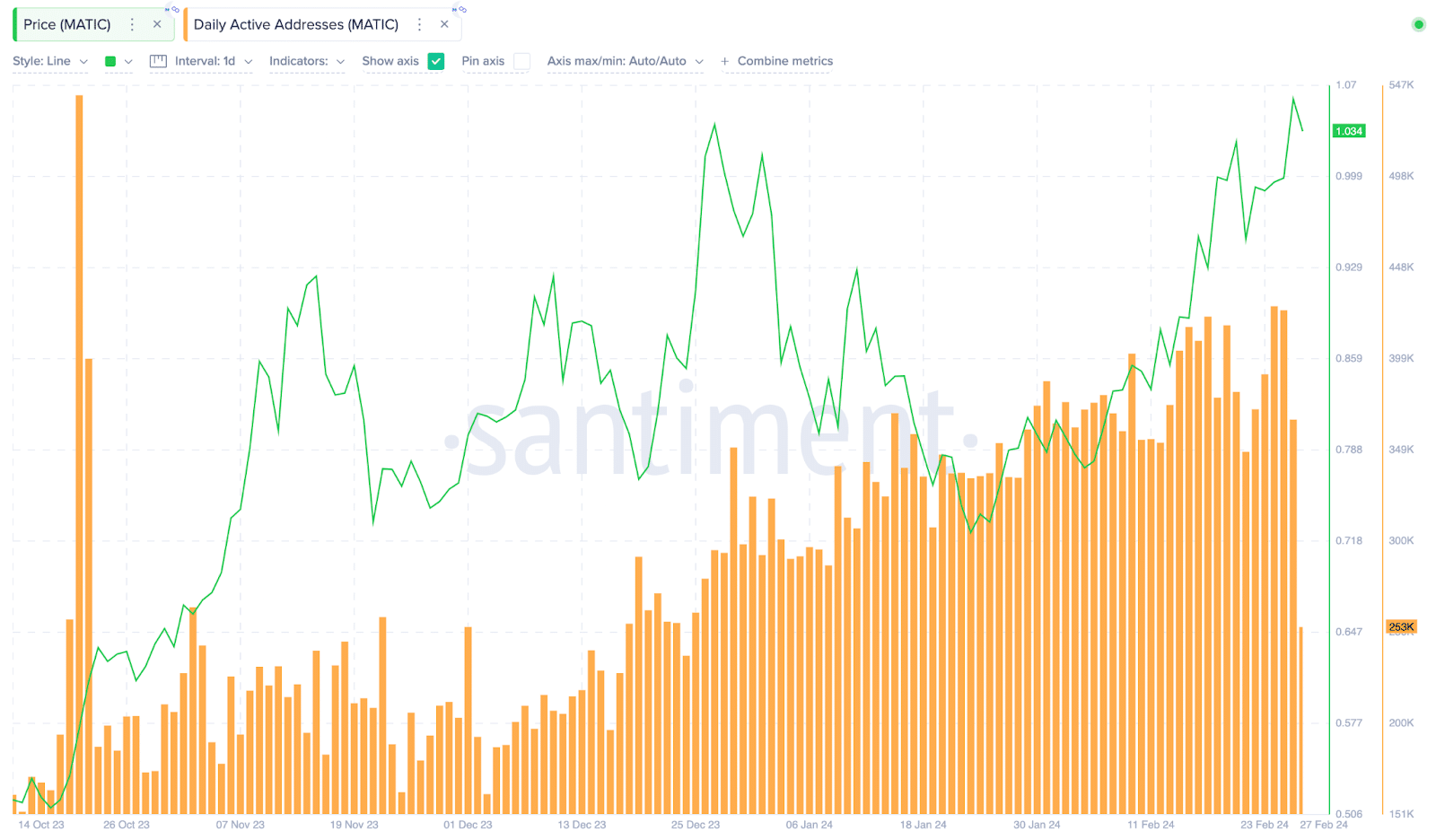

Santiment’s day by day energetic addresses (DAA) monitor the variety of distinctive addresses that perform legitimate transactions on a blockchain community over 24 hours. Polygon has attracted unusually excessive consumer exercise for the reason that flip of the yr regardless of uneven value motion.

As depicted, Polygon’s Each day Lively Addresses (DAA) hit a five-month peak of 427,000 on Feb. 25, having been on a meteoric rise for the reason that flip of the yr, even amid uneven value motion.

The rising values of Each day Lively Addresses are a key bullish indicator highlighting that the core companies provided on the underlying community are in demand.

When it coincides with a historic value uptrend, as noticed above, it means that the rally is pushed by natural utility and never merely speculators FOMO-ing in.

Extra importantly, Polygon’s exercise surge amid the defi growth additional emphasizes its standing as some of the sought-after scaling networks. This places MATIC in a vantage place to seize extra worth because the defi market good points extra traction within the coming weeks.

MATIC value forecast: $1.20 goal in agency focus

Primarily based on market developments, MATIC’s value is predicted to achieve the subsequent goal of round $1.20. Nonetheless, within the quick time period, the bulls should first clear the preliminary resistance within the $1.10 territory.

IntoTheBlock’s international in/out of the cash knowledge reveals that 52,830 addresses had acquired 172.3 million MATIC on the common value of $1.11. Provided that they’ve been holding at a loss since April 2023, many might choose to take some earnings.

If the defi market growth enters second gear, the MATIC pulls might capitalize on the ensuing community traction to drive the value rally above $1.20 as predicted.

Nonetheless, the bears can’t negate this bullish prediction if the preliminary profit-taking wave sends MATIC value tumbling beneath $0.90. Nonetheless, given the general optimistic sentiment surrounding the Layer-2 token markets, these bearish prospects appear far-fetched.

The 59,330 addresses that purchased 972,980 MATIC on the common value of $0.91 might provide vital short-term help.

[ad_2]

Source link