[ad_1]

Key Insights

DMG Blockchain Options Inc. (CVE:DMGI) has not carried out nicely lately and CEO Sheldon Bennett will most likely must up their recreation. Shareholders shall be excited about what the board should say about turning efficiency round on the subsequent AGM on fifteenth of March. They will even get an opportunity to affect managerial decision-making via voting on resolutions reminiscent of government remuneration, which can influence agency worth sooner or later. We current the case why we expect CEO compensation is out of sync with firm efficiency.

Check out our latest analysis for DMG Blockchain Solutions

How Does Complete Compensation For Sheldon Bennett Examine With Different Firms In The Trade?

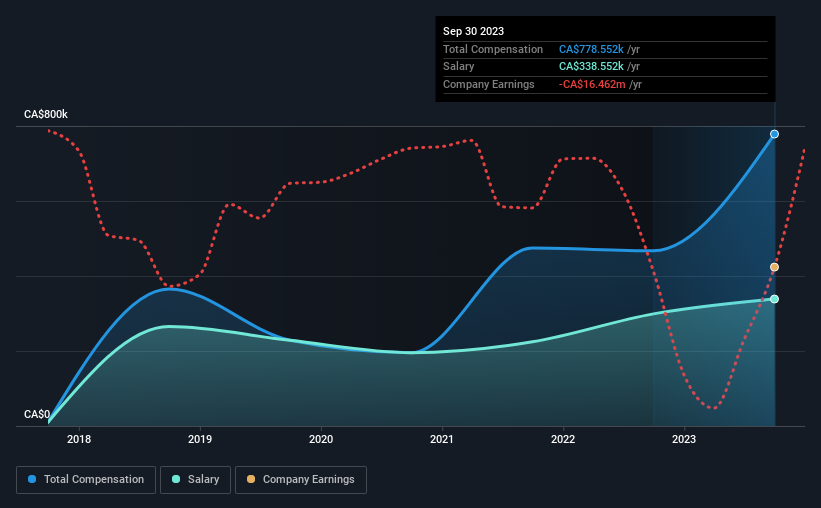

Our knowledge signifies that DMG Blockchain Options Inc. has a market capitalization of CA$98m, and complete annual CEO compensation was reported as CA$779k for the 12 months to September 2023. That is a notable improve of 67% on final 12 months. Whereas we all the time have a look at complete compensation first, our evaluation reveals that the wage element is much less, at CA$339k.

On evaluating similar-sized firms within the Canadian Software industry with market capitalizations under CA$270m, we discovered that the median complete CEO compensation was CA$347k. Therefore, we will conclude that Sheldon Bennett is remunerated greater than the business median. What’s extra, Sheldon Bennett holds CA$2.4m price of shares within the firm in their very own identify, indicating that they’ve a number of pores and skin within the recreation.

|

Part |

2023 |

2022 |

Proportion (2023) |

|

Wage |

CA$339k |

CA$299k |

43% |

|

Different |

CA$440k |

CA$168k |

57% |

|

Complete Compensation |

CA$779k |

CA$467k |

100% |

On an business degree, round 70% of complete compensation represents wage and 30% is different remuneration. DMG Blockchain Options pays a modest slice of remuneration via wage, as in comparison with the broader business. If complete compensation is slanted in the direction of non-salary advantages, it signifies that CEO pay is linked to firm efficiency.

A Have a look at DMG Blockchain Options Inc.’s Development Numbers

Over the past three years, DMG Blockchain Options Inc. has shrunk its earnings per share by 39% per 12 months. It noticed its income drop 16% over the past 12 months.

The decline in EPS is a bit regarding. That is compounded by the very fact income is definitely down on final 12 months. It is laborious to argue the corporate is firing on all cylinders, so shareholders is perhaps averse to excessive CEO remuneration. Transferring away from present kind for a second, it might be essential to verify this free visual depiction of what analysts expect for the future.

Has DMG Blockchain Options Inc. Been A Good Funding?

Few DMG Blockchain Options Inc. shareholders would really feel glad with the return of -77% over three years. This implies it will be unwise for the corporate to pay the CEO too generously.

In Abstract…

Not solely have shareholders not seen a good return on their funding, however the enterprise hasn’t carried out nicely both. Few shareholders could be prepared to award the CEO with a pay increase. On the upcoming AGM, administration will get an opportunity to clarify how they plan to get the enterprise again on monitor and tackle the considerations from buyers.

It’s all the time advisable to analyse CEO pay, together with performing an intensive evaluation of the corporate’s key efficiency areas. We did our analysis and recognized 3 warning signs (and 2 which are a bit concerning) in DMG Blockchain Options we expect it’s best to learn about.

In fact, you would possibly discover a improbable funding by taking a look at a distinct set of shares. So take a peek at this free list of interesting companies.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link