[ad_1]

The next is a visitor article from Vincent Maliepaard, Advertising and marketing Director at IntoTheBlock

What’s BlackRock’s BUIDL Fund?

The BUIDL fund, formally referred to as the BlackRock USD Institutional Digital Liquidity Fund, represents BlackRock‘s enterprise into tokenized belongings on a public blockchain. Using the Ethereum community, BUIDL invests in money, short-term debt securities, and U.S. Treasury bonds.

The launch of BlackRock’s BUIDL fund excited many within the trade as a result of it showcases how conventional monetary devices can combine with the revolutionary capabilities of DeFi.

Nevertheless, BlackRock is just not the primary to discover this know-how. Different notable corporations have additionally made vital strides on this space. For example, Abrdn, a significant UK asset supervisor, launched a tokenized model of its £15 billion Lux Sterling cash market fund on the Hedera Hashgraph DLT in June 2023 (Ledger Insights).

Equally, Hamilton Lane, one other funding supervisor, opened a tokenized feeder fund on the Polygon blockchain in early 2023. This fund permits particular person buyers to entry non-public fairness with considerably lowered minimal funding necessities in comparison with conventional variations (markets.businessinsider.com).

Quite a few examples from the blockchain trade have contributed to a rising area of interest ecosystem throughout the bigger blockchain trade referred to as “Actual-world Belongings,” or RWAs.

Actual-World Belongings in Crypto

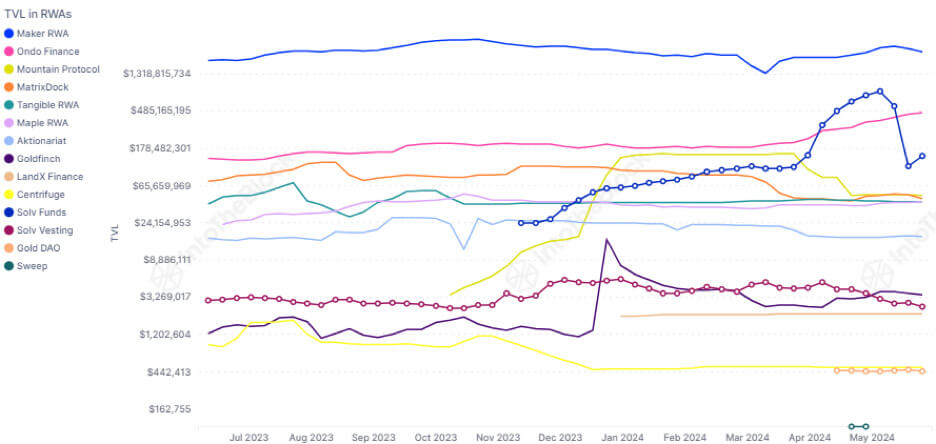

Real-world Assets (RWA) have emerged as some of the vital areas of focus within the blockchain trade this yr. Tasks on this area purpose to channel yield and belongings from the normal financial system into the digital area. This integration leverages the inherent interoperability of DeFi, enabling new types of asset utilization and yield technology.

In 2023, vital strides had been made on this sector, marked by efficiently incorporating U.S. Treasury bond yields into DeFi via protocols like Mountain Protocol. In consequence, the entire worth locked (TVL) in RWA protocols soared to over $2.9 billion. High protocols within the RWA ecosystem now depend over 194,000 RWA protocol token holders between them, reflecting its fast adoption and rising affect.

Growth and Development of the BUIDL Fund

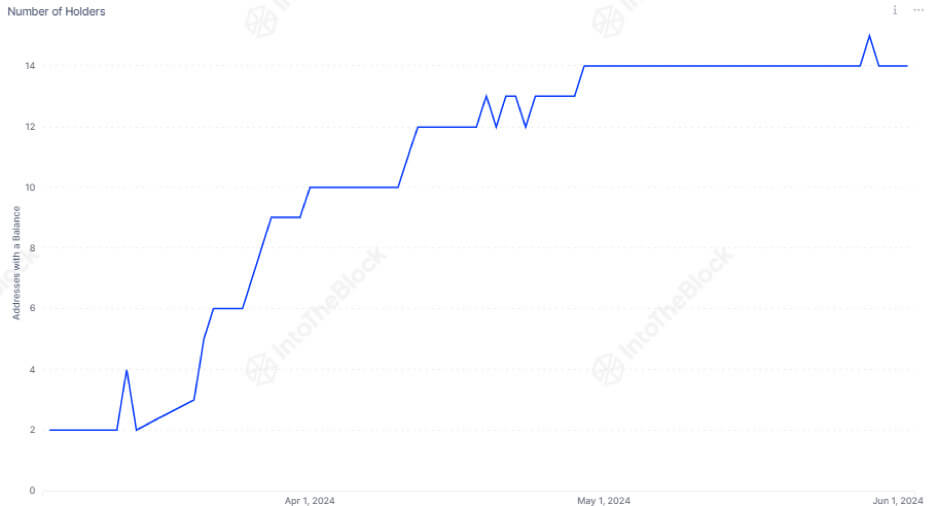

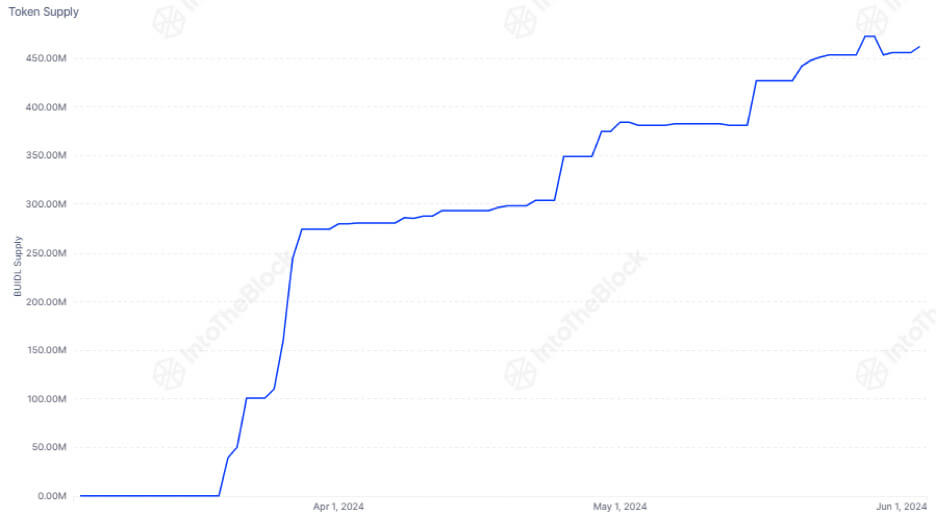

The construction of BlackRock’s BUIDL fund is designed to cater to institutional buyers, requiring a minimal funding of $5 million per entity. The fund has 14 holders and has showcased gradual however notable development since its launch.

Whereas the variety of holders could develop progressively, every new investor considerably boosts the fund’s whole holdings. Present knowledge reveals there are 462,542,901 circulating tokens, every representing roughly $1, bringing the entire fund worth to $462 million.

The Way forward for BlackRock’s BUIDL Fund and RWA in DeFi

Because the DeFi sector continues attracting consideration from conventional monetary gamers, integrating RWAs like these within the BUIDL fund is anticipated to speed up. This development is pushed by the inherent benefits of tokenization, together with elevated transparency, liquidity, and entry to a broader vary of buyers. This evolution extends past the blockchain trade and units the stage for a extra interconnected and environment friendly international monetary system.

Talked about on this article

[ad_2]

Source link