[ad_1]

- BTC’s metrics prompt that promoting strain on the coin was low.

- Market indicators hinted at a number of extra much less risky days forward.

Bitcoin [BTC] continues to underperform over the previous couple of days because it fails to go above the $65k mark. Within the meantime, a deep studying mannequin predicted one thing fascinating because it prompt that BTC’s value may attain new highs in simply the subsequent 30 days.

Bitcoin’s new ATH quickly?

In response to CoinMarketCap, the final seven days remained fairly dormant as BTC’s value solely moved marginally. The identical pattern was additionally seen in its every day value motion. On the time of writing, BTC was buying and selling at $64,294.85 with a market capitalization of over $1.26 trillion.

Whereas BTC’s value remained much less risky, CryptoOnChain, an writer and analyst at CryptoQuant, posted an analysis highlighting a notable improvement. The evaluation used a deep studying mannequin that predicted BTC’s subsequent 30-day value motion.

The AI mannequin has been skilled based mostly on 370 on-chain indicators to foretell the worth of Bitcoin within the subsequent 30 days based mostly on the info from the previous 12 months.

The evaluation additionally included visualizations of precise value versus predicted value by the mannequin for the coaching, validation, and check datasets.

If the prediction of the AI mannequin is to be believed, then BTC’s value will acquire bullish momentum after 25 days. The worth uptrend would permit BTC to go above $77k, as per the AI mannequin.

What metrics counsel

For the reason that $77k goal appeared fairly formidable, AMBCrypto checked BTC’s metrics to seek out out whether or not the king of cryptos is preparing for a bull run.

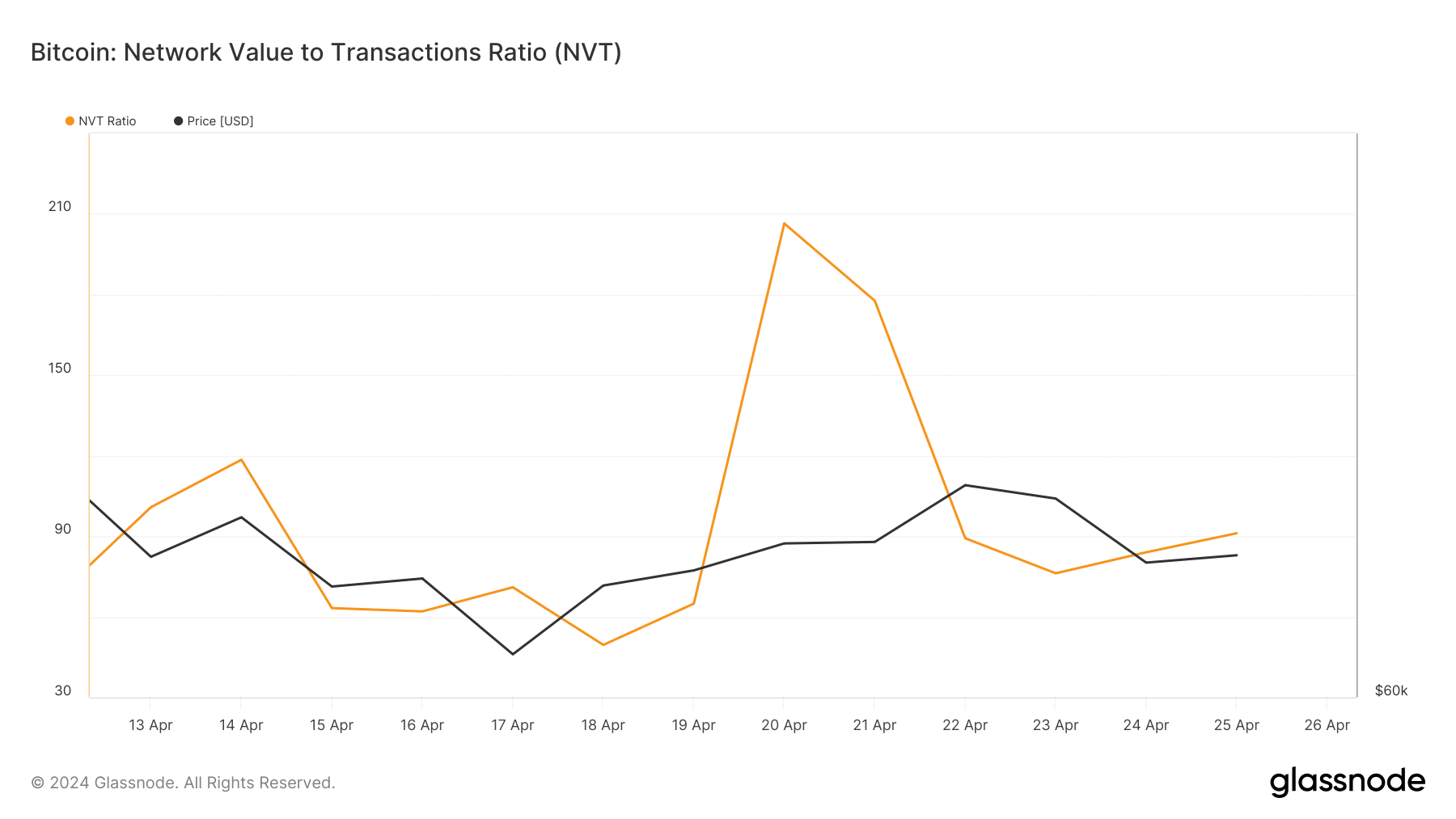

We discovered that its community to worth (NVT) ratio registered a pointy drop. A decline within the metric implies that an asset is undervalued, indicating a potential value enhance.

Other than these, fairly a number of different metrics additionally appeared bullish on BTC. AMBCrypto’s evaluation of CryptoQuant’s data revealed that BTC’s alternate reserve was dropping.

Its web deposit on exchanges was low in comparison with the final seven days’ common. These indicated that promoting strain on BTC was dropping.

Moreover, BTC’s binary CDD was inexperienced, which means that long-term holders’ actions within the final 7 days have been decrease than common.

Nevertheless, at press time, Bitcoin’s concern and greed index had a price of 70. This prompt that the market was in a “greed” section, which may be troublesome within the brief time period.

Learn Bitcoin [BTC] Price Prediction 2024 -2025

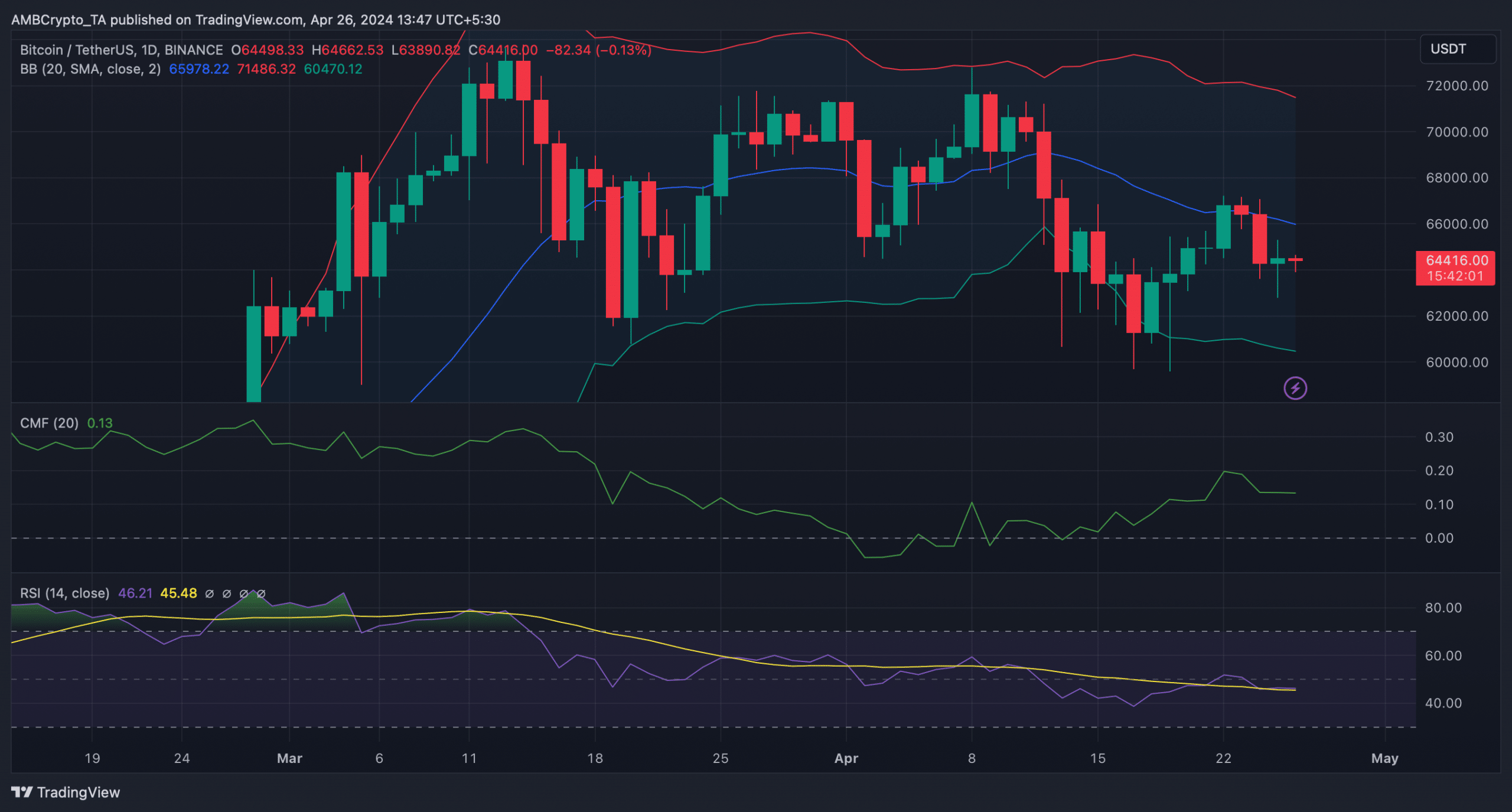

AMBCrypto then took a fast have a look at BTC’s every day chart to raised perceive whether or not the coin would flip risky. We discovered that BTC did not go above its 20-day Easy Shifting Common (SMA).

Furthermore, each its Chaikin Cash Move (CMF) and Relative Energy Index (RSI) went sideways, indicating that buyers may witness a number of extra slow-moving days.

[ad_2]

Source link