[ad_1]

- A cohort of BTC whales have continued to fill their luggage.

- This has occurred regardless of the coin’s current worth motion.

Bitcoin [BTC] whales have intensified accumulation regardless of the coin’s current decline beneath $62,000.

In accordance with on-chain information supplier Santiment, BTC whales holding between 1000 and 10,000 cash gathered 15,121 BTC valued at $930 million between the seventh and the eighth of Could.

This pushed the cohort’s complete BTC holding to its highest stage in 14 days.

🐳 As #Bitcoin ranges tightly between $61K and $64K, massive whales have made some accumulation strikes over the previous 24 hours. Wallets with 1K-10K $BTC have collectively gathered ~$941M value of cash, rebounding to their highest holding stage in 2 weeks. https://t.co/NkYwRsc8Pd pic.twitter.com/LWAt03TgUP

— Santiment (@santimentfeed) May 8, 2024

At press time, this group of BTC traders held 38% of the coin’s circulating provide of 20 million BTC.

BTC has the bears to take care of

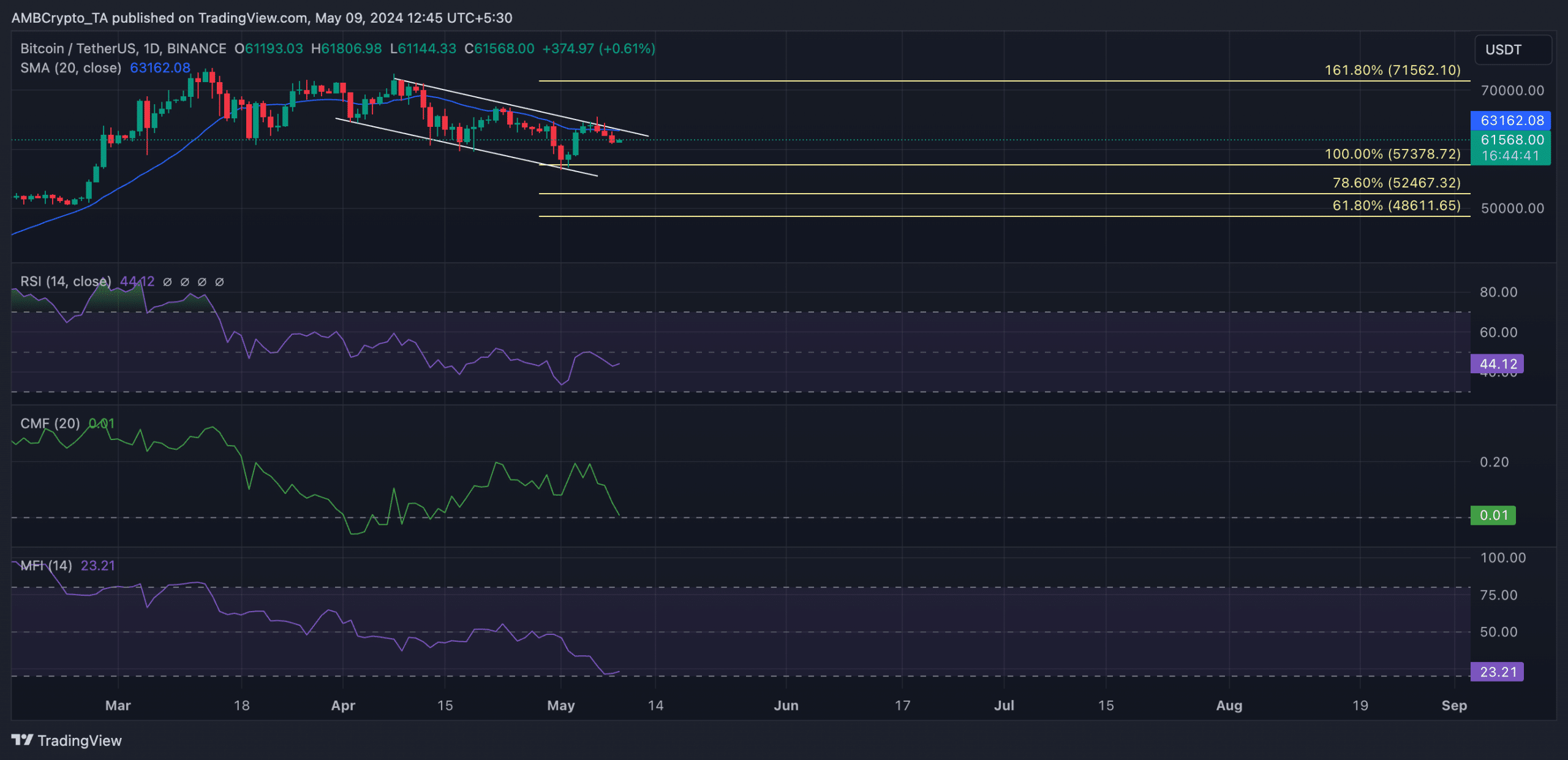

At press time, BTC exchanged fingers at $61,621. The coin lately crossed beneath its 20-day easy shifting common (SMA), placing it prone to an additional decline within the quick time period.

When an asset’s worth falls beneath its 20-day SMA, it means that the short-term pattern for the asset is downward.

Market contributors typically view this as an indication that sellers are in management and that the asset’s worth will doubtless proceed declining.

Readings from BTC’s worth motion on a 1-day chart confirmed that its worth fell beneath its 20-day SMA on the seventh of Could and has since witnessed a 3% decline in its worth.

Additional, the coin has seen a decline in demand amongst basic market contributors. An evaluation of its key momentum indicators confirmed them beneath their respective heart traces at press time.

For instance, the coin’s Relative Energy Index (RSI) was 44.12, whereas its Cash Circulation Index (MFI) was 23.21. At these values, the indications confirmed vital bearish strain out there.

Likewise, as of this writing, the coin’s Chaikin Cash Circulation (CMF) was poised to cross beneath the zero line. This indicator measures the cash move into and out of the coin’s market.

A CMF worth beneath zero signifies market weak point, suggesting elevated liquidity exit.

If the bears strengthen their place, they could pull the coin’s worth all the way down to the help line of BTC’s descending channel sample.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

If this occurs, the main cryptocurrency asset will trade fingers on the $57,000 worth area.

Nevertheless, if this bearish projection is invalidated as bullish exercise beneficial properties momentum, BTC’s worth could rally towards the sample’s resistance line and try a crossover.

[ad_2]

Source link