[ad_1]

- Solana’s design permits extra environment friendly DeFi purposes with much less capital locked up.

- Solana’s structure provides sooner transactions and parallel processing.

- Community metrics showcase this effectivity.

The Decentralized Finance (DeFi) sector is on the forefront of blockchain innovation, providing a substitute for conventional monetary methods by means of decentralized purposes (dApps). Inside this aggressive panorama, Solana and Ethereum stand out as main platforms, every striving to supply essentially the most environment friendly, safe, and user-friendly atmosphere for DeFi purposes.

The battle for dominance hinges on a number of components, together with transaction velocity, charges, and scalability. Most not too long ago, a Reflexivity Analysis report highlighted the significance of capital effectivity in DeFi. Notably, Solana stands out by way of this key metric, providing higher efficiency for merchants than Ethereum.

Solana’s Capital Effectivity Outshines Ethereum

In March 2024, Reflexivity Analysis printed an analysis highlighting Solana’s vital lead in capital effectivity over Ethereum. This metric is crucial within the DeFi house because it signifies how effectively a blockchain makes use of locked-up worth to facilitate financial exercise and development.

Capital effectivity, a key metric in TradFi, measures how successfully capital is used to generate income and facilitate financial exercise. In DeFi, the metric measures the connection between the whole worth locked (TVL) and the platform’s financial output, similar to buying and selling quantity or generated charges.

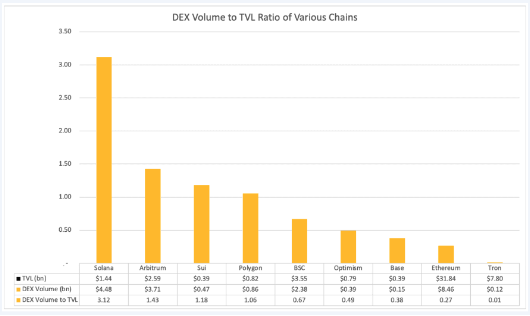

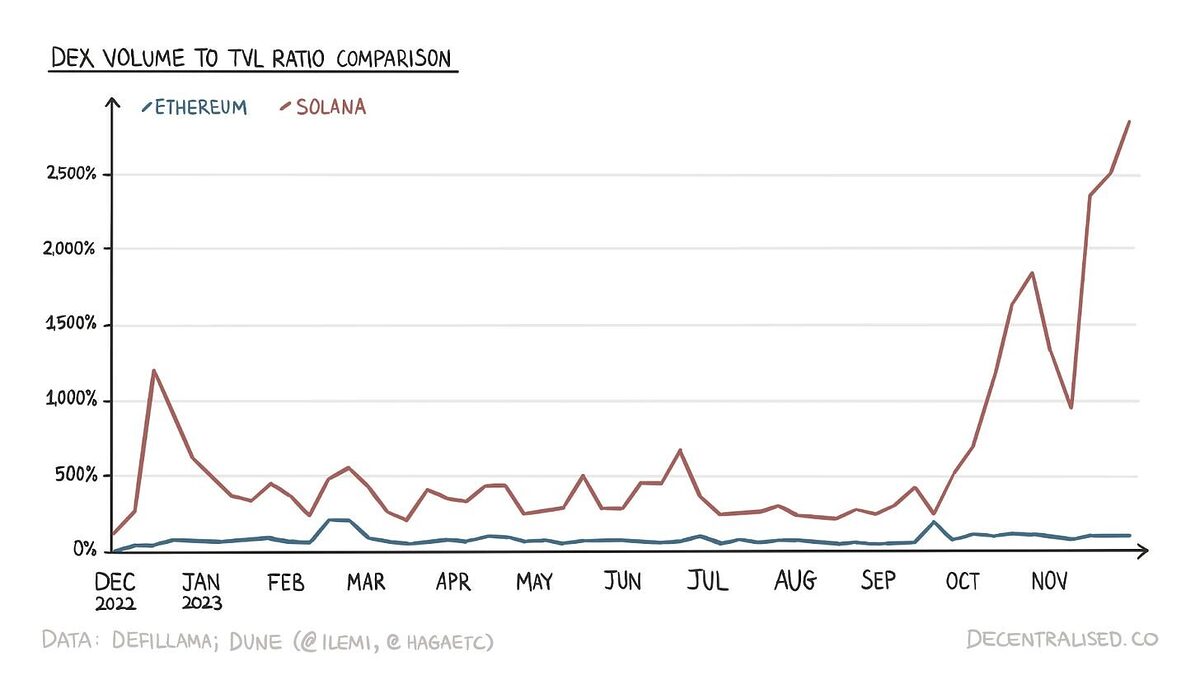

Within the first quarter of 2024, Solana was forward of different chains by way of the connection between its DEX quantity and TVL. In actual fact, DEX quantity to TVL in that interval was at 3.12, in comparison with Ethereum’s 0.27. This means robust capital effectivity.

This metric soared in latest months, because of a major enhance in DEX quantity, with out a comparative enhance in TVL. This was in distinction to Ethereum, for which DEX quantity to TVL remained largely unchanged.

The report means that one of many causes behind this variation is Solana’s structure. The community helps sooner transactions and decreased charges, which suggests much less capital is tied up in transactions ready for affirmation. Moreover, Solana’s capability to course of transactions in parallel considerably boosts its DeFi operations’ effectivity.

By requiring much less capital to attain greater ranges of financial exercise, Solana can doubtlessly entice a wider array of builders and customers. In actual fact, the most recent knowledge means that Solana is attracting much more exercise.

Solana’s DeFi Quantity Surges in 2024

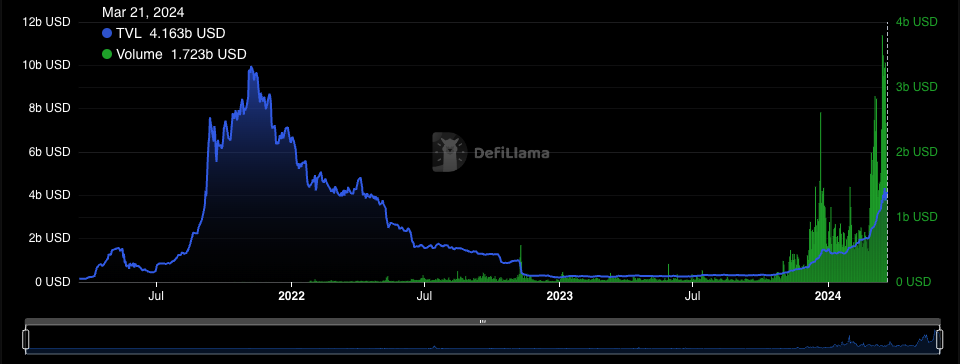

Excessive capital effectivity has already propelled Solana ahead, and it has seen a meteoric rise in its ecosystem and buying and selling quantity. Solana’s TVL stands at an impressive $3.913 billion, underscoring the substantial quantity of belongings pouring into its ecosystem.

Buying and selling quantity has seen a considerable rise, presently standing at $1.792 billion. Furthermore, the community collected $4.39 million in charges and generated $2.2 million in income during the last 24 hours.

Solana’s spectacular metrics in TVL, charges, income, and DeFi quantity illustrate the platform’s vital aggressive edge within the DeFi house. These figures are a testomony to Solana’s capital effectivity, the place much less capital is required to unlock greater financial exercise in comparison with different platforms.

On the Flipside

- Low charges on Solana implies that a lot of Solana’s transactions are spam. Whereas this contributes to capital effectivity, it additionally showcases a difficulty with the community.

- Reflexivity Analysis’s report acknowledges that Ethereum’s DeFi ecosystem ought to embody the exercise on each the mainnet and L2 rollups for a whole image.

Why This Issues

The competitors between Solana and Ethereum underscores the significance of steady enchancment and innovation inside the blockchain house.

Learn extra about Solana’s efficiency:

Solana’s Stellar Rise in 2024: What’s Behind the Success?

Learn extra about Polkadot’s ecosystem:

[ad_2]

Source link