[ad_1]

The cryptocurrency market has taken an fascinating flip in the previous couple of days, with the value of Bitcoin enduring an intense amount of bearish pressure. On Thursday, July 4, the premier cryptocurrency broke beneath the $60,000 mark, falling as little as $57,000.

BTC continued its value descent on Friday, with the market chief touring down beneath $54,000 sooner or later. This disappointing value run has been linked to varied occasions, together with authorities selloffs and potential promoting after information of the Mt. Gox payout.

Authorities Bitcoin Promoting Is Overestimated: CryptoQuant CEO

In a brand new put up on the X platform, CryptoQuant CEO and founder Ki Younger Ju has weighed in on the current studies of countries’ governments offloading seized BTC property. Most notably, the German government has been executing varied transactions involving important quantities of Bitcoin in current weeks.

The FUD (worry, uncertainty, and doubt) from the current selloffs is believed to be one of many main drivers of the present downward strain on the Bitcoin value. Nonetheless, the CryptoQuant CEO believes that the influence of the government selling seized BTC property is being over-inflated.

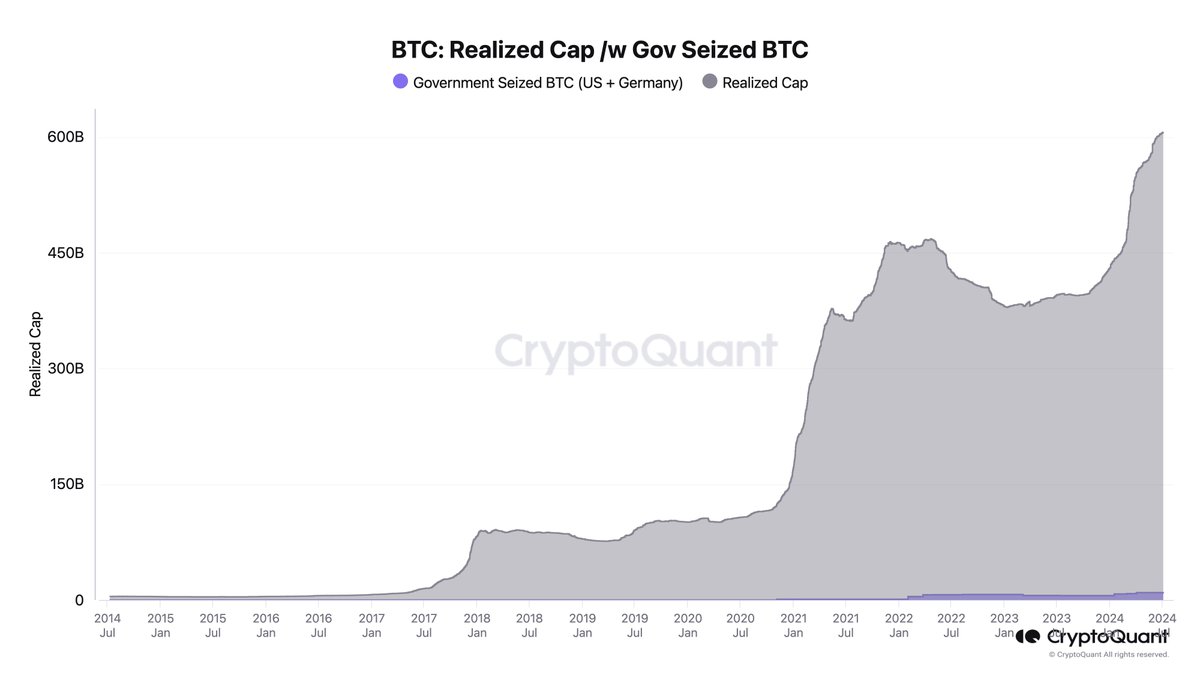

This analysis is predicated on the realized cap of Bitcoin in a few 12 months. In response to CryptoQuant information, $224 billion has moved into the market since 2023, however solely $9 billion (lower than 5%) is from government-seized BTC. It’s price noting, although, that this information solely accounts for Bitcoin seized by the US and German governments.

Supply: Ki Young Ju/X

Younger Ju famous in his put up that the realized cap right here represents the whole capital that has flowed into the market since 2023. The “realized” cap differs from the extra conventional “market” cap in that it’s based mostly on the value of every coin when it final moved.

In a separate post on X, the founder reiterated religion within the long-term promise of the premier cryptocurrency, stating that the Bitcoin bull cycle isn’t over but. In response to the blockchain agency CEO, the bull run will doubtless proceed till early subsequent 12 months.

What’s extra, Younger Ju was capable of pinpoint the potential prime of the Bitcoin cycle utilizing the realized cap metric. The CryptoQuant founder expects the premier cryptocurrency to achieve its peak on this cycle across the $112,000 value degree.

BTC Value At A Look

The price of Bitcoin recovered above $56,000 within the late hours of Friday, July 5, and is buying and selling at $56,400 as of this writing. Nonetheless, the market chief continues to be down by practically 6% within the final seven days.

BTC value at $56,401 on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

[ad_2]

Source link