[ad_1]

- Bitcoin’s present retracement is seen as a precursor to a possible main rally in the direction of $73,000.

- Market metrics and evaluation point out sturdy foundations for BTC, regardless of a drop in energetic addresses.

Bitcoin [BTC] has just lately exhibited vital bullish conduct, marking a notable rise of almost 10% from final week’s low of $65,000 to a excessive of $71,000 this week.

Nonetheless, the cryptocurrency has seen a slight retreat, at the moment buying and selling at $68,659. This pause within the upward momentum is seen by analysts as a precursor to a possible main rally.

A return to $73,000 may sign the beginning of what’s termed because the “escape velocity” section for Bitcoin, indicating a attainable acceleration away from present value ranges into new highs.

Analyzing market metrics and investor conduct

Crypto analyst James Verify, in a current market report dated twenty first Could, described this $73,000 value level as essential for Bitcoin’s trajectory.

The time period “escape velocity,” borrowed from astrophysics, is used right here to indicate the minimal velocity Bitcoin would wish to interrupt free from its present vary and begin a extra aggressive value climb with out extra push.

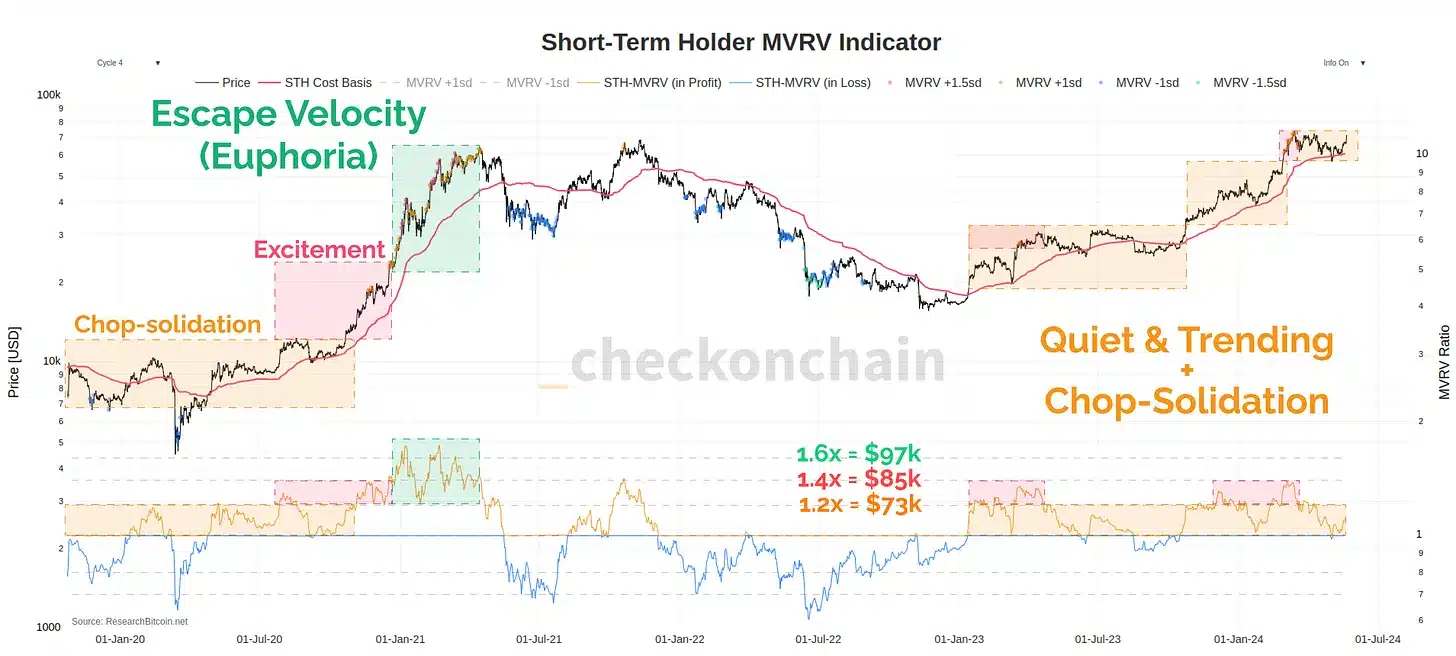

James Verify factors out the significance of the Quick-Time period Holder (STH) Market Worth to Realized Worth (MVRV) metric, which he believes exhibits the market will not be but “overstretched, overbought, and oversaturated.”

Verify means that whereas the market is enthusiastic, it has not but entered a section of euphoria that always precedes a major pullback.

The analyst disclosed that the market is constructing sturdy foundations for a rally, with $73,000 being a vital level that might set off a extra substantial rise in Bitcoin’s value.

Nonetheless, there may be additionally warning round this value degree. Quick-term holders, outlined as wallets which have held Bitcoin for lower than 155 days, are in “ample revenue” at this level, which could result in some resistance as a consequence of potential promoting stress.

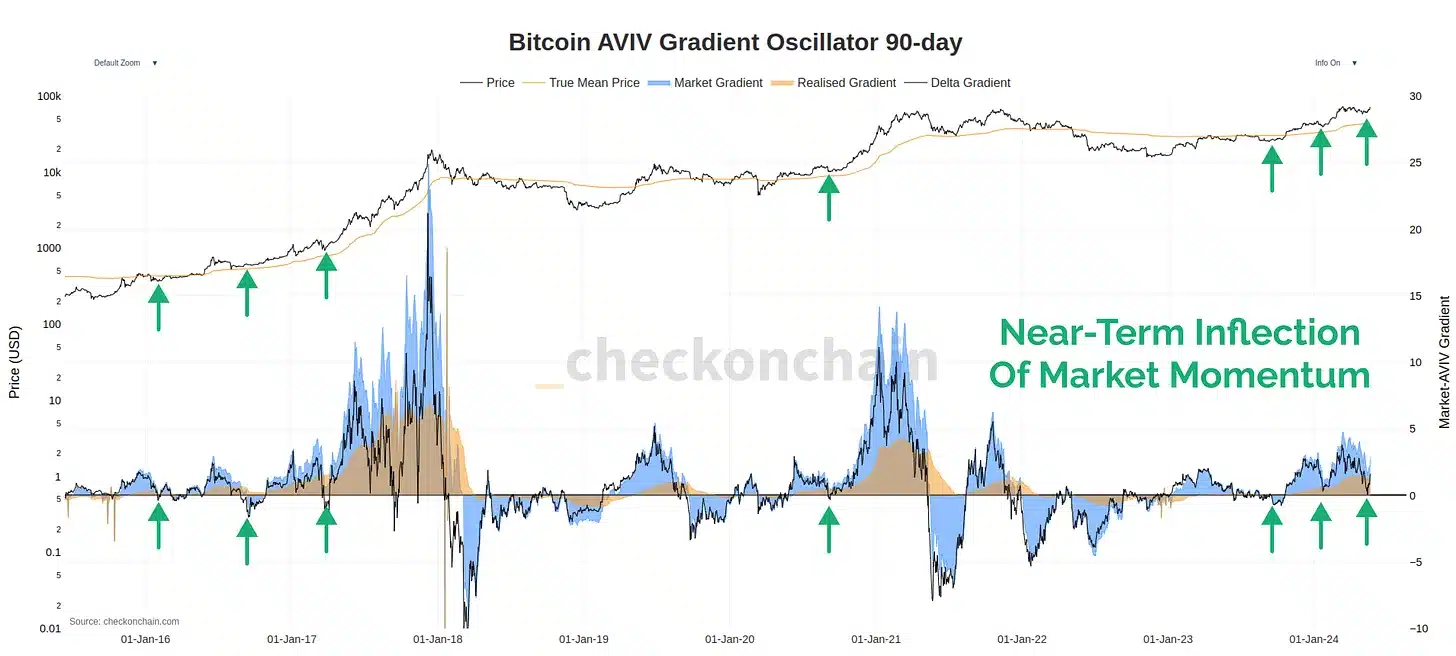

The AVIV momentum oscillator, notably over a 90-day interval, has been supportive, displaying that value actions relative to on-chain capital inflows are recovering strongly, typical of a bull market section.

Key observations from on-chain knowledge

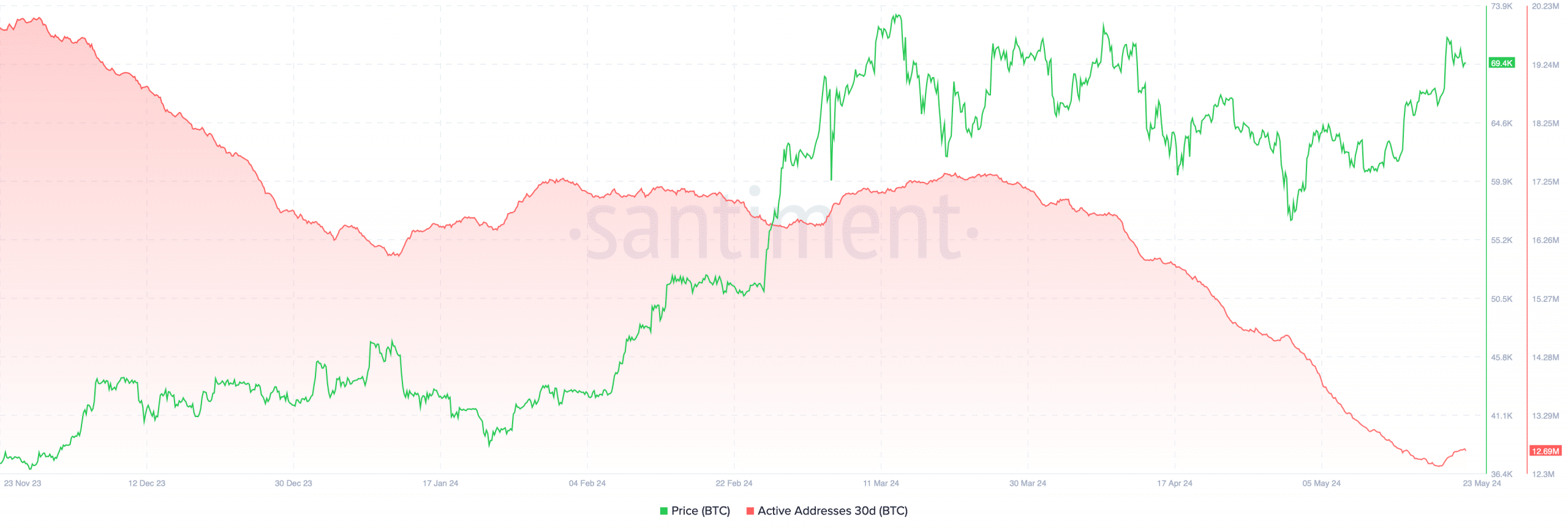

AMBcrypto’s evaluation, supported by data from Santiment, signifies a decline in Bitcoin’s energetic addresses from over 17 million in March to beneath 13 million at the moment.

Regardless of this lower, Bitcoin has continued to point out bullish strikes, breaking by a number of resistance ranges. This means that whereas the community’s exercise is decreasing, the worth remains to be being pushed upwards by different elements.

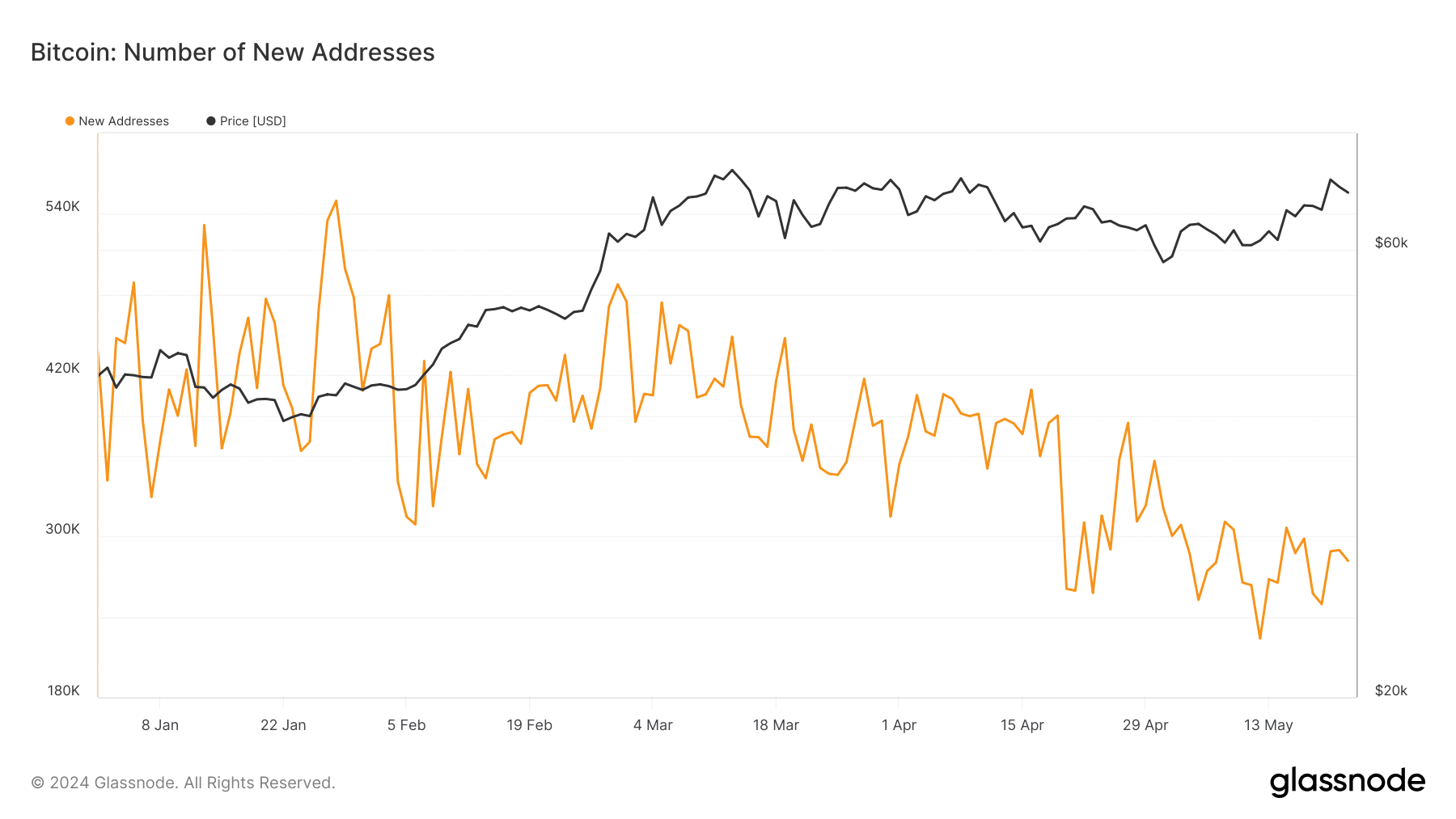

Glassnode’s data additional confirmed that the variety of new addresses has additionally been declining, making a sample of decrease highs and lows. This helps Verify’s view that the Bitcoin market has not reached a state of euphoria, which usually alerts an overheated market.

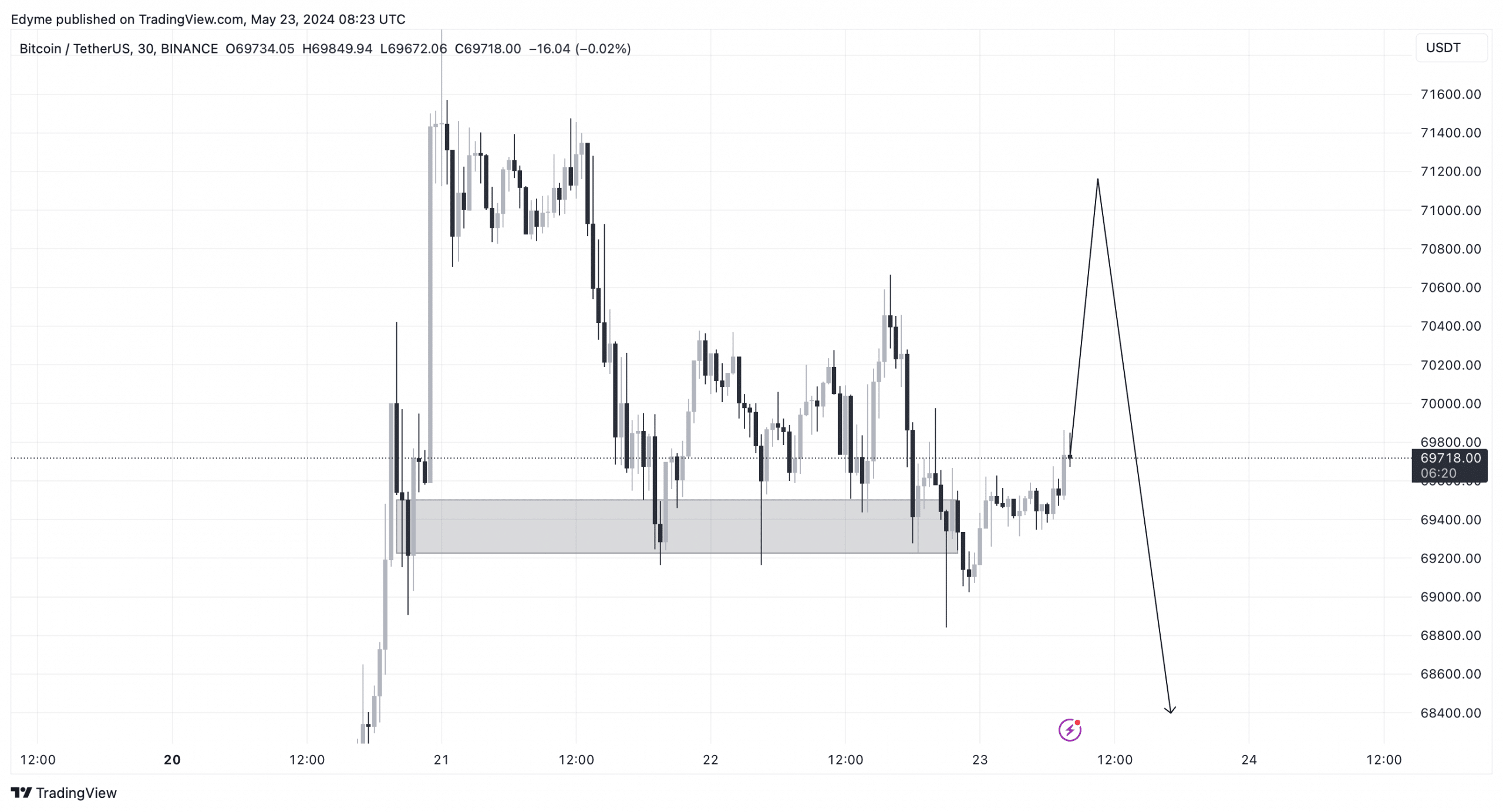

On the 30-minute chart, Bitcoin has just lately damaged by an important demand zone, hinting that the asset may retrace additional to collect extra liquidity earlier than resuming its uptrend.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

A key degree to look at, as per AMBCrypto’s recent report, is around $71,500. A weekly candle shut above this mark could possibly be the set off for Bitcoin to interrupt out from its present re-accumulation vary.

This degree aligns with Verify’s evaluation {that a} push previous $73,000 may provoke the escape velocity section, marking a doubtlessly explosive subsequent stage in Bitcoin’s market cycle.

[ad_2]

Source link