[ad_1]

- We discover the potential of a Bitcoin provide shock after current market observations.

- Bitcoin velocity pivots, indicating that Bitcoin is nicely right into a extremely risky part.

When Bitcoin [BTC] underwent one other halving earlier this yr, there was hypothesis {that a} provide shock would quickly observe. At present, the potential of a Bitcoin supply shock is way increased, particularly after the current crash.

In Bitcoin’s case, a provide shock would happen if trade reserves dropped to excessive lows. On the identical time, demand may stay fixed or soar increased.

Such a situation would doubtless result in an imbalance in favor of a fast upside.

Bitcoin’s conduct throughout the newest crash provided some indication {that a} provide shock could be across the nook.

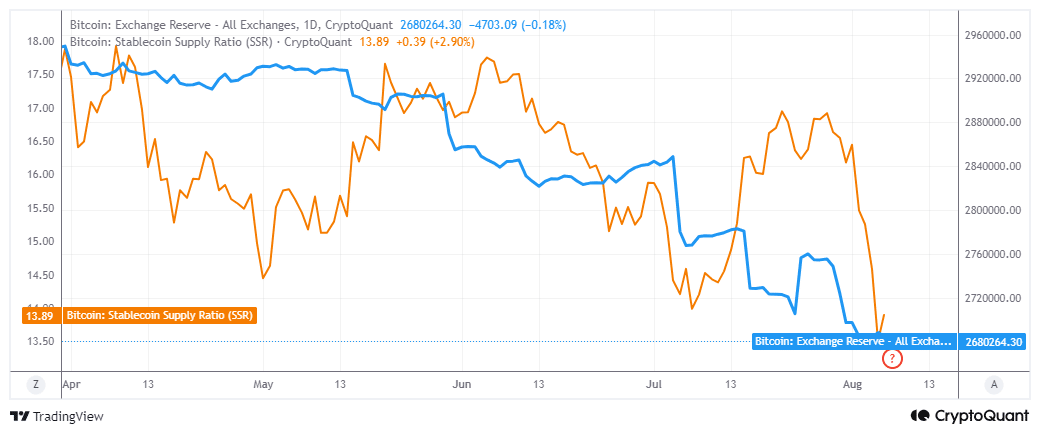

The primary main signal supporting this expectation was the remark that the Bitcoin trade reserves indicator is now decrease than it was final week.

In actual fact, it solely leveled out throughout the crash and not using a noteworthy uptick, regardless of the large surge in promote aspect stress.

AMBCrypto did, nevertheless, observe a spike within the Bitcoin stablecoin provide ratio within the final two days after its earlier decline.

This was an necessary remark as a result of each time this indicator went up up to now, it was accompanied by a BTC value rally. It could thus mark the star of one other reduction rally for the cryptocurrency.

Bitcoin velocity pivots

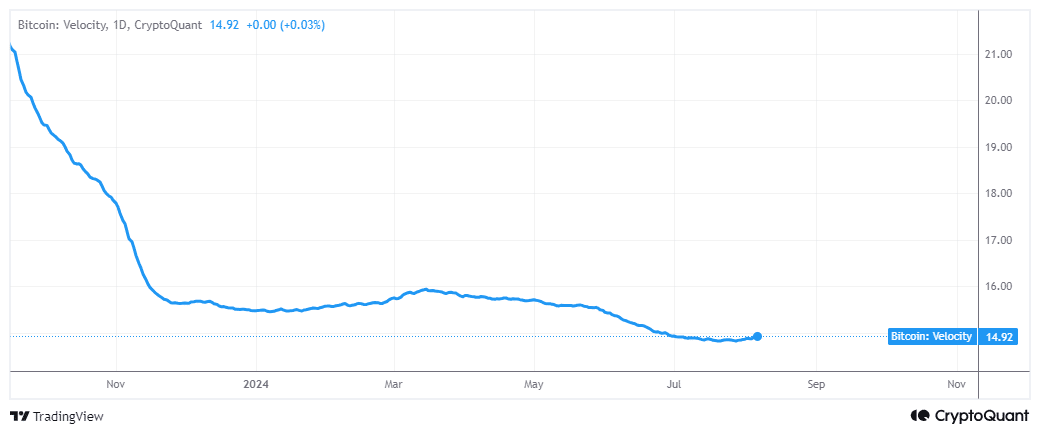

There are a number of explanation why Bitcoin velocity (the speed at which it exchanges fingers) adjustments. A peak in pleasure, whether or not unfavorable or optimistic, might result in extra velocity.

When liquidity flows out of the market and BTC demand goes low, the rate tends to dip.

The final main uptrend began in 2020 when pleasure and liquidity began flooding into crypto. It peaked in August 2022 after the FTX crash and stablecoin depeggings that occurred that yr.

The newest surge in BTC velocity began in January and resulted in March as liquidity examined the waters, resulting in some uptrend.

Bitcoin’s velocity, at press time, signaled a pivot to the uptrend. If this uptrend is sustained, it could point out that BTC is headed for an additional season of pleasure and extremely risky value adjustments.

It will all rely on the extent of liquidity available in the market.

However what would occur available in the market, there was a robust Bitcoin velocity surge?

Nicely, the truth that the BTC provide on exchanges retains declining signifies that there’s sturdy long run bullish optimism, largely as a result of ETFs are actually concerned, and loopy excessive predictions are but to be achieved.

Is your portfolio inexperienced? Try the BTC Profit Calculator

Larger velocity mixed with sturdy demand might play out in favor of the bulls. It might additionally doubtless be accompanied by massive dips, similar to the one which occurred lately.

Big value actions would happen if a provide shock, doubtless pushing up Bitcoin’s velocity.

[ad_2]

Source link