[ad_1]

- Crypto whales accrued 5,900 BTC price $397 million from CEXs amid the worth drop.

- BTC’s buying and selling quantity surged by 65%, signaling larger participation from merchants and traders.

On twenty ninth July, america authorities moved $2 billion price of Bitcoin [BTC] to new wallets. This notable transfer gained large consideration from crypto fans and badly impacted the general market.

Following this incident, BTC was buying and selling close to the $66,520 degree and skilled a 4.6% value drop within the final 24 hours. Amid this value drop, participation from traders and merchants surged by 65%, signaling potential “purchase the dip” exercise.

Whales scoop up 5,900 Bitcoin

Moreover, whales and establishments took this value drop as a chance and accrued a big quantity of BTC.

On thirtieth July, an on-chain analytic agency spotonchain made a submit on X (beforehand Twitter) stating that 4 whales have added a notable 5,900 BTC price $397 million from Centralized Exchanges (CEXs) within the final 24 hours.

As per the spotonchain report, the whale tackle “12QVs” withdrew a large 4,500 BTC price $303 million from Binance at a median of $67,298. Out of this, 3,500 BTC price $233 million have been withdrawn simply after the BTC value plunged.

In the meantime, the opposite three whales, that are more likely to be one entity, withdrew 1,400 BTC price $94 million from Bitfinex at a median of $67,185.

Moreover, since twelfth June, they’ve withdrawn a large 3,910 BTC an a median of $65,764, and now maintain an unrealized revenue of over $4.59 million.

Bitcoin technical evaluation and upcoming ranges

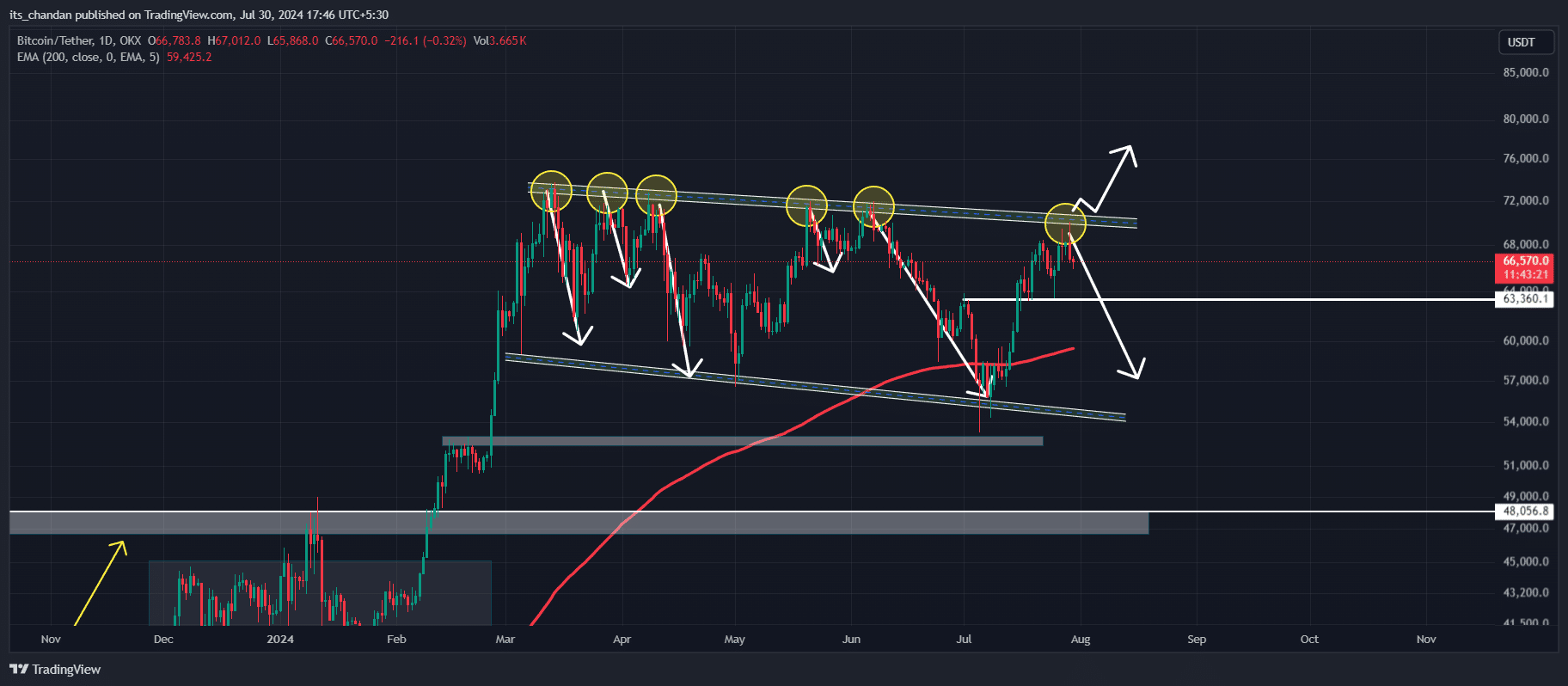

In response to skilled technical evaluation, BTC is shifting in a draw back channel sample and is at the moment experiencing resistance from the highest.

Traditionally, every time BTC reaches this degree, it experiences a large value fall. Since March 2024, BTC has reached the highest of this channel sample 5 occasions, and every time it skilled a value reversal.

If the sentiment stays the identical, there’s a excessive probability BTC may fall to the $63,350 degree and even decrease.

Nevertheless, to expertise upside momentum, will probably be crucial for BTC to provide a breakout of this draw back channel sample and a robust day by day candle closing above the $71,800 mark.

BTC’s main liquidation degree

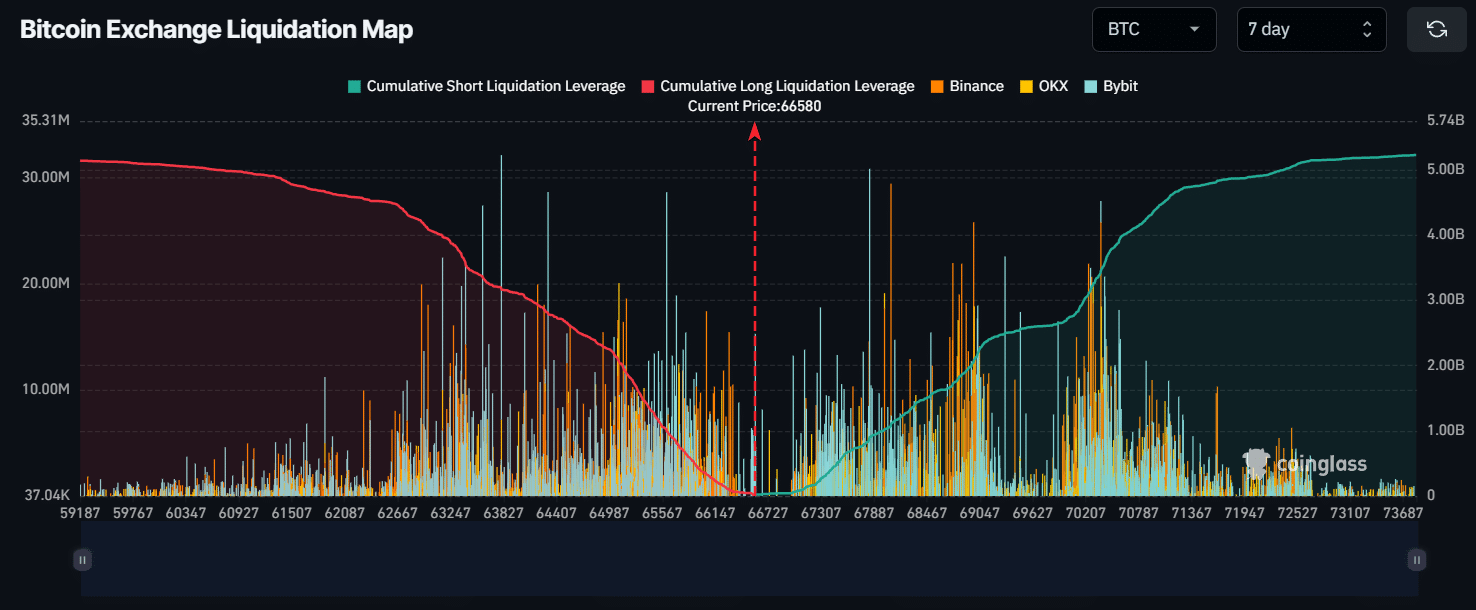

Within the final seven days, two main liquidation ranges have been noticed close to the $70,330 degree on the upper aspect and $63,800 on the decrease aspect.

If historical past repeats and the BTC value falls to the $63,800 degree, almost $3.20 billion price of lengthy positions will probably be liquidated.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Conversely, if BTC’s value experiences an upside transfer and hits the $71,800 mark, almost $3.3 billion brief positions will probably be liquidated.

Together with this bearish outlook, BTC futures Open Curiosity (OI) skilled a fall of 6% within the final 24 hours. This decline in OI suggests decrease curiosity from merchants and traders.

[ad_2]

Source link