[ad_1]

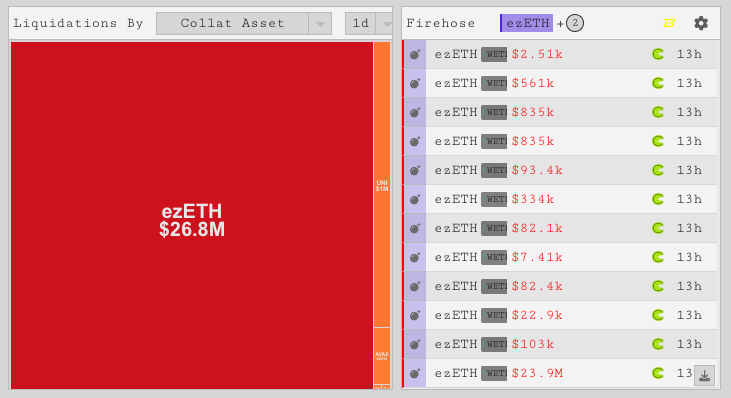

A dramatic flip of occasions on the decentralized finance (DeFi) platform Pac Finance led to a $26.8 million liquidation occasion, closely impacting quite a few customers.

This monetary upheaval occurred unexpectedly on April 11 and has since stirred substantial debate inside the cryptocurrency group.

How DeFi Customers Misplaced Over $26.8 Million in Liquidations?

Working on the Blast network, Pac Finance permits cryptocurrency lovers to deposit their funds to earn curiosity by lending. The platform secures loans by guaranteeing debtors obtain solely as much as a specified proportion of their collateral, generally known as the “loan-to-value ratio” (LTV).

Usually, any modifications to this vital ratio are introduced prematurely to keep up market stability.

Unexpectedly, blockchain data from the Blast Community revealed that at 1:06 AM UTC, a wallet managed by a developer adjusted the LTV for Renzo Restaked Ether (ezETH) to 60%. The ezETH-leveraging farmers nearly immediately discovered themselves out of compliance with the brand new collateral necessities.

Consequently, this sudden change precipitated widespread liquidations amongst customers.

Learn extra: What Is a Crypto Loan? A Guide to Using the DeFi Instrument

Such fast liquidations expose the extra dangers from protocol modifications, which will be as extreme as these from market swings. For instance, current shifts in Bitcoin’s price resulted in over $500 million in liquidations on April 2. Nonetheless, these had been as a result of worth volatility, in contrast to Pac Finance’s protocol-triggered liquidations.

DeFi professional Kydo has recommended that different Liquid Restaking Tokens (LRTs), resembling Renzo, ought to warn customers about these high-risk ventures. Regardless of the engaging incomes potential of staked cryptocurrencies, the unpredictable nature of administrative selections can result in vital monetary losses.

Following the turmoil, Pac Finance acknowledged that it was conscious of the incident. Furthermore, the DeFi platform claims that it’s creating a plan with affected customers to deal with the problem.

“In our effort to regulate the LTV, we tasked a wise contract engineer to make the mandatory modifications. Nonetheless, it was found that the liquidation threshold was altered unexpectedly with out prior notification to our workforce, resulting in the present challenge. Going ahead, we are going to arrange a governance contract/timelock and discussion board for all future upgrades to make sure that discussions are deliberate forward of time,” Pac Finance explained.

This incident serves as an important reminder of the significance of transparency and cautious protocol administration in DeFi initiatives. Buyers ought to totally perceive the operational mechanisms and phrases of any DeFi service and stay vigilant about any modifications that would have an effect on their investments.

Learn extra: Identifying & Exploring Risk on DeFi Lending Protocols

Furthermore, the occasion highlights the important want for efficient communication between DeFi platforms and their consumer bases. Trust can quickly erode with out immediate and clear communication following vital monetary disruptions, probably deterring new customers.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

[ad_2]

Source link