[ad_1]

- This was the most important spike within the motion of BTC’s dormant provide in additional than two years.

- Whales continued so as to add Bitcoin publicity to their portfolios.

Bitcoin [BTC] consolidated within the $64k — $67k vary over the week, going through a stiff resistance at $68k.

At press time, the king coin was exchanging fingers at $64.14k, 12% decrease than the all-time excessive (ATH) hit earlier within the month, in keeping with CoinMarketCap.

What to anticipate subsequent?

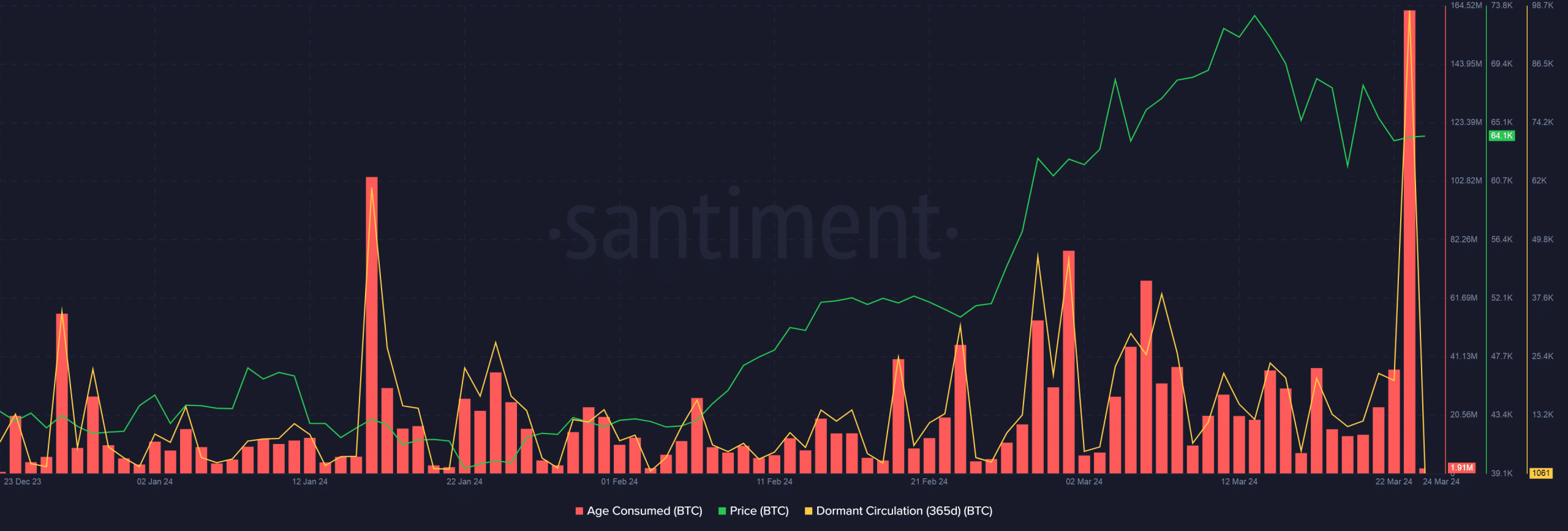

Nevertheless, days forward may witness a major bout of volatility. In keeping with AMBCrypto’s evaluation of Santiment’s knowledge, many beforehand inactive BTCs began transferring between addresses on the twenty third of March.

In actual fact, this was the most important spike within the motion of BTC’s dormant provide in additional than two years.

For a lot of 2023, dormant provide throughout main age bands hit new highs, signaling a market technique of warning and HODLing.

However with Bitcoin’s value zooming to new highs in 2024, these long-term holders started chasing earnings, releasing up extra Bitcoins for energetic buying and selling. Usually, fall in dormant provide precedes volatility and value surges.

Present market construction helps value enhance

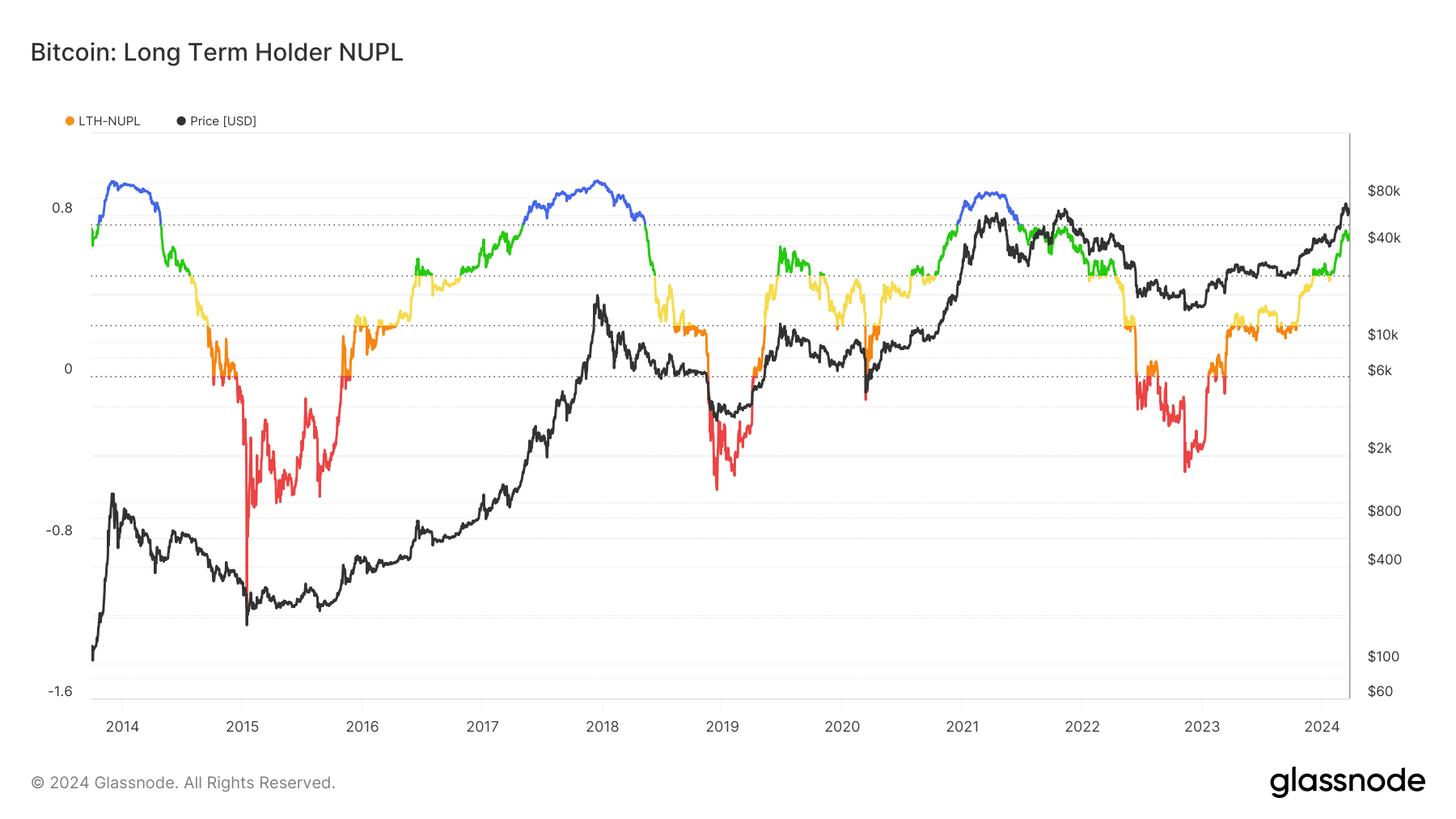

Notably, a lot of the long-term holders have been in a state of revenue, AMBCrypto analyzed utilizing Glassnode’s Web Unrealized Revenue/Loss metric.

This market section, dubbed as one among perception, has traditionally aided additional value will increase, as proven under. The market high, typically related to euphoria and greed, was nonetheless a good distance off.

Whales proceed to stockpile

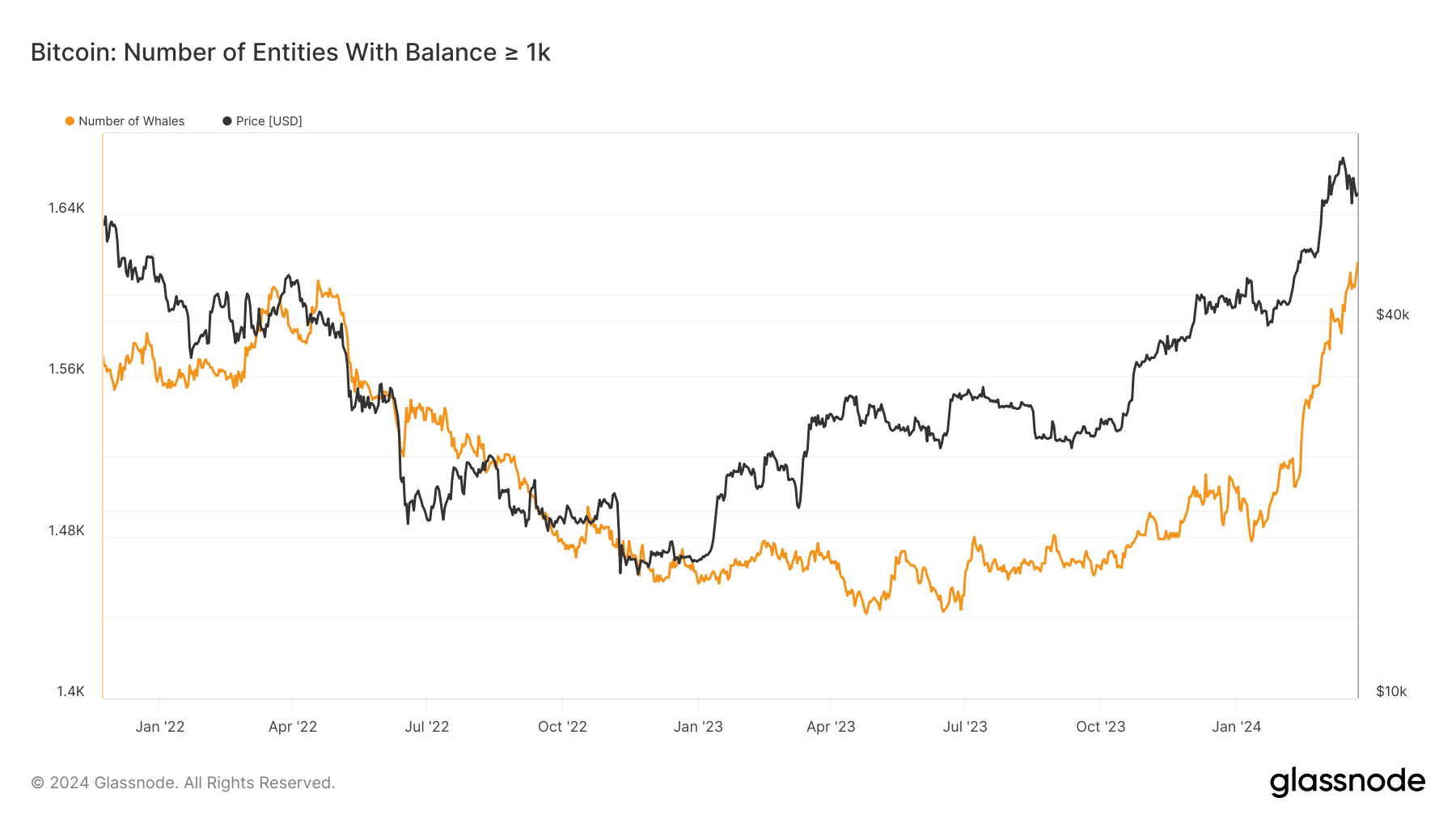

In the meantime, whales have been making full use of the suppressed market so as to add extra Bitcoin publicity to their portfolios.

The variety of distinctive entities holding no less than 1k cash jumped to 1,616 on the twenty third of March, the best since February 2021.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Apparently, the buildup didn’t decelerate regardless of Bitcoin’s sharp correction from its peak, suggesting a perception within the crypto’s long-term value appreciation.

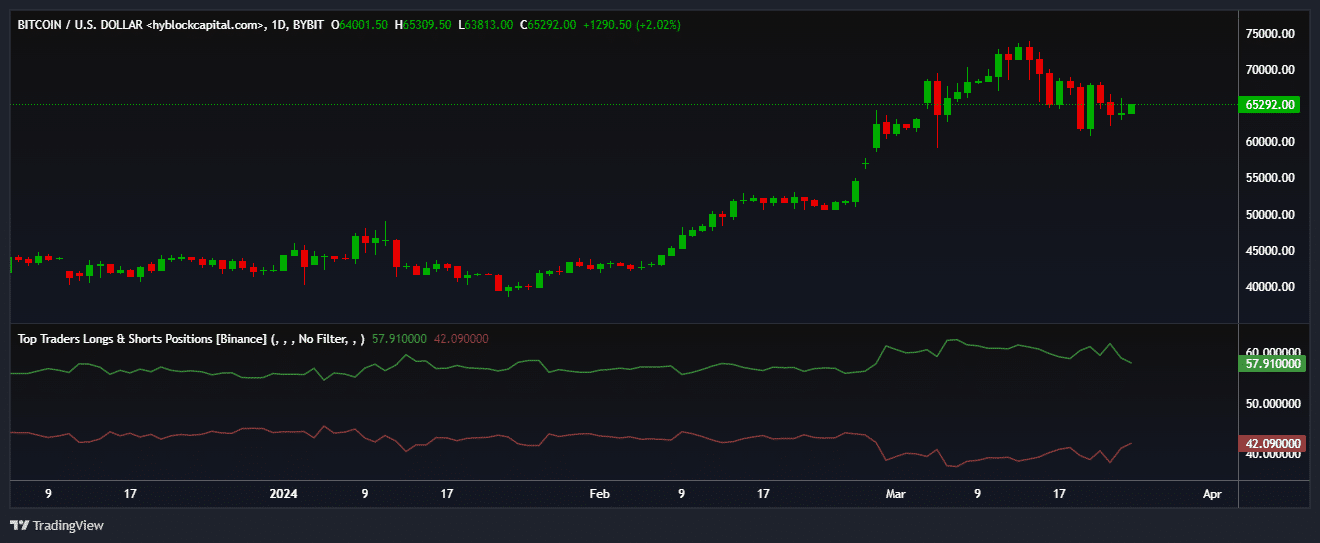

Whales exhibited their optimism within the derivatives markets as properly. At press time, practically 58% of all whale positions on Binance have been lengthy on Bitcoin, as per Hyblock Capital.

[ad_2]

Source link