[ad_1]

- An change circulate metric confirmed that the native backside could be in for BTC, ETH.

- The market sentiment was not bullish and holder conduct at essential assist ranges can be key for the subsequent worth transfer.

Bitcoin [BTC] and Ethereum [ETH] bulls struggled to shift the market dynamic of their favor. The massive losses of the previous ten days meant that the value was again at a assist zone the place patrons are anticipated to halt the sellers.

Ethereum’s MVRV and NVT ratios confirmed the asset could be undervalued. The liquidity pocket at $3500 may see a brief squeeze, however momentum was bearish in any other case.

In the meantime, one other BTC investigation confirmed that mining activity had receded and that miners had been promoting Bitcoin. Nevertheless, the promoting strain had begun to drop in depth over the previous two days.

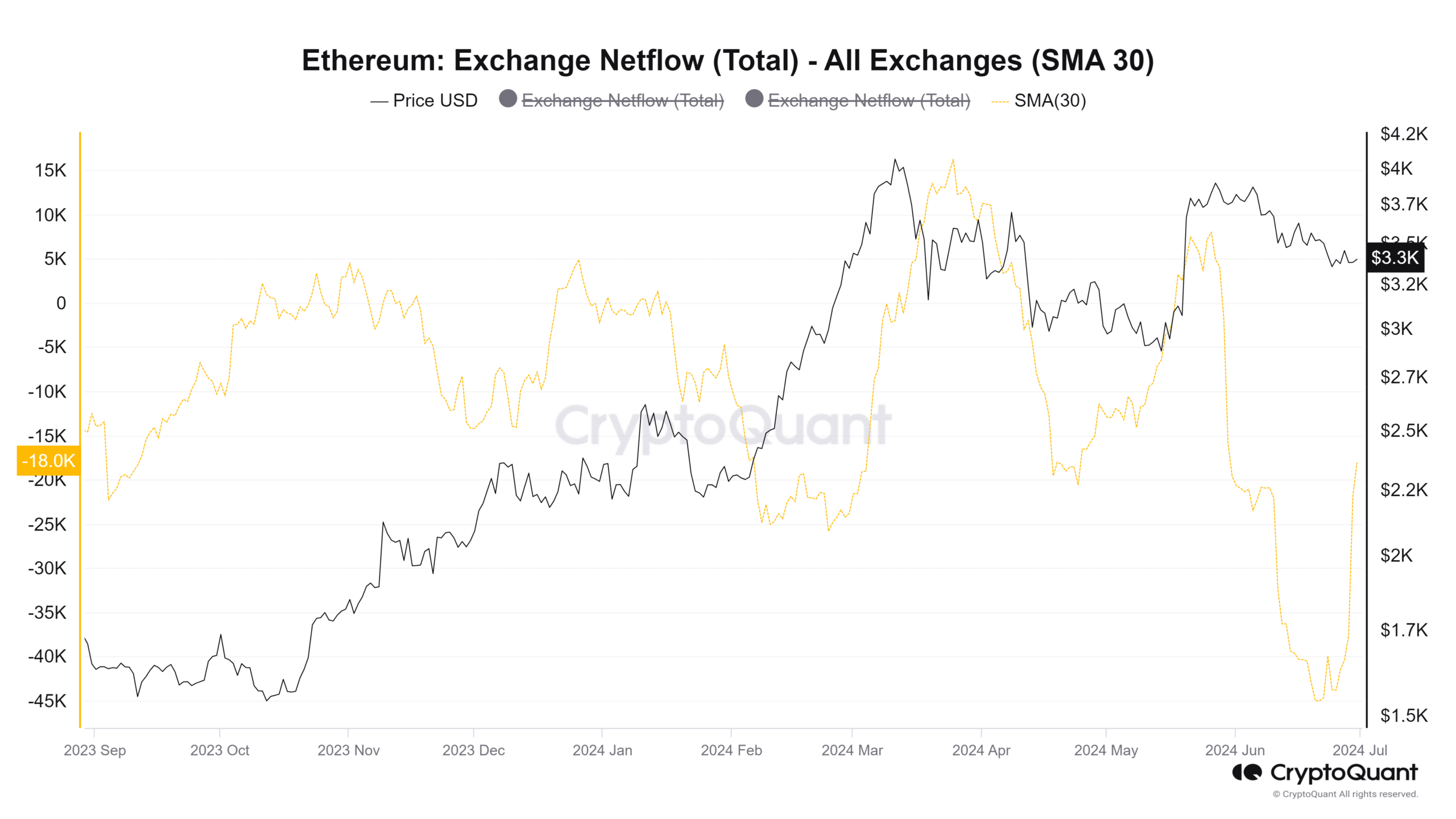

AMBCrypto determined to take a look at the motion of each property from exchanges to gauge the market sentiment. It revealed that bulls may not have an excessive amount of to cheer for but.

What does the change netflow metric point out?

The change web flows metric gives helpful insights into the market. When the flows are constructive, it reveals inflows are larger.

This in flip is an indication of potential promoting strain on the asset, because it implies members are sending the crypto to exchanges to promote them.

Values under zero imply that outflows are larger, which is an efficient signal for patrons.

It signifies that market members are withdrawing their property from exchanges, prone to place them in safer storage, and signifies accumulation.

Supply: CryptoQuant

The 30-day easy shifting averages had been used to raised perceive the change circulate tendencies. The ETH inflows had been appreciable in mid-March and towards late Could.

Each occurrences marked a neighborhood high for the value.

Previously month, the online circulate was closely unfavourable, displaying accumulation. Over the previous eight days, the outflow has slowed down, however the 30DMA web circulate remained in unfavourable territory.

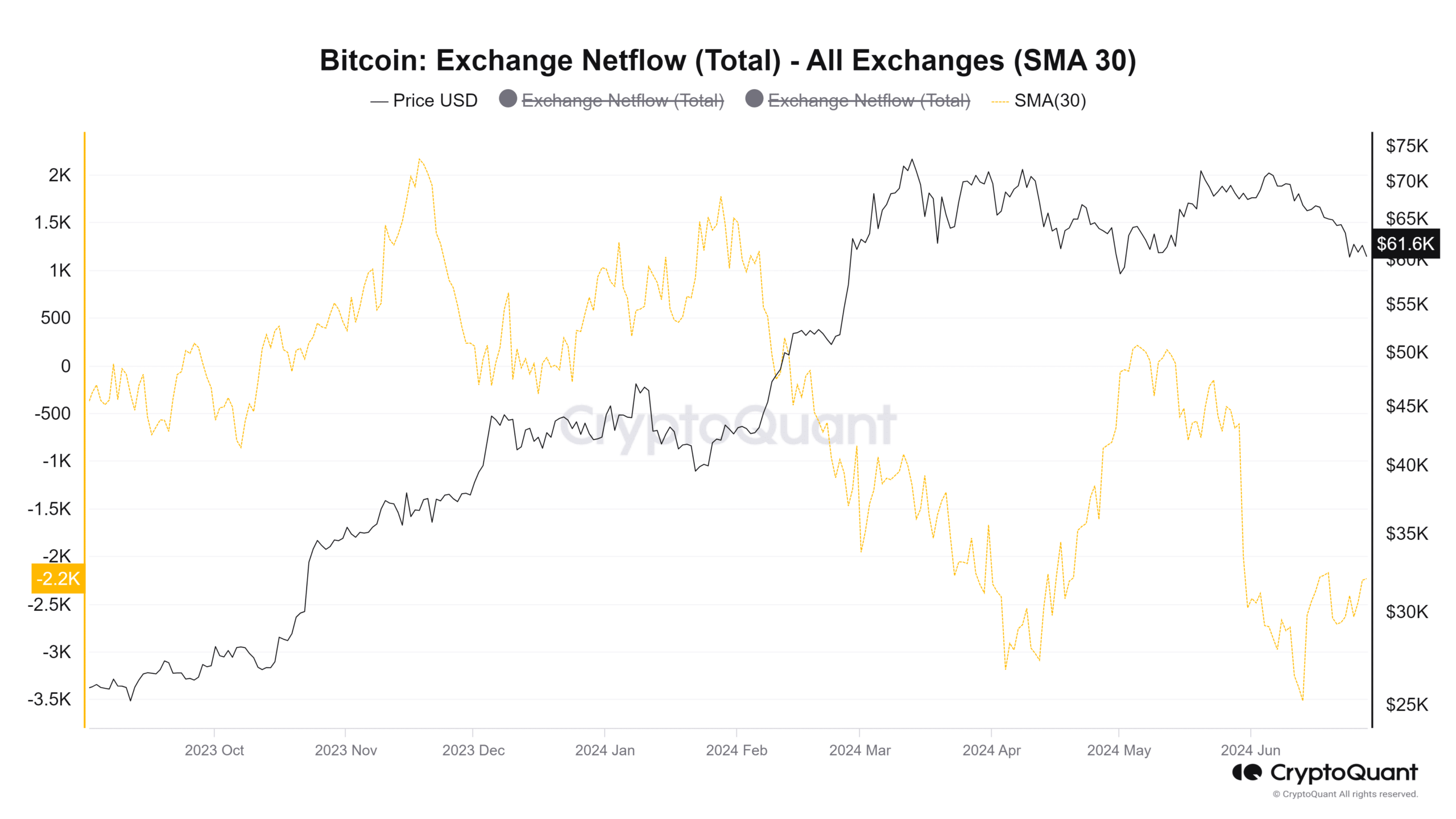

Supply: CryptoQuant

In the meantime, Bitcoin noticed constant accumulation in February and March. The 30DMA confirmed that the circulate of BTC out of the exchanges continued to dominate.

In late April and on the twenty first of Could, there have been spikes within the BTC influx, however they had been exceptions to the pattern.

Are Bitcoin, Ethereum headed for a consolidation?

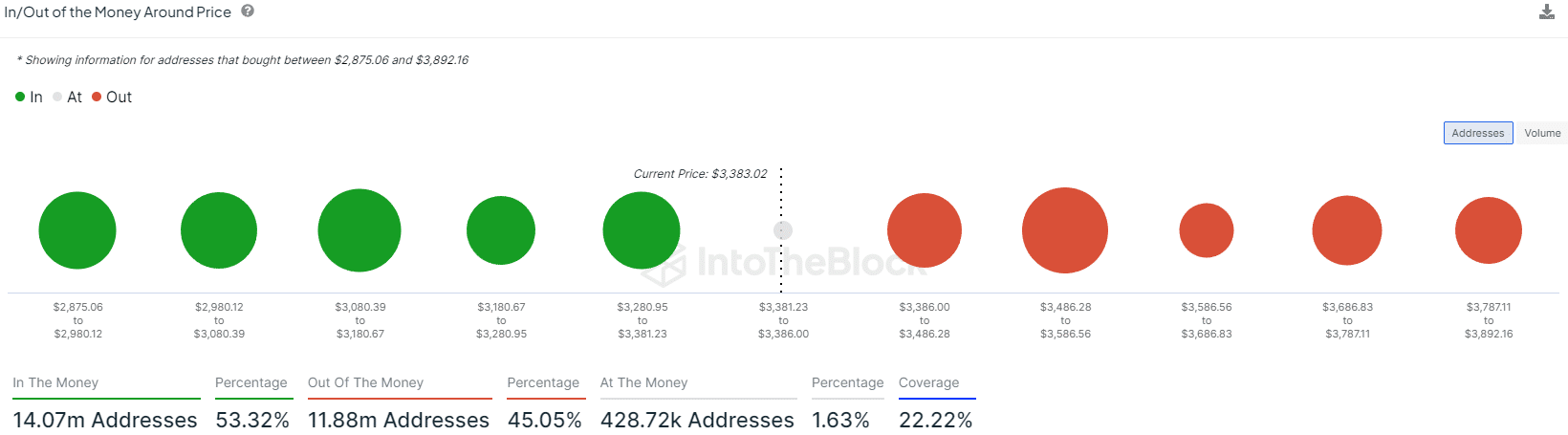

Supply: IntoTheBlock

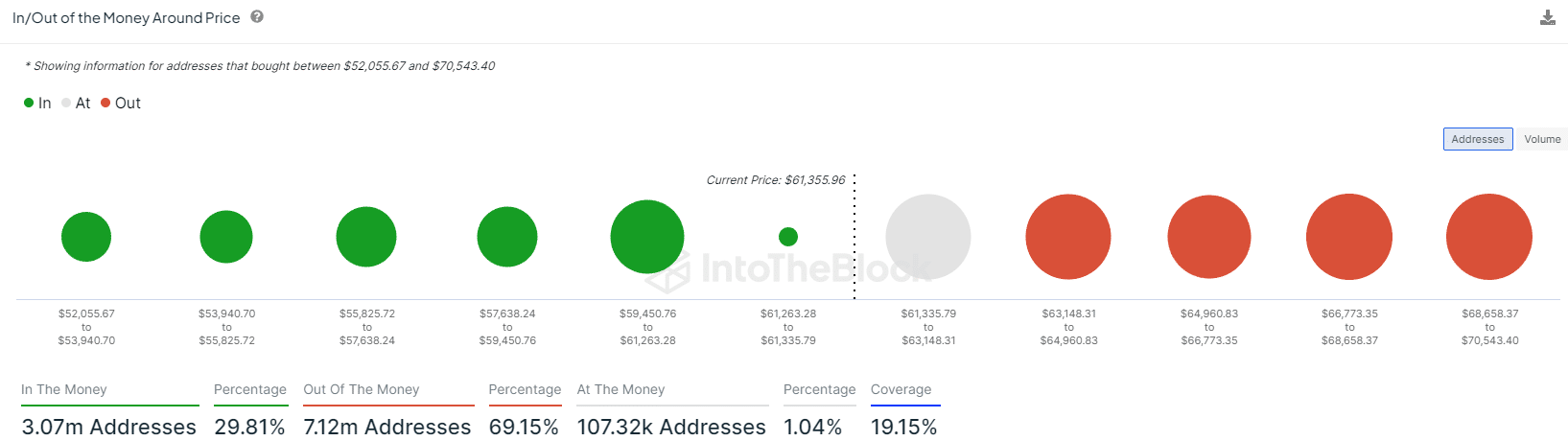

AMBCrypto’s examination of the in/out of the cash information from IntoTheBlock highlighted key assist areas.

The in/out of cash across the worth confirmed Ethereum has a robust bastion of assist from $3080-$3180 and $3280-$3381. Equally, the $3486-$3586 can be a staunch resistance.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Price Prediction 2024-25

For Bitcoin, the $59,450-$61,263 is assist and $63,148-$64,960 resistance.

This meant that the present worth consolidation of each these crypto market leaders may very well be confined inside these ranges and result in a variety formation.

[ad_2]

Source link