[ad_1]

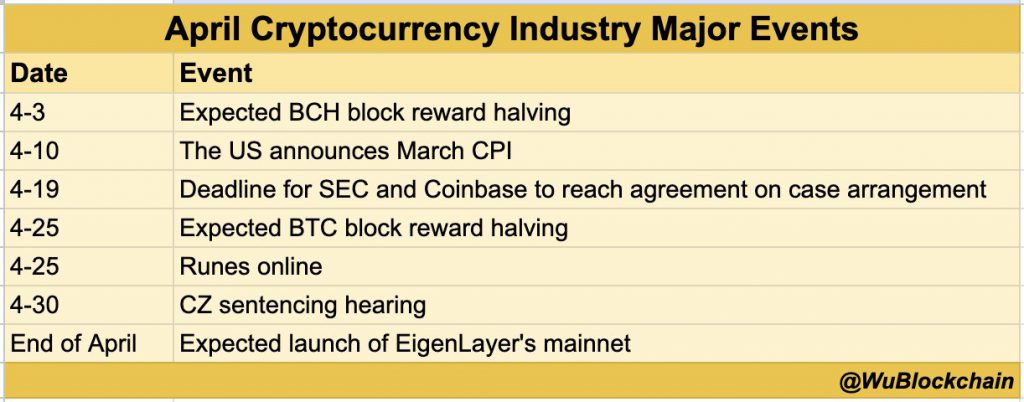

April 2024 looms as an important juncture for the cryptocurrency market, set to witness a convergence of serious occurrences that would doubtlessly alter the dynamics of digital belongings.

From pivotal protocol developments to authorized confrontations involving business heavyweights, the month is brimming with occasions which will dictate the trajectory of the marketplace for the foreseeable future.

Bitcoin Halving

We’ve now entered the extremely anticipated month of April 2024, with the Bitcoin halving event simply across the nook, a mere 20 days away. Because the countdown to the halving occasion continues, Bitcoin (BTC) has exhibited notable power in its value just lately.

On the time of writing, Bitcoin is buying and selling at $66,000 ranges, boasting a market capitalization of $1.31 trillion. The upcoming fourth Bitcoin halving stands out as essentially the most eagerly awaited occasion of April, traditionally characterised by elevated market volatility and speculative exercise.

Revered analysts counsel that this halving might set off a surge in altcoin costs, doubtlessly indicating a shift in Bitcoin’s dominance. This hypothesis good points momentum as Bitcoin demonstrates exceptional volatility, surpassing even Ether within the lead-up to the halving occasion.

SEC and Coinbase Lawsuit

The Securities and Alternate Fee (SEC) stays steadfast in its pursuit of authorized motion towards Coinbase. This additional prolongs the cryptocurrency alternate’s authorized challenges. The Courtroom’s rejection of Coinbase’s movement to dismiss the lawsuit signifies an ongoing and protracted authorized dispute.

It underscores the regulatory ambiguities confronted by main gamers within the crypto business. Each events are required to submit a case administration plan by April 19. It additional outlines the important thing points within the case and the methods for trial proceedings.

Also Read: Bitcoin vs Gold: Why Economist Peter Schiff Believes Gold Trumps BTC

US March CPI Launch

All consideration can be centered on April 10 when the Shopper Value Index (CPI) knowledge for March is launched. It would provide essential insights into inflation patterns. Analysts will meticulously scrutinize this knowledge, anticipating its implications for Federal Open Market Committee (FOMC) choices.

That is concerning rates of interest and financial coverage. Regardless of prevailing expectations, Forbes signifies that changes to rates of interest are unbelievable in April. That is in preparation for his or her upcoming assembly on Might 1.

Whereas no alterations to rates of interest are foreseen on the assembly, comparatively delicate inflation knowledge might lay the groundwork for a possible rate of interest minimize in the summertime, aligning with the anticipated outlook of most FOMC officers and fixed-income markets.

CZ’s Listening to

The sentencing of Changpeng Zhao (CZ), the founder and former CEO of Binance, has been delayed till April 30, as said in a discover filed in Seattle federal court docket on Monday.

CZ’s authorized struggles have garnered vital consideration, significantly his efforts to acquire permission to journey to the UAE for medical causes. Certainly, these have been constantly denied by the US Federal Courtroom as a result of lack of an extradition treaty.

Honourable Mentions

April additionally witnesses the Bitcoin Money (BCH) halving. This comes with the launch of EigenLayer’s mainnet, marking vital milestones inside their respective ecosystems. These developments carry implications for buyers and customers, underscoring the continual evolution and maturation of the cryptocurrency market.

As April unfolds, the cryptocurrency neighborhood awaits the outcomes of those pivotal occasions, aware of their potential to reshape the trajectory of Bitcoin and the broader crypto market within the months forward. With regulatory ambiguities, authorized entanglements, and protocol upgrades dominating the discourse, April 2024 emerges as a defining second within the ongoing narrative of cryptocurrencies.

Also Read: Shiba Inu Gets Nod from Early Bitcoin Investor: Is It Time to Buy?

[ad_2]

Source link