[ad_1]

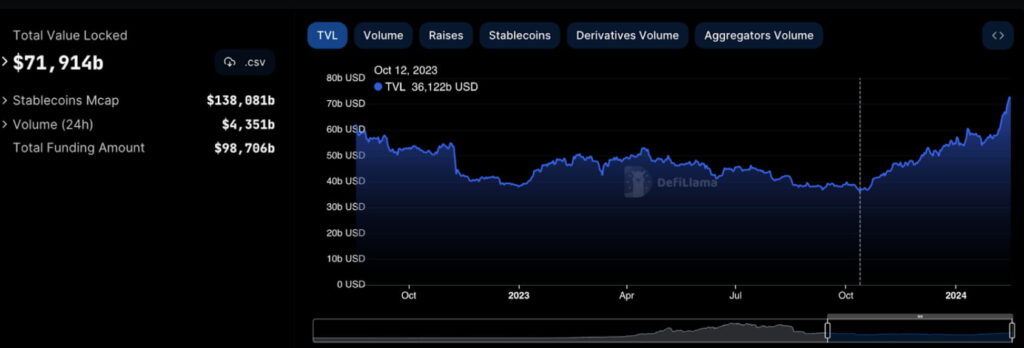

The decentralized finance (DeFi) panorama has been persistently rising since late 2023, after a fall that began in Might 2022.

Particularly, the overall worth locked (TVL) in DeFi surged practically 100% previously 4 months. On February 17, TVL reached a 2-year excessive of $71.914 billion. That is near a double-up from the native backside at $36.122 billion on October 12, 2023.

A part of this development instantly outcomes from a worth pump in USD of every locked cryptocurrency contained in the protocols. Nevertheless, one other related side was an elevated adoption and natural quantity of the funds locked, measured in cryptocurrencies.

Aggressive DeFi ecosystem and TVL distribution

Notably, Solana (SOL), Cardano (ADA), Avalanche (AVAX), and lots of different layer-1 blockchains have persistently grown their DeFi ecosystem. New protocols, decentralized apps, tokens, options, and companies contributed to this development, in response to data from DefiLlama.

Sharding blockchains like Radix (XRD), MultiversX (EGLD), Close to Protocol (NEAR), and Sui Community (SUI) fueled innovation and scalability. Due to this fact, new use instances began to look, consequentially attracting extra buyers and capital to decentralized finance.

Ethereum (ETH) momentarily lost its leadership in decentralized exchange volume to Solana whereas seeing its TVL dominance fall previously 4 months.

However, Ethereum regained the 24-hour quantity management with $1.374 billion, adopted by Solana with $717.09 million. Bitcoin (BTC) dominates the month-to-month surge among the many high 10 blockchains, with a virtually 350% improve in complete worth locked.

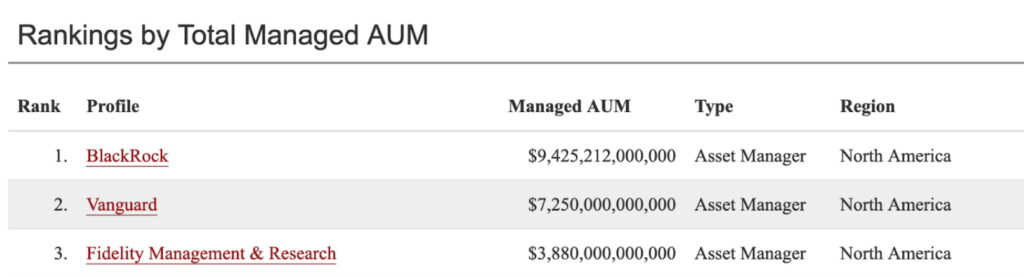

The whole worth locked in DeFi equals 1% of Vanguard’s AUM

On this context, the funds locked in DeFi now equal practically 1% of Vanguard’s belongings beneath administration (AUM). Vanguard is the world’s second-largest asset supervisor with $7.25 trillion AUM, simply behind BlackRock Inc. (NYSE: BLK).

On a facet word, the finance titan shocked the market by refusing to supply the authorised Bitcoin ETFs to its brokerage’s clients. On January 11, Vanguard prevented its clients from gaining publicity to BTC by way of legally authorised ETFs.

Nonetheless, the anti-Bitcoin institution is also a major shareholder in Bitcoin mining companies, as reported by Finbold.

In conclusion, cryptocurrencies have been rising and conquering completely different funding profiles over time. Decentralized finance is a promising phase that can probably proceed to develop in 2024 and sooner or later, difficult traditional finance dominance as buyers’ desire.

However, the ‘Legacy’ also moves towards gaining more share and influence over the crypto market, as warned by Charles Hoskinson. Within the meantime, speculators drive the capital movement out and in of every of their methods of selection.

[ad_2]

Source link