[ad_1]

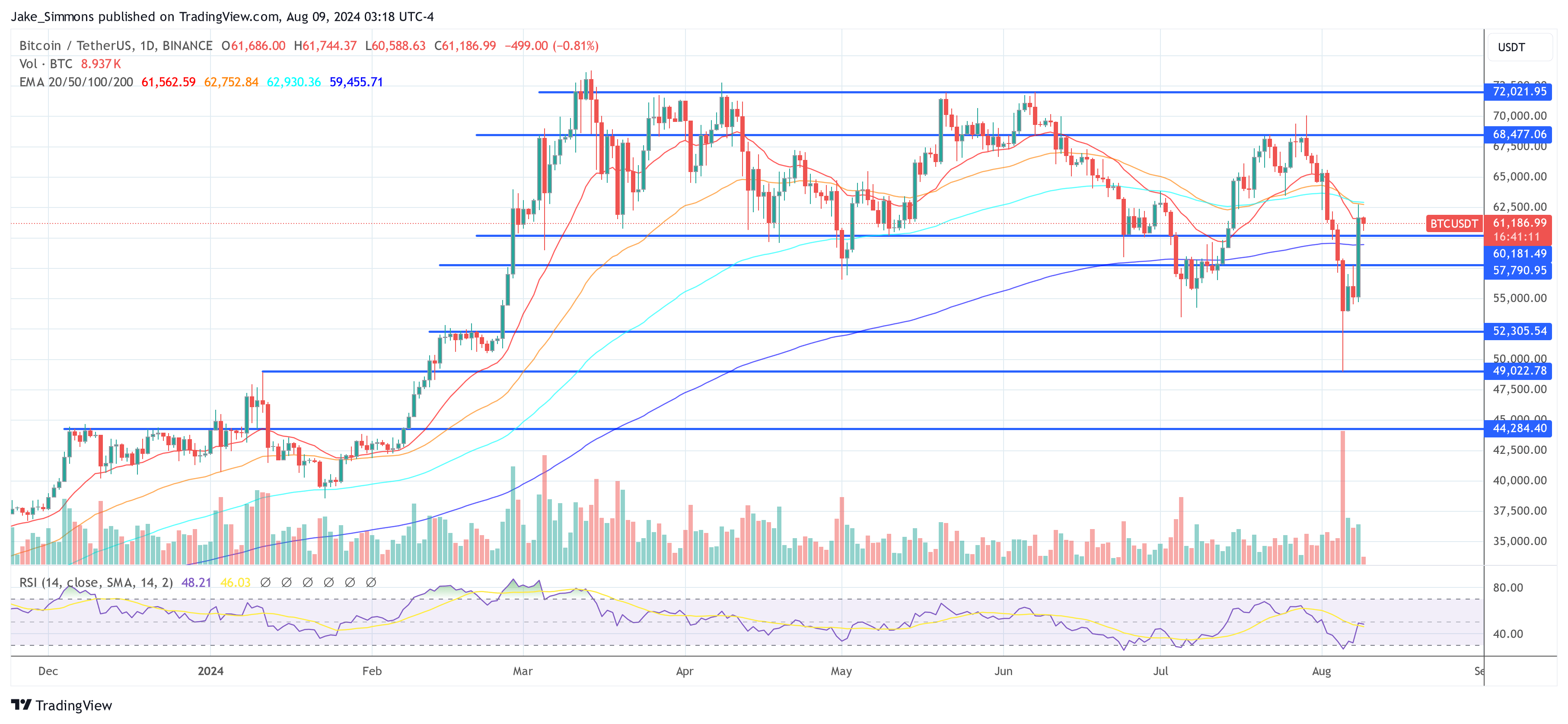

The Bitcoin value information a serious rally in latest days. After plummeting to a low of $49,000 on Monday, the BTC value soared as excessive as $62,700 throughout the Asian buying and selling session in the present day. Thus, BTC has surged 24% from its Monday low. Over the past 24 hours alone, BTC has risen by 7%. These are the important thing causes:

#1 Fading US Recession Fears Gasoline Bitcoin Rally

Macro economics are the clear driver of the value transfer as equities have rallied together with Bitcoin. Notably, the July unemployment price in the USA elevated to 4.3%, the very best within the final 4 months. This triggered issues a few potential recession, as per the Sahm Rule. This financial indicator suggests {that a} recession could be beginning if the three-month shifting common of the nationwide unemployment price rises by 0.50 proportion factors or extra relative to its lowest level within the earlier 12 months.

Associated Studying

The preliminary panic was exacerbated by a jobs report that fell in need of expectations, with solely 114,000 new jobs in comparison with the anticipated 175,000. Nevertheless, the narrative shifted dramatically yesterday with the most recent launch of jobless claims information. A major drop to 233,000, down by 17,000, marked the biggest decline in virtually a 12 months, soothing jittery markets.

Mohamed A. El-Erian, President of Queens School Cambridge and chief financial adviser at Allianz, defined through X that the worldwide monetary markets reacted to the info launch and interpreted it as “a reduction after final week’s unemployment and development scare.” Nevertheless, he additionally warned that “that this high-frequency information collection is inherently noisy.”

US weekly jobless claims got here in at 233,000, down from a revised 250,000 — a reduction after final week’s unemployment and development scare.

The small print of this information launch will likely be topic to the next degree of scrutiny with a view to assessing breadth and different distributional points.… https://t.co/fBqaJVs3sM— Mohamed A. El-Erian (@elerianm) August 8, 2024

Macro analyst Alex Krüger additional elaborated that “the market crash triggered by final week’s unemployment & payrolls information has now totally reversed, after in the present day’s weekly jobless claims information. Value motion and new jobs information affirm what I suspected: that the entire equities market had a crypto model levered flush-out, pushed principally by positioning, narrative and mass hysteria, and never as a lot by fundamentals.”

Associated Studying

Krüger additionally cautioned towards overemphasis on single information factors: “There’s a motive the Fed makes emphasis on making no choices on single information factors. Payrolls information will be very noisy. But final Friday a lot of the market went on a loopy rampage calling for a coverage mistake and emergency price cuts.”

#2 Quick Liquidations Amplify BTC Surge

The volatility in Bitcoin’s value additionally catalyzed a big variety of brief liquidations. Prior to now 24 hours alone, 52,413 merchants had been liquidated, with complete crypto liquidations reaching $222.02 million, in keeping with Coinglass data. For Bitcoin particularly, over $90 million briefly positions had been liquidated, marking it because the third-highest short-liquidation occasion previously 5 months.

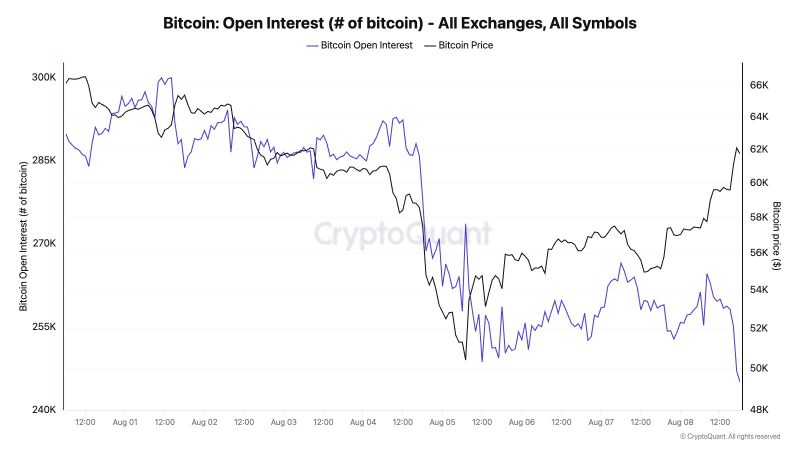

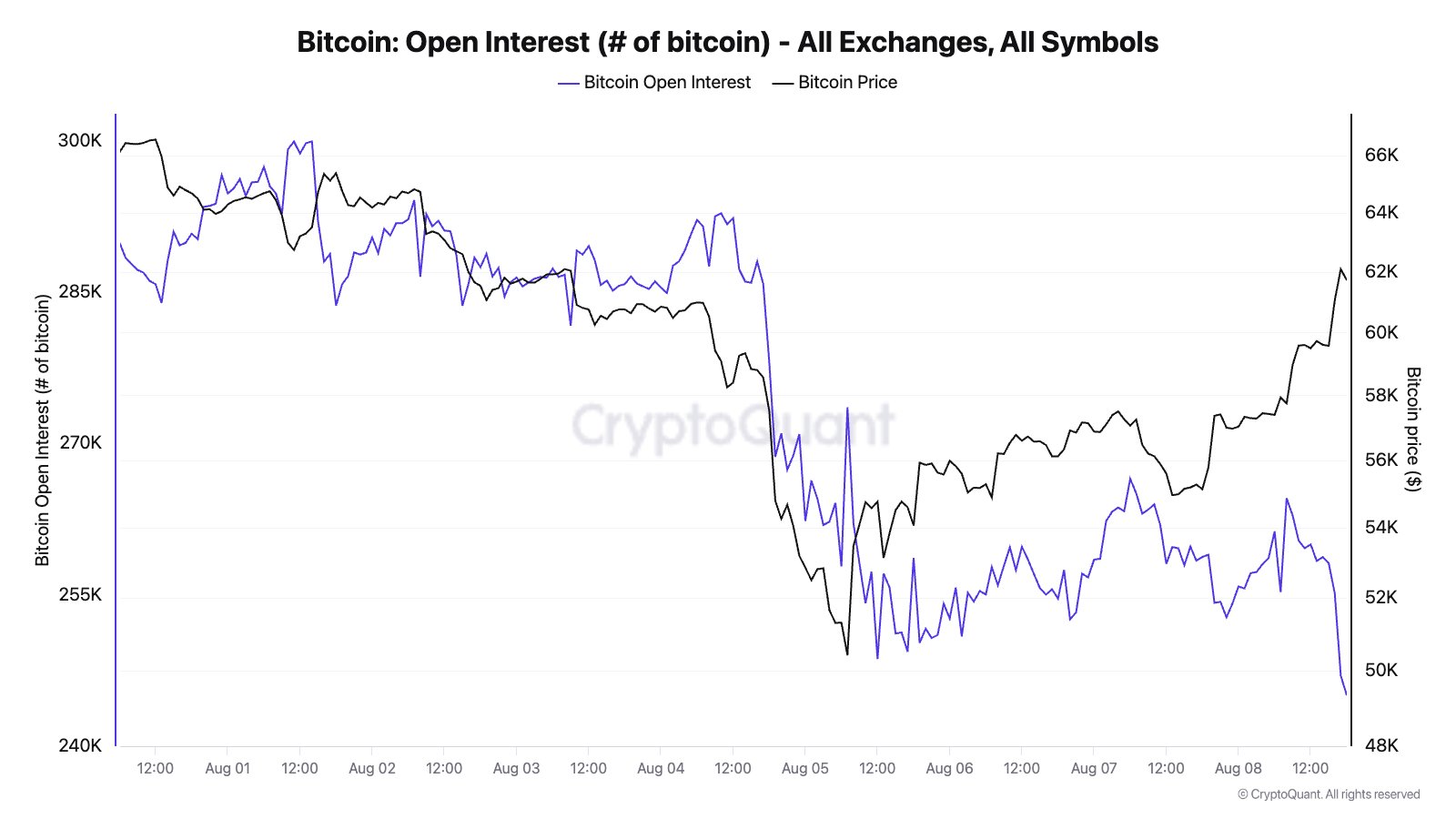

Julio Moreno, Head of Analysis at CryptoQuant, clarified the impression of those liquidations in the marketplace: “This Bitcoin bounce has been principally shorts overlaying positions within the futures market. Open curiosity down, costs up.”

#3 MicroStrategy Shopping for?

Because the Bitcoin value climbed larger, there was a notable surge in demand from the spot market. Crypto analyst Kiarash Hossainpour speculated, “You heard it right here first: I may think about this loopy late evening market purchase coming from none aside from Saylor. The man simply introduced one other $2 billion purchase the opposite day. Who else buys within the illiquid hours after the US shut on a Thursday evening? Precisely, no one.”

MicroStrategy, below the management of Michael Saylor, announced final week plans to extend its Bitcoin holdings considerably, making ready to lift $2 billion by a brand new at-the-market fairness providing as reported in its Q2 2024 earnings report. The corporate said: “We proceed to carefully handle our fairness capital, and are submitting a registration assertion for a brand new $2 billion at-the-market fairness providing program.”

At press time, BTC traded at $61,186.

Featured picture created with DALL.E, chart from TradingView.com

[ad_2]

Source link