[ad_1]

MicroStrategy (MSTR) reported a internet working lack of $53.1 million, or $3.09 per share, within the first quarter after taking a digital asset impairment cost of $191.6 million, in response to a Monday afternoon press release.

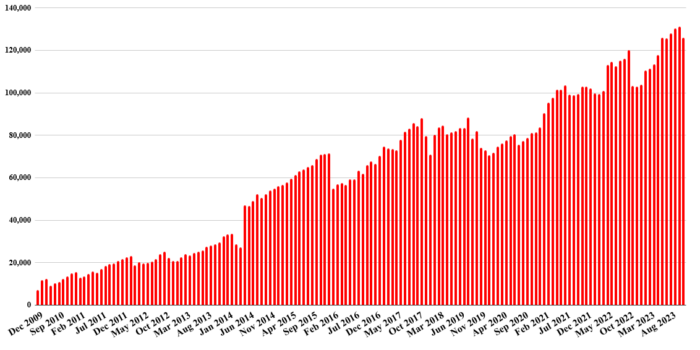

Whereas some had anticipated the corporate may undertake the brand new digital asset truthful worth accounting customary, and thus report a large revenue because of bitcoin’s (BTC) first quarter rally, the corporate elected not to take action. By the outdated customary, MicroStrategy at quarter’s finish valued its bitcoin holdings at a worth of $23,680 every, or $5.1 billion, slightly than March’s closing worth of $71,028, or $15.2 billion.

The corporate additionally introduced a small April addition of 122 tokens to its bitcoin stack, bringing whole holdings to 214,400. That will be valued at $13.5 billion at bitcoin’s present worth of about $63,000.

For all of 2024 to date, MSTR has acquired 25,250 bitcoins for $1.65 billion, or a mean worth of $65,232 every.

Shares are decrease by 3.3% in after hours buying and selling.

Talking on the earnings name, CFO Andrew Kang stated the corporate absolutely plans to undertake the brand new digital asset truthful worth accounting rule and is at the moment evaluating the most effective time to take action. The Monetary Monetary Accounting Requirements Board (FASB) has mandated that the brand new rule be applied by Jan. 1, 2025, however early adoption is allowed.

Replace (April 29, 22:31 UTC): Added feedback from the CFO.

[ad_2]

Source link