[ad_1]

On-chain information reveals that the Bitcoin taker buy/sell ratio has skilled a big surge on a specific crypto alternate. Right here’s the way it may impression the worth of the premier cryptocurrency.

Bitcoin Traders Shopping for The Dip On This Trade

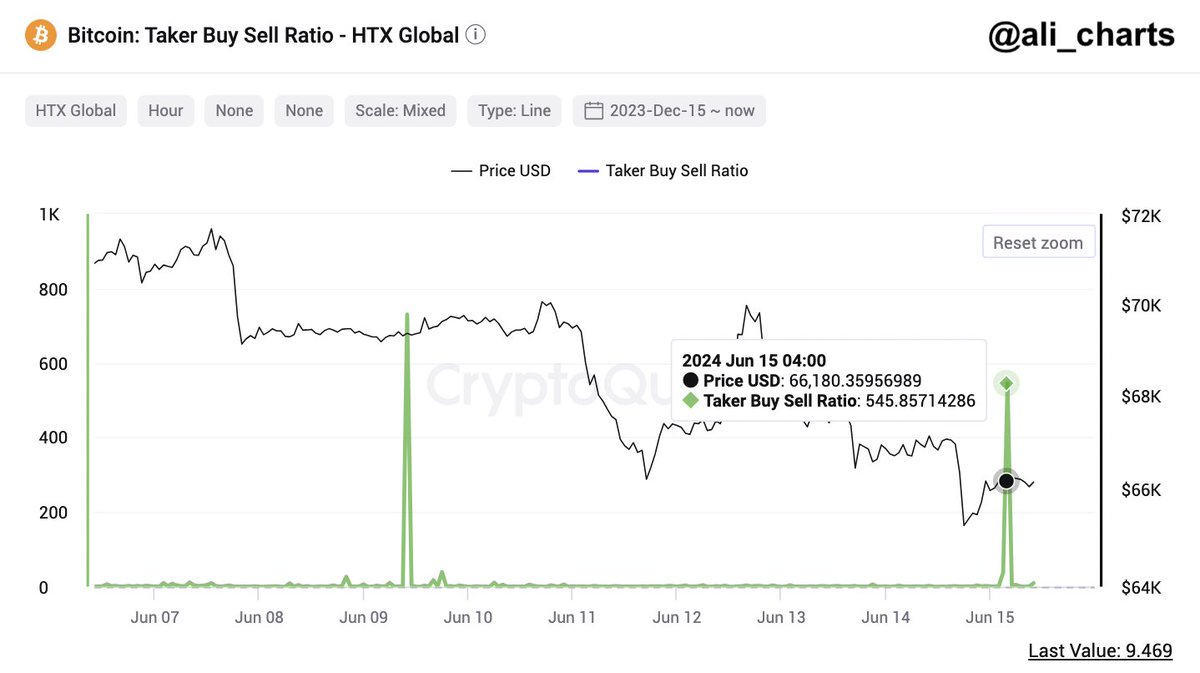

Outstanding crypto pundit Ali Martinez took to the X platform to reveal that traders on a specific alternate have been profiting from the current fall in Bitcoin worth. The related indicator right here is the taker purchase/promote ratio, which measures the ratio between the taker purchase volumes and the taker promote volumes.

Usually, when the worth of this metric is bigger than 1, it implies that the taker purchase quantity is increased than the taker promote quantity on the alternate in query. On this case, extra merchants are willing to buy coins at a better worth on the buying and selling platform.

Conversely, when the taker purchase/promote ratio is beneath 1, it signifies that extra sellers are keen to promote cash at a lower cost, indicating that the promote quantity is bigger than the purchase quantity.

Bitcoin taker purchase/promote ratio | Supply: Ali_charts/X

In accordance with information from CryptoQuant, the Bitcoin taker purchase/promote ratio on the HTX Trade (previously often known as Huobi) lately skyrocketed to above 545 on Saturday. This implies a big improve in shopping for stress and a shift in investor sentiment.

Martinez famous in his submit on X that this spike in bullish stress could possibly be a sign of impending upward worth motion for Bitcoin. These excessive purchase volumes on the HTX alternate come on the again of BTC’s current fall to $65,000.

Nonetheless, it’s price noting that the common Bitcoin taker buy/sell ratio throughout all exchanges continues to be beneath 1. On the time of writing, the worth of this metric stands round 0.8.

BTC’s Common Mining Price Surges Above $86,500

The most recent information reveals Bitcoin’s common mining value has soared to $86,668. This determine displays the cumulative bills related to producing one BTC, together with electrical energy, {hardware}, and operational prices.

As highlighted by Ali Martinez in a post on X, each important improve in BTC’s common mining value is normally adopted by a corresponding improve within the coin’s market worth. With this historic context, the newest improve within the common mining value suggests {that a} worth improve could possibly be on the horizon for Bitcoin.

#Bitcoin‘s common mining value is at present at $86,668.

And guess what? Traditionally, $BTC at all times surges above its common mining value! pic.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

As of this writing, the worth of Bitcoin continues to hover across the $66,000 mark, with no important change prior to now day. In accordance with CoinGecko information, the premier cryptocurrency is down by almost 5% prior to now week.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Barron’s, chart from TradingView

[ad_2]

Source link